Backtesting Parabolic SAR Trading Strategy in Tradingview

This script provides a solid foundation for backtesting the Positional Parabolic SAR Strategy in TradingView. We have already discussed the strategy in the last chapter.

//@version=5

strategy("Positional Parabolic SAR Strategy | Unofficed.com", overlay=true)

initial = input(0.02)

step = input(0.02)

cap = input(0.2)

var bool isUptrend = na

var float Extremum = na

var float SARValue = na

var float Accelerator = initial

var float futureSAR = na

if bar_index > 0

isNewTrendBar = false

SARValue := futureSAR

if bar_index == 1

float pastSAR = na

float pastExtremum = na

previousLow = low[1]

previousHigh = high[1]

currentClose = close

pastClose = close[1]

if currentClose > pastClose

isUptrend := true

Extremum := high

pastSAR := previousLow

pastExtremum := high

else

isUptrend := false

Extremum := low

pastSAR := previousHigh

pastExtremum := low

isNewTrendBar := true

SARValue := pastSAR + initial * (pastExtremum - pastSAR)

if isUptrend

if SARValue > low

isNewTrendBar := true

isUptrend := false

SARValue := math.max(Extremum, high)

Extremum := low

Accelerator := initial

else

if SARValue < high

isNewTrendBar := true

isUptrend := true

SARValue := math.min(Extremum, low)

Extremum := high

Accelerator := initial

if not isNewTrendBar

if isUptrend

if high > Extremum

Extremum := high

Accelerator := math.min(Accelerator + step, cap)

else

if low < Extremum

Extremum := low

Accelerator := math.min(Accelerator + step, cap)

if isUptrend

SARValue := math.min(SARValue, low[1])

if bar_index > 1

SARValue := math.min(SARValue, low[2])

else

SARValue := math.max(SARValue, high[1])

if bar_index > 1

SARValue := math.max(SARValue, high[2])

futureSAR := SARValue + Accelerator * (Extremum - SARValue)

if barstate.isconfirmed

if isUptrend

strategy.entry("ShortEntry", strategy.short, stop=futureSAR, comment="ShortEntry")

strategy.cancel("LongEntry")

else

strategy.entry("LongEntry", strategy.long, stop=futureSAR, comment="LongEntry")

strategy.cancel("ShortEntry")

plot(SARValue, style=plot.style_cross, linewidth=3, color=color.white)

plot(futureSAR, style=plot.style_cross, linewidth=3, color=color.red)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

Script Breakdown:

//@version=5: Specifies the version of Pine Script being used, which in this case is version 5.strategy("Positional Parabolic SAR Strategy", overlay=true): Defines a new strategy with the title “Positional Parabolic SAR Strategy” and sets the overlay to true to display the strategy on the price chart.initial = input(0.02),step = input(0.02),cap = input(0.2): Initializes input variables for the Parabolic SAR parameters: initial, step, and cap.Variable Initialization:

var bool isUptrend = na: Declares a boolean variable to track if the market is in an uptrend.var float Extremum = na: Tracks the extreme point (highest high or lowest low) in the current trend.var float SARValue = na: Stores the value of the Parabolic SAR.var float Accelerator = initial: Sets the acceleration factor for the Parabolic SAR calculation.var float futureSAR = na: Holds the predicted next period SAR value.

if bar_index > 0: Ensures the code below executes only from the second bar onward to have at least one previous bar for reference.Main Logic:

- The section within

if bar_index > 0contains the logic for calculating the Parabolic SAR values based on price action. - It checks whether the market is in an uptrend or downtrend, adjusts the acceleration factor, and calculates the SAR value accordingly.

- The section within

Entry and Exit Logic:

- Within

if barstate.isconfirmed, the script defines the entry and exit conditions usingstrategy.entryandstrategy.cancelfunctions based on the SAR values and market trend.

- Within

Visualization:

plot(SARValue, style=plot.style_cross, linewidth=3, color=color.white): Plots the current SAR value on the chart.plot(futureSAR, style=plot.style_cross, linewidth=3, color=color.red): Plots the predicted next period SAR value on the chart.

Backtesting NIFTY Futures

In Tradingview, You can find the NIFTY futures in a continous contact which means it will auto rollver when there is expiry and it will take the prive of the contact whcih is about to expire. So that is exaclty what we need.

So although the lot size and margin changes over time, we have taken the contract to be 1 which mean it will take the 1 lot automatically. The current margin of 1 lot nifty is around 1,50,000 inr. So, Lets run the strategy with various timeframe to analsyse how it is working.

The reason of choosing NIFTY straightforward because it is an index.

The core principal of Parabolic SAR lies on the assumption that the market follows normal distribution. We can refer “index” as “the market” anyways. What can be more appropiate?

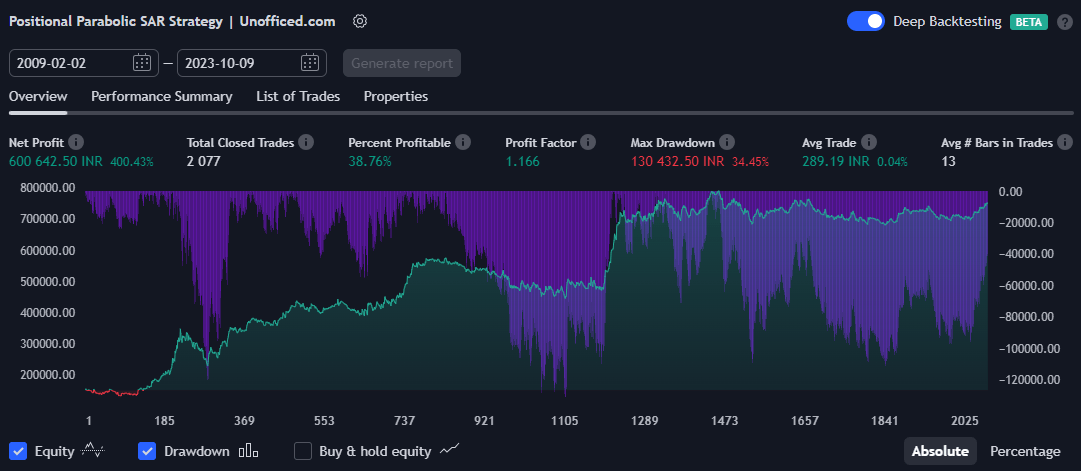

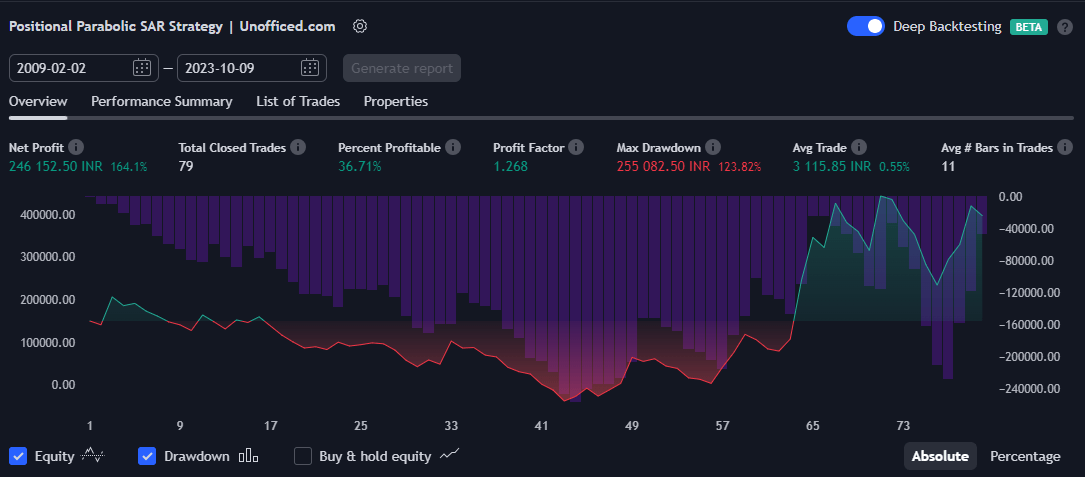

15 Minutes Timeframe

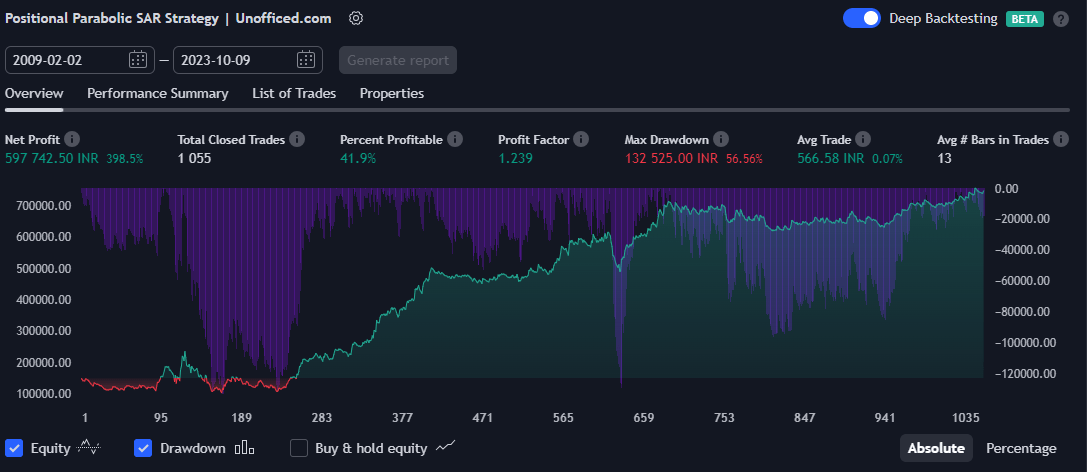

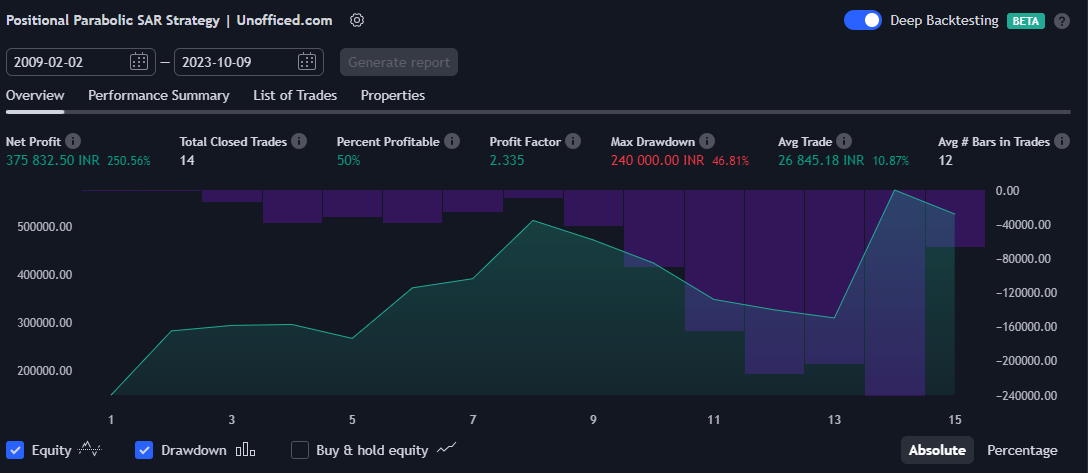

30 Minutes Timeframe

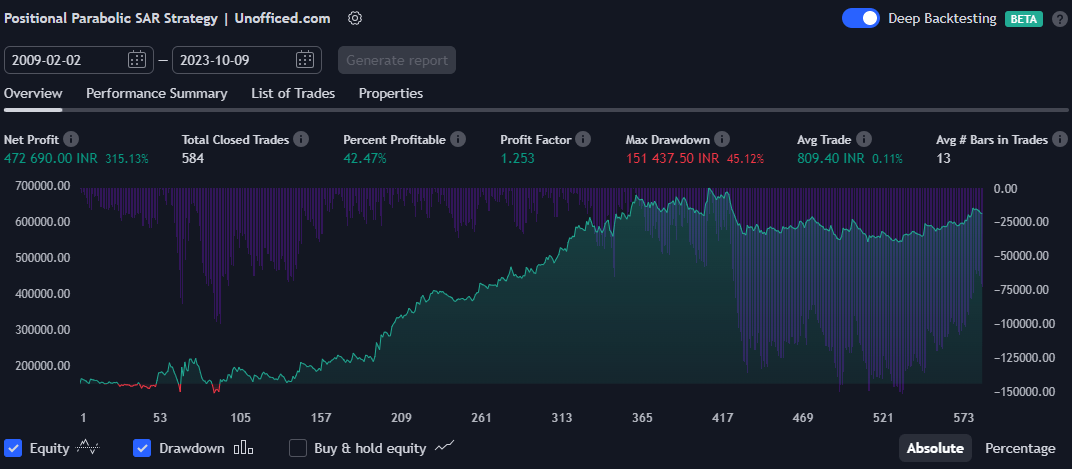

1 Hour Timeframe

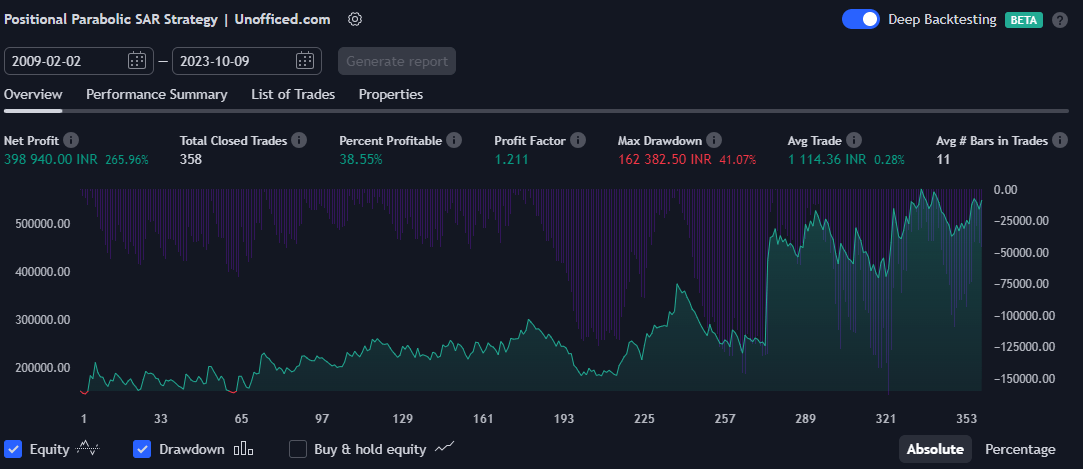

1 Day Timeframe

1 Week Timeframe

1 Month Timeframe

The rationale behind selecting the 30-minute strategy for illustration is evident from the above data – the performance dwindles as the timeframe extends. This decline is primarily due to the multitude of events and news that crop up in a longer timeframe, deviating from a normal distribution.

- While a 15-minute strategy showcases higher profits, it generates twice the number of trades compared to a 30-minute timeframe. Hence, to curb costs, a 30-minute window has been opted for.

- Also the profitibility of the 30-minute strategy is slight higher.

Although the monthly timeframe emerges as the most favorable, the scant number of trades it produces renders it inadequate as a data point for analysis.

So far, it is a blockbuster and simple strategy that works!

- Now, apart from NIFTY, What other instrument we can backtest with the Parabolic SAR Strategy?

- Also, Can it be automated directly in the account so that We do not have to stay glued into the screen?

- Why don’t you explore the strategy yourself with various instruments and various timeframes and share all the interesting results you get.