Learn Intraday Short Selling

In Entropy, we take leverage of the fact that the stock market follows the normal distribution and we apply the methods using Bollinger Bands and other means of mean reversion. We have a few in-house strategies modified for NSE – BRS, 3BB, F3BB, Alpha.

- The Strategies are designed inhouse and modified over countless times with various parameters.

- It is 100% end to end automated strategy. Initially started as a Price Action Scanner, later it pivoted to a machine learning model named K-Nearest Neighbors (KNN) Model.

- Learn the basic theory and how to Trade Entropy Trades using the Scanner for free.

Join the premium Entropy Community if you’re interested in checking past core discussions, premium contents and to engage with other strategy followers.

Entropy Course

Entropy Course

Entropy Community

Entropy Community

Entropy Scanner

Entropy Scanner

3BB Scanner

Entropy Alpha Scanner

Entropy Alpha Scanner

Entropy Book

Entropy Alpha Dashboard

Entropy Alpha Dashboard

Past Performance

** Use UPI/Net Banking directly to avoid the convenience charge. Contact @dexter in Slack for details.

Course Content

- To maintain liquidity, It scans the stocks which are in derivatives.

- 3BB Scanners and in general, Entropy does not work when there is fundamental news.

Scanner History –

You can check the last 80 scans/triggers here. (It gets updated daily EOD) –Entropy Scanner is made with two scanners –

- Entropy 3BB Strategy Watchlist Scanner

- Entropy 3BB Strategy Trigger Scanner

The Entropy 3BB Strategy Watchlist Scanner scans the stocks in 3BB Scanner and provides a pre-listed “Watchlist” of potential trade entries for Entropy 3BB Strategy

Here is a list of some of those additional parameters like –

- Weekend Strategy Validity in 15 Minutes and 5 Minutes Timeframe (Case Basis)

- Narrow Range (Compression i.e Inside Bars and modified NR Theory)

- Bollinger Width

- Proper 3BB Pattern Formation

- Econominc News i.e. It scans data for news and give them weightage.

- Candlestick Type in some cases

- Dynamic Entry: The entry parameters are dynamic based on market conditions. For Example, in a consolidating market, We need to loosen up on the validity of weekend logics while it is vice-versa for the case of the market at the time of results season because it becomes highly volatile.

Initially started as a Price Action Scanner, later it pivoted to a machine learning model named K-Nearest Neighbors (KNN) Model.

Scanner History –

We have also added a few more filters and conditions to minimize false breakouts. It also checks an immediate daily trends to ensure more profitability.

KNN Model

K-Nearest Neighbors (KNN) is a simple yet effective machine learning algorithm used for classification and regression tasks. The algorithm is based on the concept that similar data points are likely to have similar outcomes.

In KNN, the model finds the K-nearest data points to a new data point and assigns a label to the new point based on the labels of its K-nearest neighbors. The value of K is a hyperparameter that can be tuned to improve the model’s accuracy.

For example, if we have a dataset of stocks and we want to predict whether a particular stock will go up or down, we can use KNN. We would first preprocess the data and extract the relevant features such as the stock’s price, volume, etc. We would then split the dataset into training and testing sets.

To make a prediction for a new stock, we would find the K-nearest stocks to the new stock based on the extracted features. We would then assign a label to the new stock based on the labels of its K-nearest neighbors. For instance, if the majority of its K-nearest neighbors have gone up in the past, we would predict that the new stock will also go up.

KNN is easy to implement and can work well with small datasets. However, it can become computationally expensive for large datasets as the algorithm has to calculate the distance between each data point. In addition, choosing the value of K can be challenging, and the algorithm can be sensitive to the scale of the data.

Entropy 3BB Strategy –

Entry: Any moment a stock comes into this scanner, one can immediately put short trade at the low of the previous candle’s low in 15 minutes timeframe. Once triggered,

Stop Loss: The Stop Loss should be updated to the high of that very day.

Exit Strategy: There are several exit strategies.

- Exit when price cross-median of 1SD Bollinger band on 15 minutes time frame.

- Exit after 30 minutes irrespective of the Profit/Loss.

- Let it auto square off at day’s end! (Recommended)

- TSL with Weekend or Bounce Strategy!

- Exit at 14:50 (We follow this.)

Entropy Alpha Strategy –

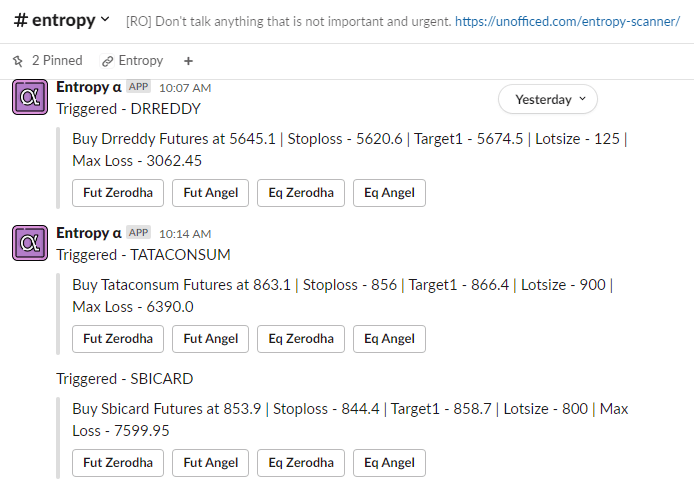

Unlike Entropy 3BB Strategy Scanner which uses two scanners which gives the watchlist first and then post the trades if it is triggered, The Entropy Alpha Strategy Scanner just posts when the trade is triggered.

Just take it when the Scanner Posts it.

Entropy 3BB Strategy –

Here go the Past trades that triggered from the watchlist of Entropy scanner –

You can backtest using the Bar Replay Method of any charting software like Tradingview with your exit strategy.

Entropy Alpha Strategy –

The Entropy Alpha Strategy is an exclusive trading approach based on the principles of the Entropy System, which revolves around probability distribution theories, with Bollinger Bands serving as its primary tool.

This is a comprehensive page showcasing the historical performance along with various analytics of Entropy Alpha trades.

Frequently Asked Questions

Absolutely not.

Sure, you might get lucky once in a while and make a small profit, but in the long run, you’re going to lose your shirt. The Indian market is particularly volatile, and unless you are absolutely sure that You can put stop loss in each trade religiously, you’re going to get eaten alive.

Your psychology will only develop after you spend some time in the market. But hey, if you’re determined to throw your money away, go ahead and give it a try. Just don’t say I didn’t warn you.

Each minute from 9:30 to 14:50.

It is incredibly stressful and time-consuming. You’ll be glued to your computer screen for hours on end, obsessively watching the market and trying to predict its every move. It’s no way to live, trust me.

Unless You put Stoploss. Then it is 15 mins a day!

Start with only 1000 INR. Take 1 quantity of equity trade for 30 days and test the strategy first.

Then jump with your comfortability.

Definitely.

Check for Trade Opportunity. Set the StopLoss. Forget. Repeat!