Backtesting Parabolic SAR Strategy in Multiple Instruments

In the previous chapter, we conducted numerous backtests on NIFTY Futures. Now, let’s venture into analyzing the Parabolic SAR Strategy across a variety of other instruments to unravel its underlying mechanics.

As we broaden our horizon beyond NIFTY, it opens up an avenue to compare and contrast how the strategy holds up across different market conditions and instruments. Whether it’s equities, commodities, or forex, understanding the adaptability and effectiveness of the Parabolic SAR Strategy is crucial. This endeavor will not only provide a holistic view of its performance but also enrich our strategic toolkit.

Backtesting Reliance Futures

In this section, we are conducting backtests on Reliance Futures with a capital of 3L.

Despite the changes in margin requirements over the years, it has never required more than 1.5L capital to hold 1 lot of derivative contract for Reliance, making a 3L capital seem quite secure.

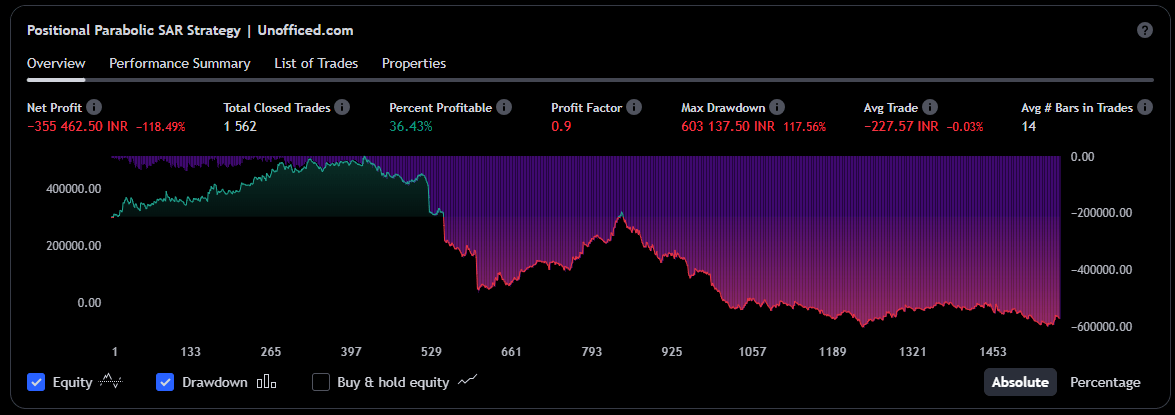

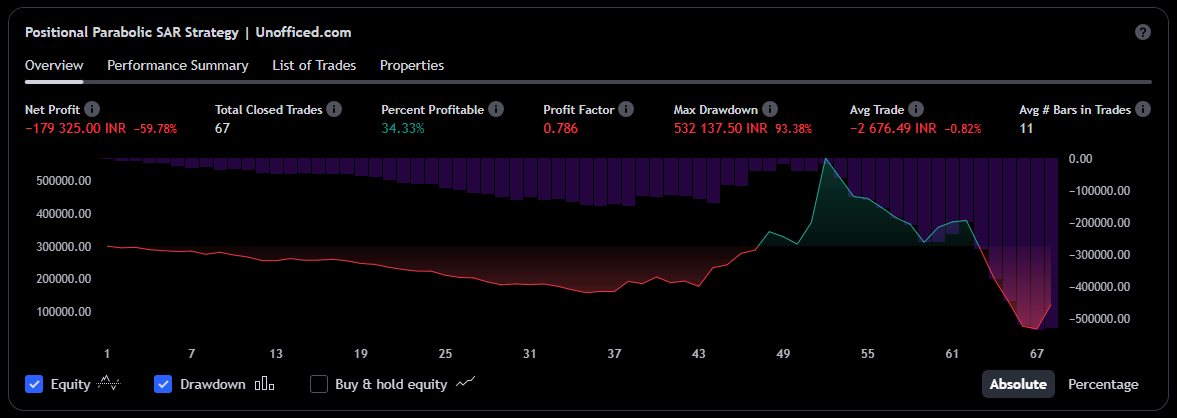

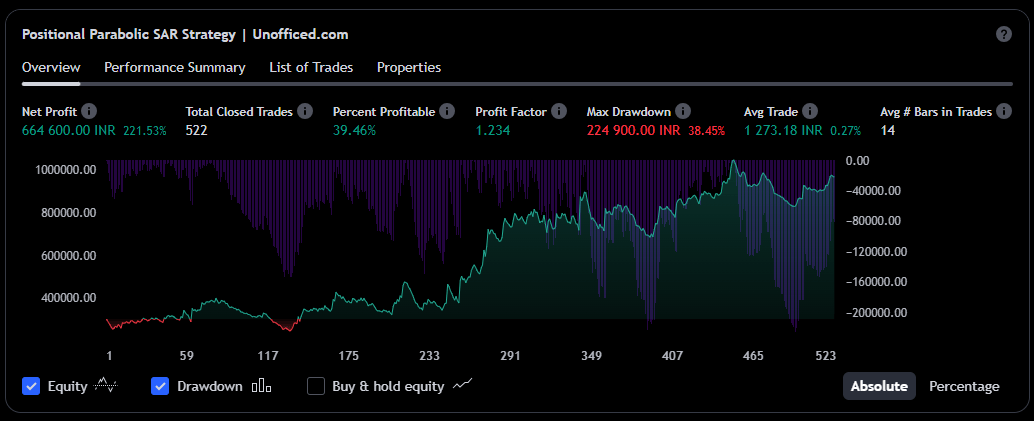

15 Minutes Timeframe

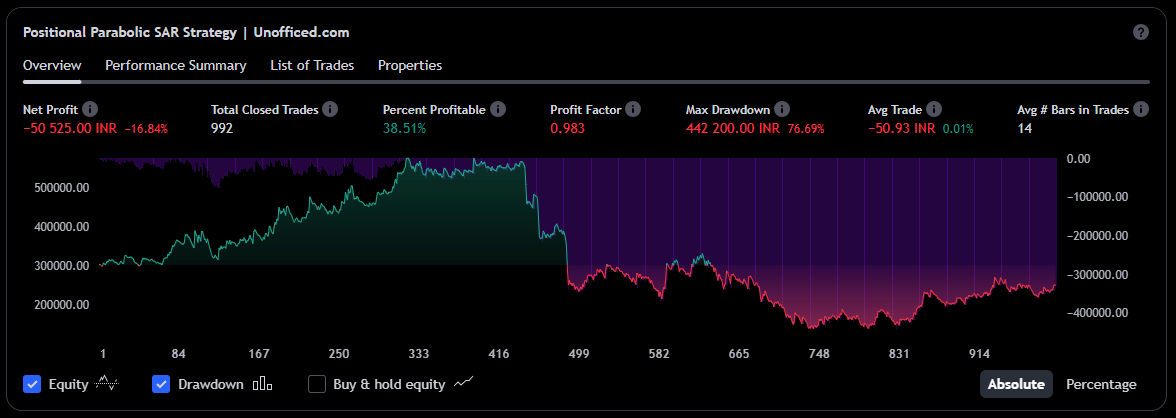

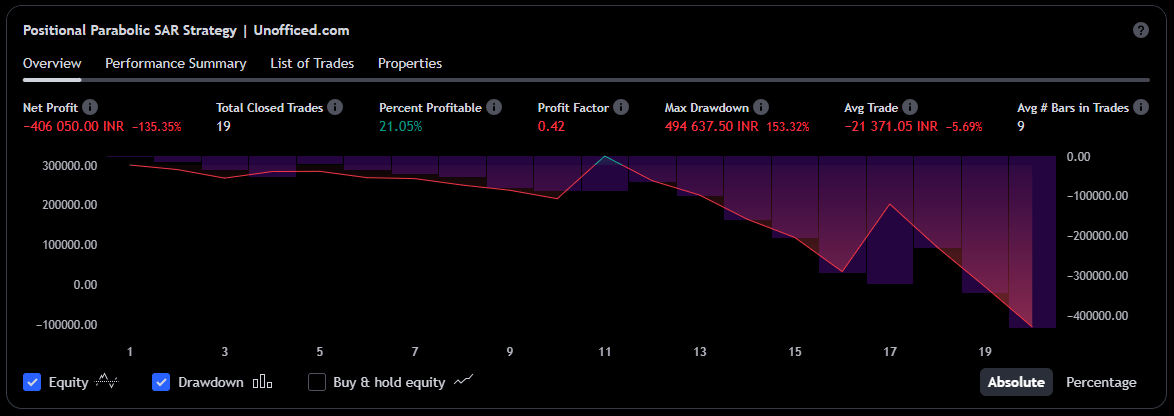

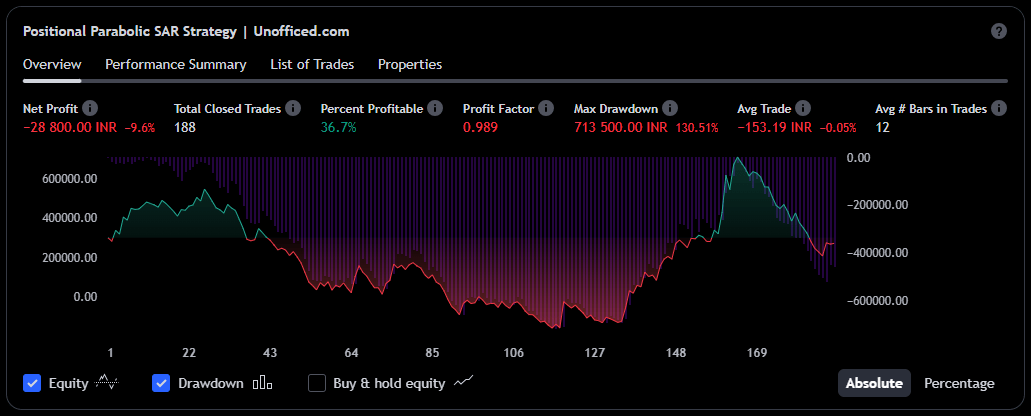

30 Minutes Timeframe

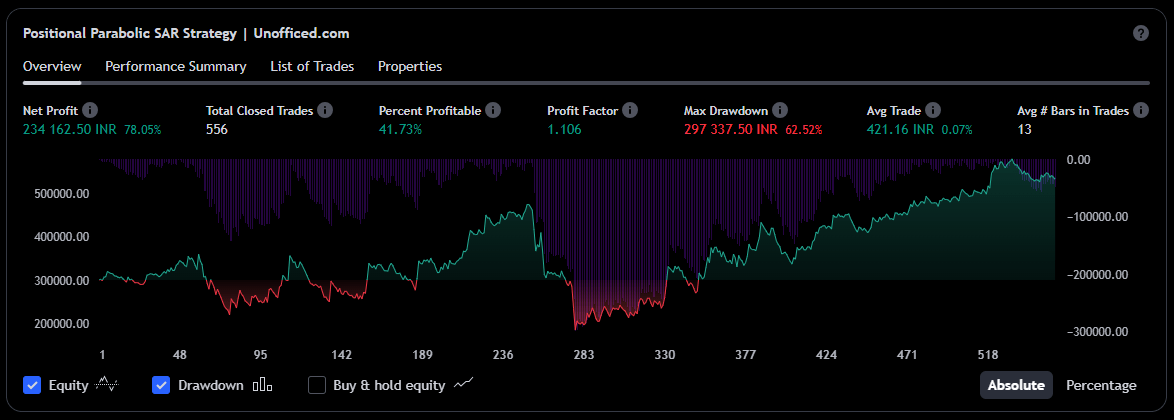

1 Hour Timeframe

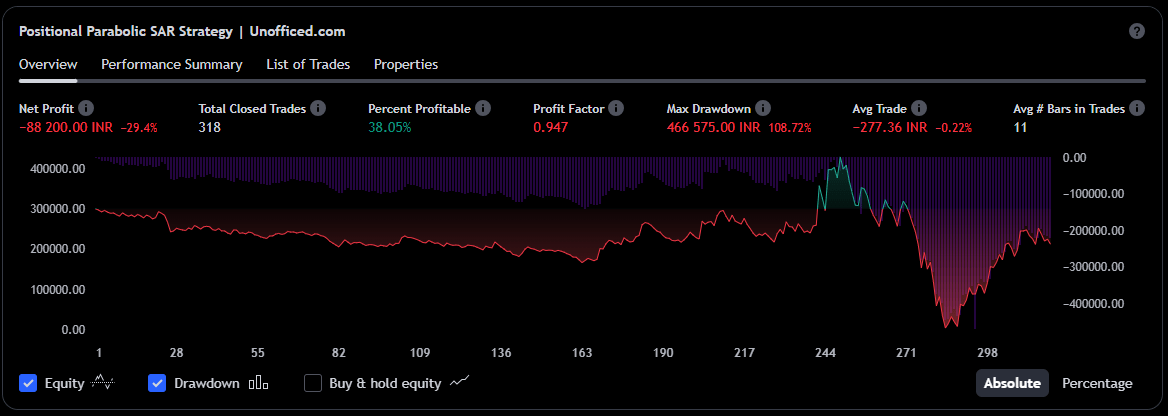

1 Day Timeframe

1 Week Timeframe

1 Month Timeframe

It’s quite intriguing to observe that, with the exception of the 1-hour timeframe, Reliance incurred substantial losses in all other timeframes. Moreover, in that 1-hour timeframe, the capital dipped below the original amount multiple times, experiencing absolute drawdown!

This leads to a question: does this imply that, aside from indices, we should hesitate to apply the Parabolic SAR directly to stocks since their prices are less likely to adhere to a normal distribution?

- Now, what about stocks that exhibit cyclical behavior?

- Could the Parabolic SAR have a different impact on such stocks?

This opens up an avenue for further examination to understand the behavior of cyclic stocks in relation to the Parabolic SAR strategy.

Backtesting Vedanta Futures

In this segment, we will shift our focus towards conducting a similar backtest on Vedanta stock, a commodity-based entity known for its cyclic nature. The cyclicality in commodity-based stocks often mirrors the fluctuations in commodity prices, thereby presenting a distinct pattern of price movements over time.

This characteristic trait of Vedanta prompts an intriguing inquiry: how would the Parabolic SAR strategy fare when applied to a commodity-centric, cyclic stock? Will the outcomes deviate from what we observed with Reliance, or align more with the patterns seen in the index?

15 Minutes Timeframe

30 Minutes Timeframe

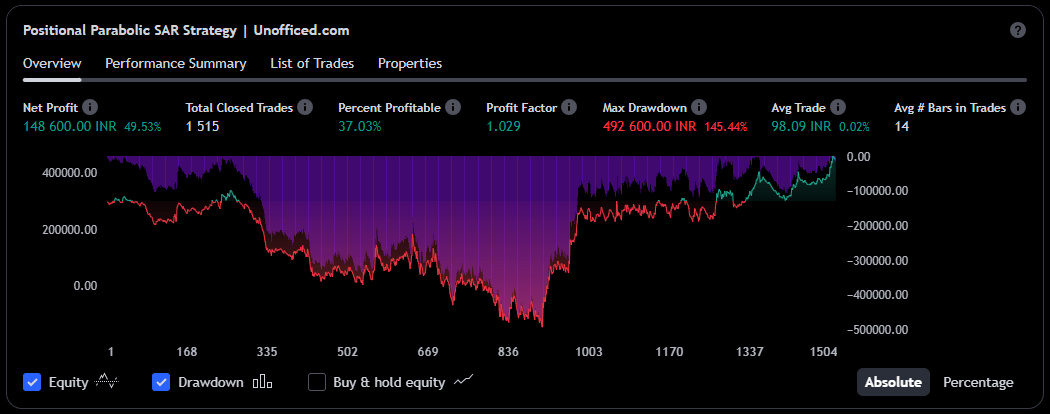

1 Hour Timeframe

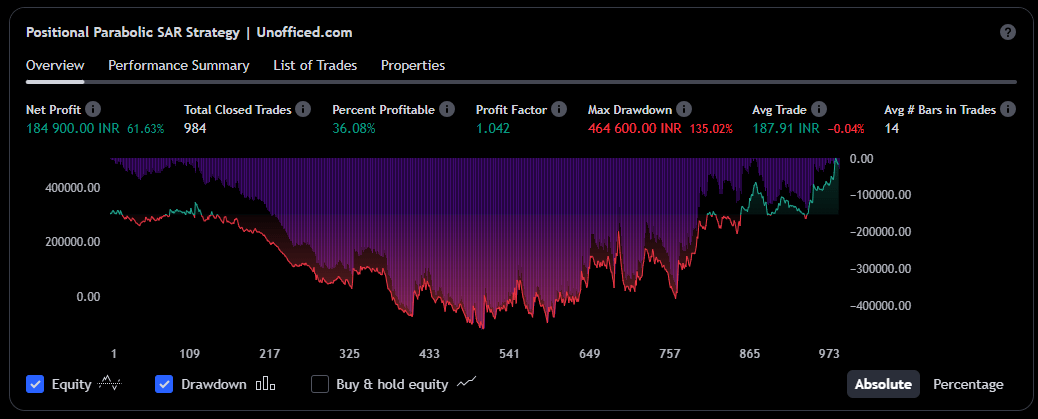

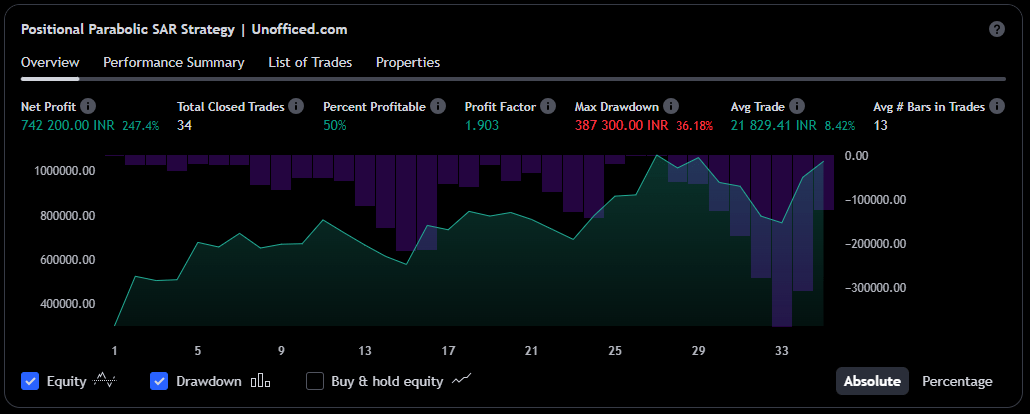

1 Day Timeframe

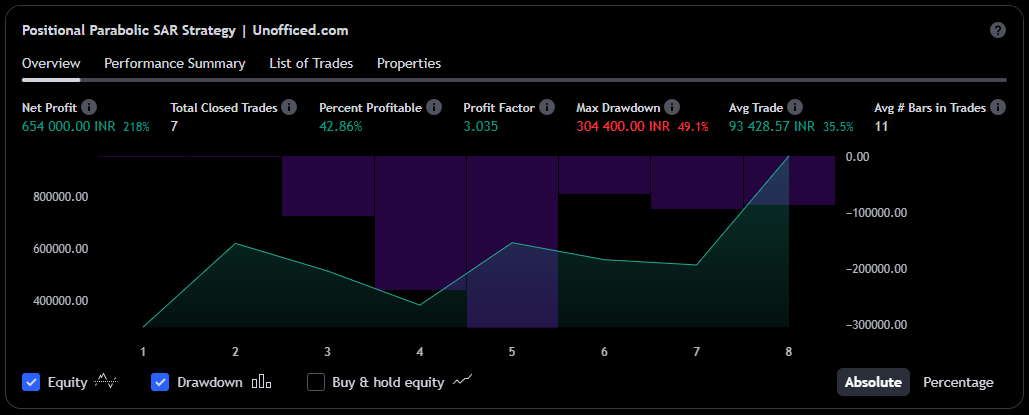

1 Week Timeframe

1 Month Timeframe

In line with our anticipation, the strategy manifested a robust profitability when applied to Vedanta across the majority of timeframes.

This outcome is an insightful revelation, showcasing the potential diversity in results when employing the Parabolic SAR strategy across varying market instruments and conditions.

Backtesting != Future Performance

However, it’s pivotal to retain a cautious perspective, as backtesting results are not definitive indicators of future performance. Here are some key points to consider:

Historical Performance vs Future Outcomes: Backtesting operates on historical data; it doesn’t account for potential future market changes. The past performance of a strategy does not guarantee similar outcomes in the future.

Market Conditions: Market conditions are in a constant state of flux, influenced by numerous external factors such as economic events, policy changes, and global occurrences. These factors can significantly impact a strategy’s effectiveness.

Overfitting: There’s a risk of overfitting when a strategy performs exceptionally well on past data. It might be tailored to past conditions and may not adapt well to new, unforeseen market scenarios.

Brokerage Fees and Slippage: Backtesting often overlooks the real-world implications of brokerage fees and slippage which can considerably affect net profitability.

Data Snooping Bias: Repeated backtesting across numerous instruments and timeframes can lead to data snooping bias, where a strategy might appear more effective than it genuinely is due to chance.

Well Overfitting is exactly what currently we are doing right now. We are basically looking for the timeframes it performed exceptionally well. Isn’t it?

Anyways, Engagement with different market instruments and exploring various timeframes can be an enriching exercise. It not only broadens your understanding but also enables a more comprehensive evaluation of the strategy’s versatility and robustness.