Bollinger Bands

In this section. you will learn –

- What the Bollinger Bands indicator is.

- What the Bollinger Bands indicator shows.

- How to use the Bollinger Bands indicator.

- How altering the Bollinger Bands indicator settings affects it.

The Bollinger Bands Indicator

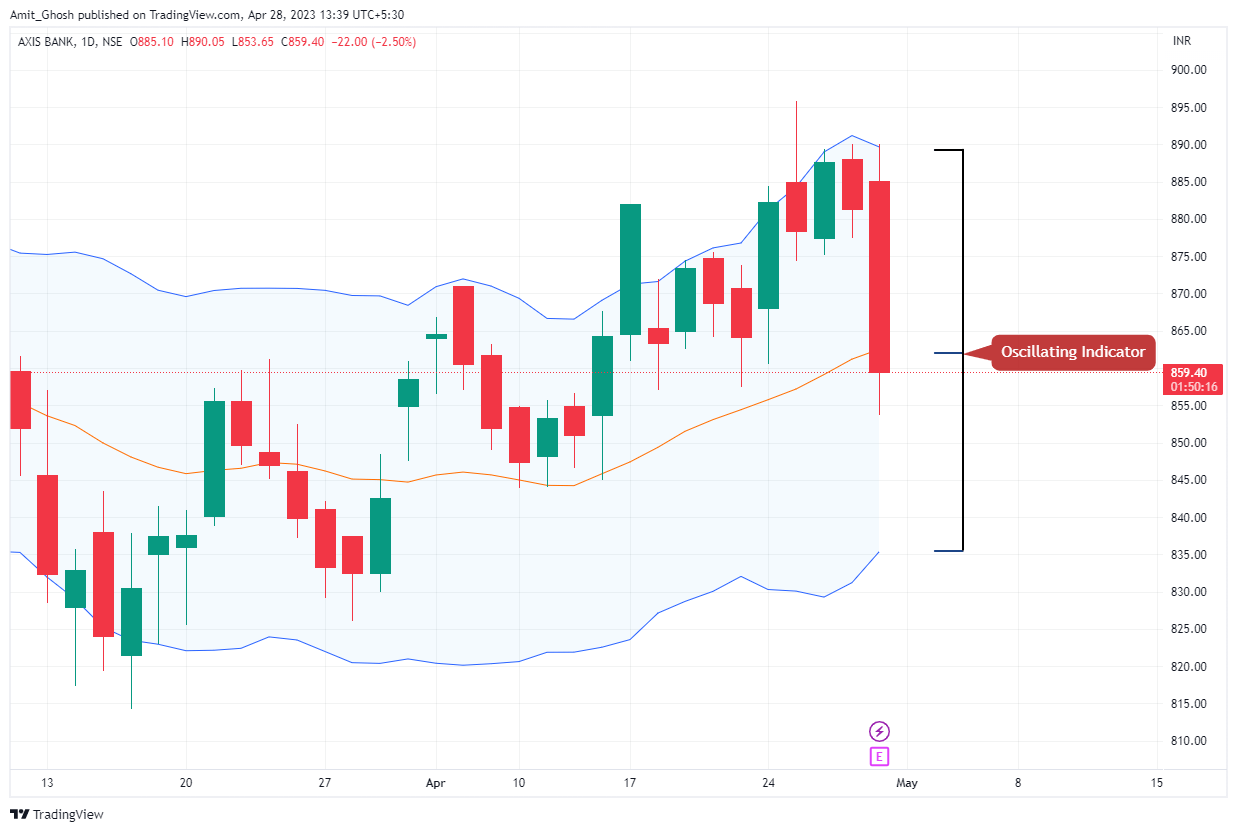

The Bollinger Bands Indicator is an oscillating indicator.

Traders use it to measure the volatility of a market.

The Bollinger Bands can help you to identify points at which the price of an asset is high or low relative to its recent average. This can in turn help you to predict when price might rise or fall to its average level.

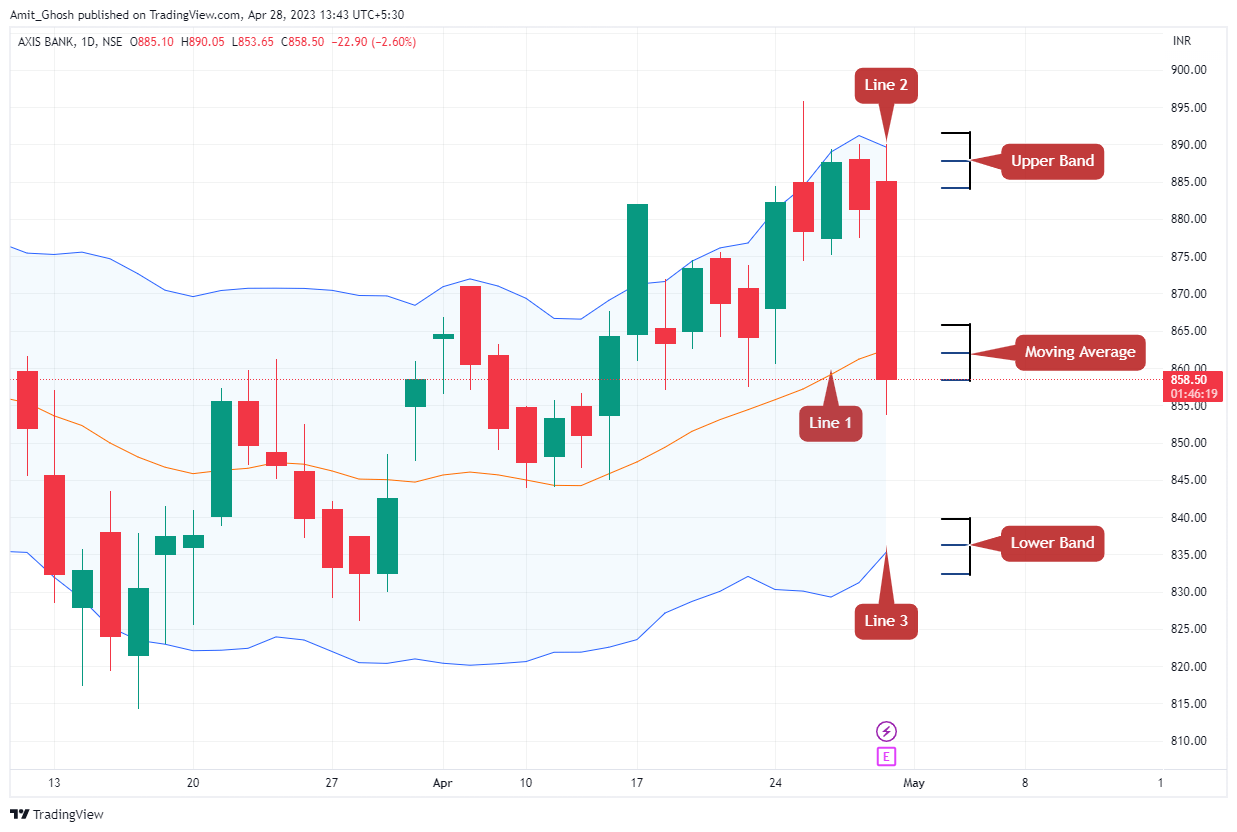

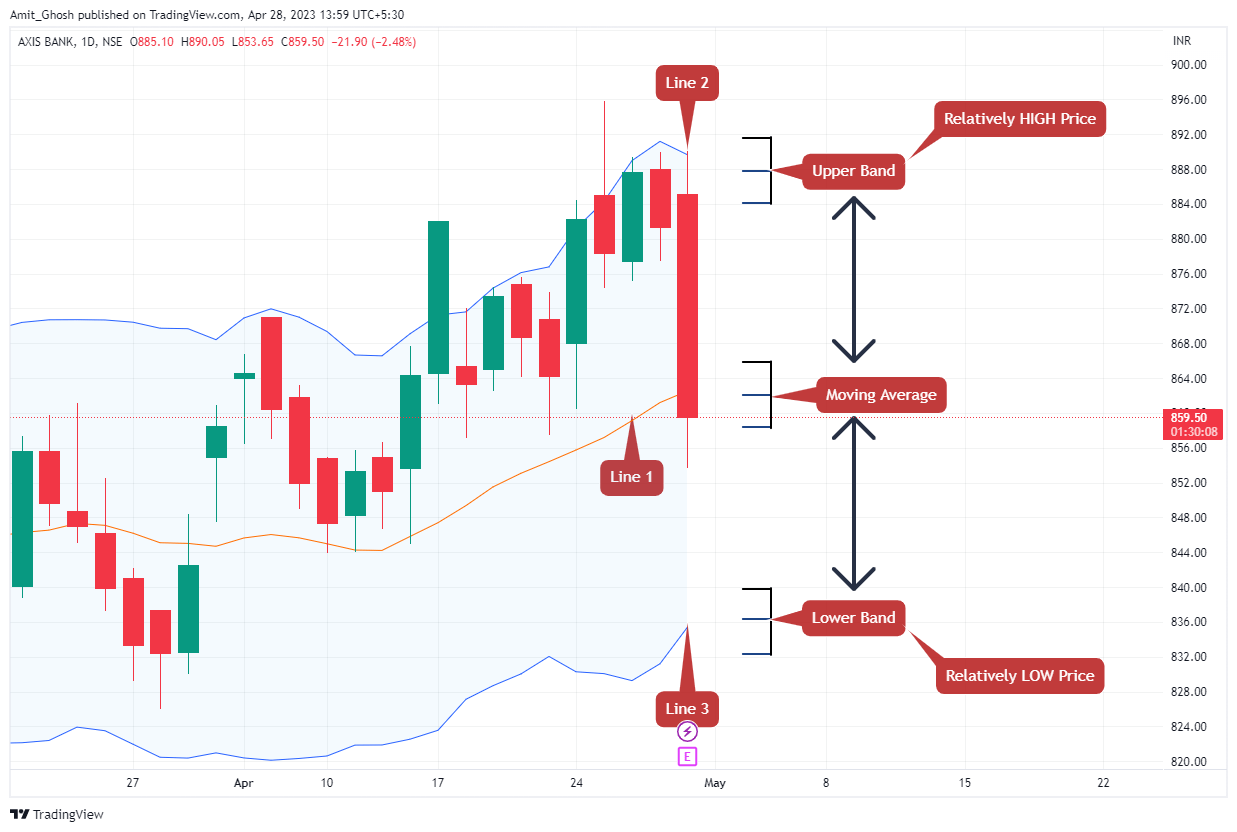

Three main lines make up the Bollinger Bands indicator.

- The first of these, the central band, is a simple moving average.

- The second and third, the upper and lower bands, represent levels at which price is relatively high or low, compared to this moving average.

Most of an asset’s price action will take place within two outer bands, meaning they can be used to predict reversals.

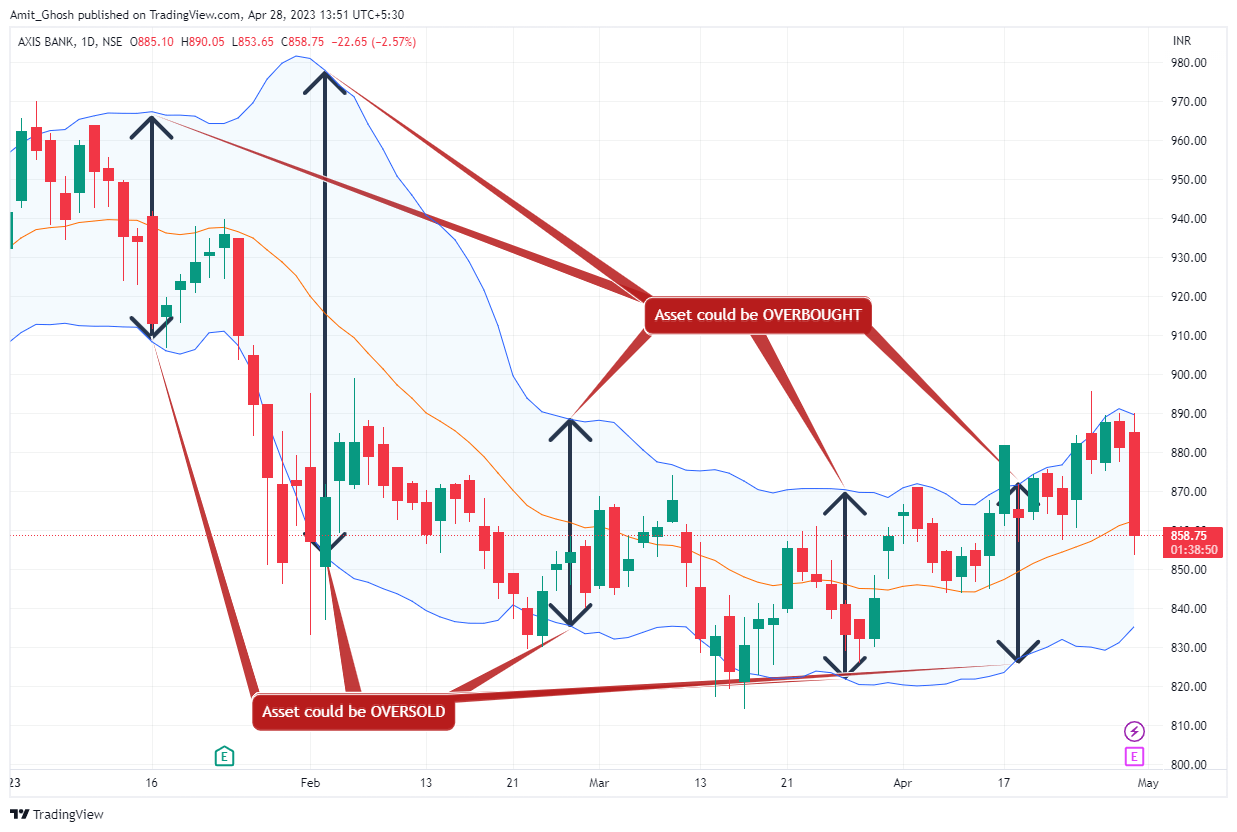

- If price reaches the upper band, this means it is relatively high and the asset could be overbought.

- You could look to sell an overbought asset on the assumption that its price will fall towards moving average.

- Conversely, if price reaches the lower band, this means it is relatively low and the asset could be oversold.

- You could look to buy an oversold asset on the assumption that its price will rise towards the central moving average.

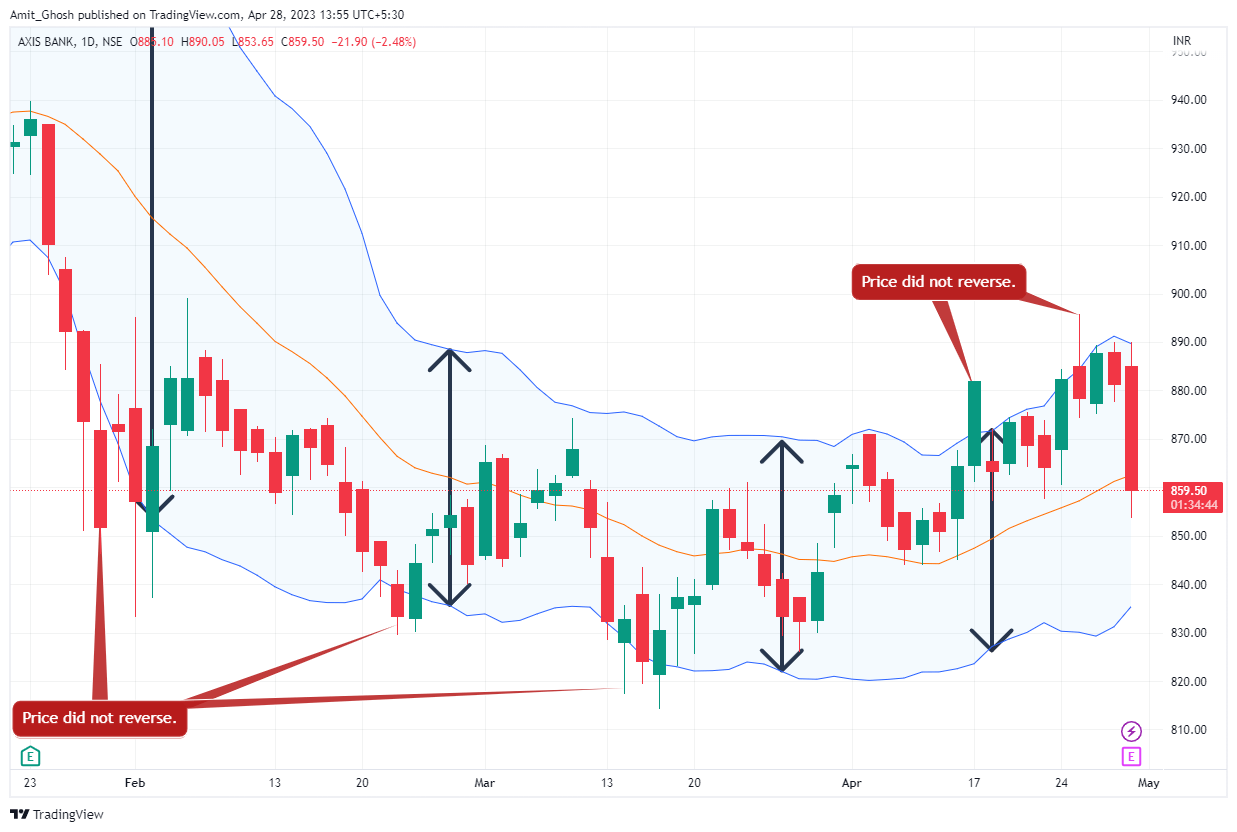

It is important to remember that just because price may reach the outer bands does not always mean it will reverse.

Always look for further confirmation from another indicator, or by using candlestick analysis before you place your trade.

The Bollinger Bands Indicator and Volatility

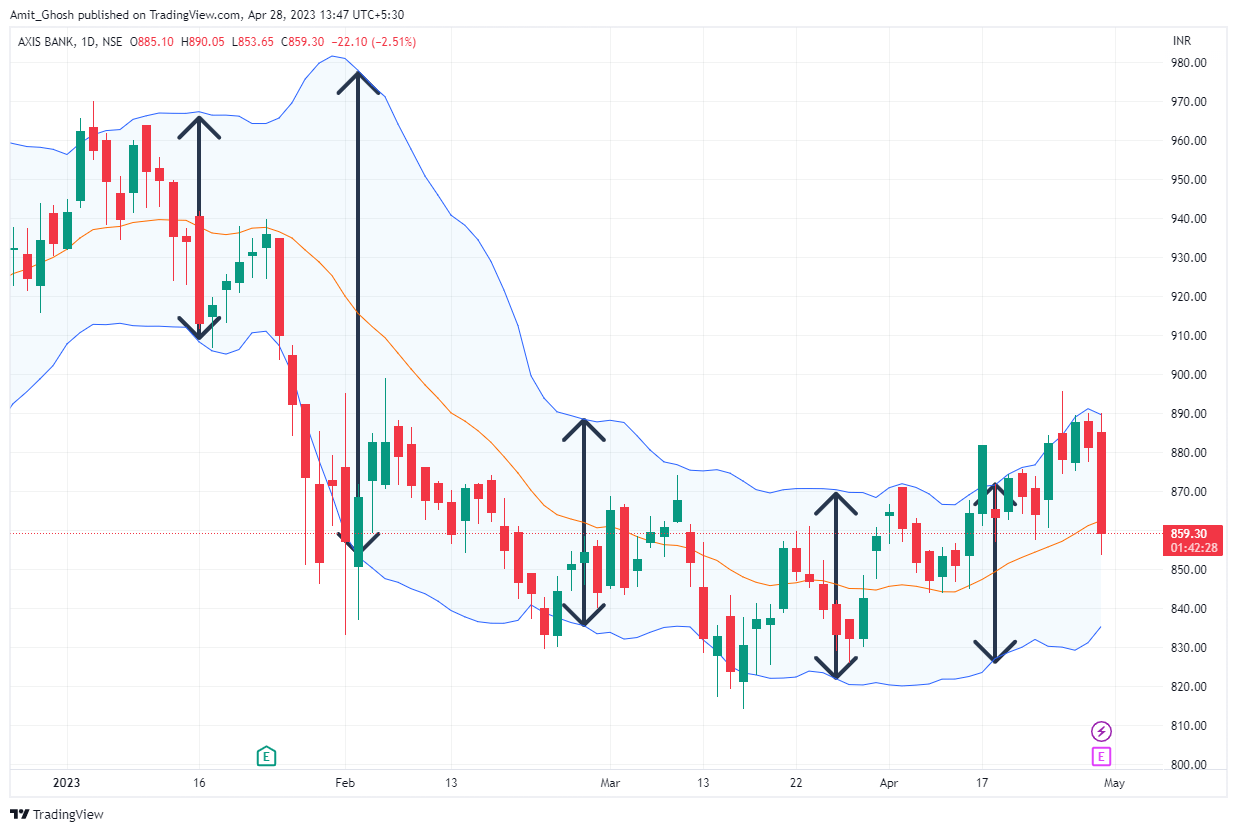

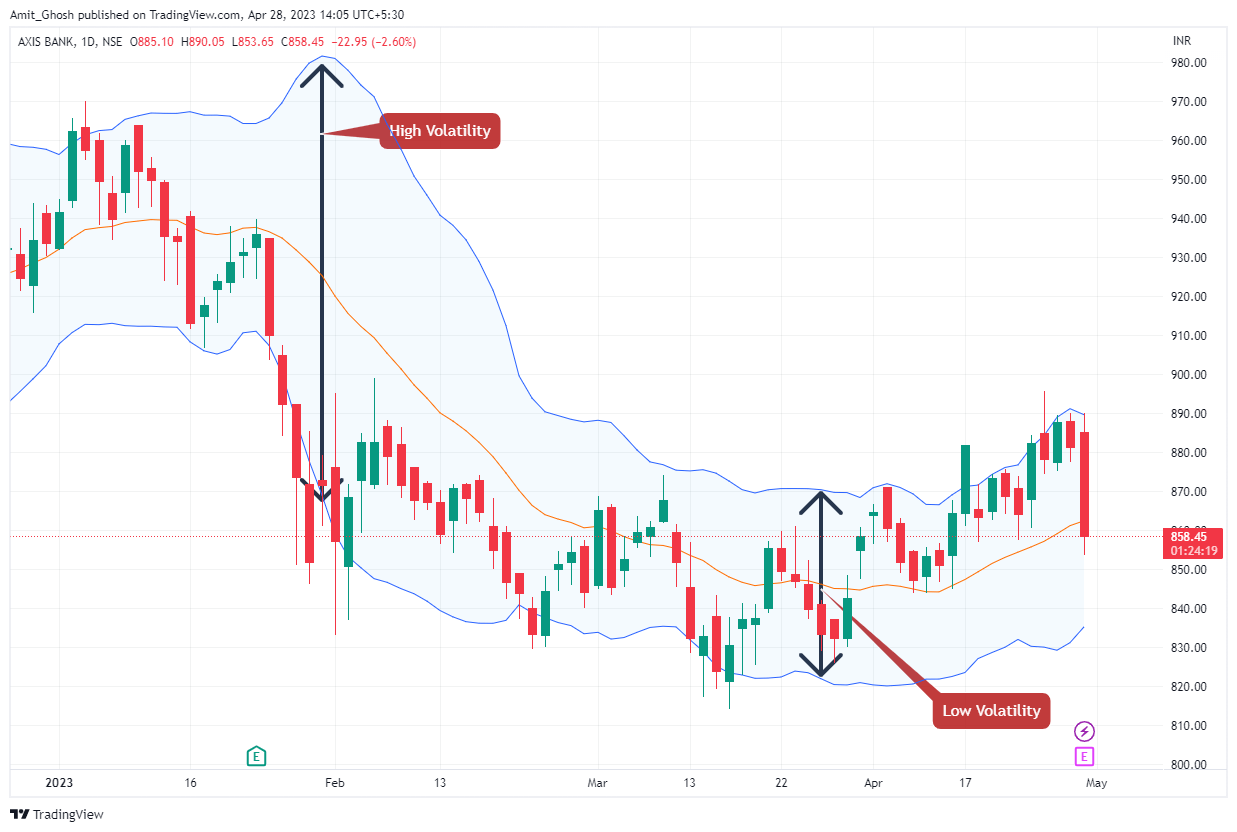

You can also use the distance between the bands to indicate how volatile the price of an asset is.

- If the distance between the bands is large, this indicates high volatility.

- Conversely, if the distance between the bands is small, this indicates low volatility.

Changing the Bollinger Settings - Period

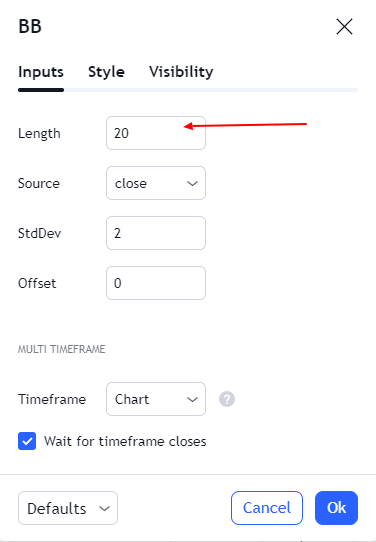

You can change the settings of the Bollinger bands indicator to suit your own personal strategy. The first setting you can change is the period setting.

Altering the period setting will alter the number of periods on which the Bollinger band is calculated. The standard period setting is 20.

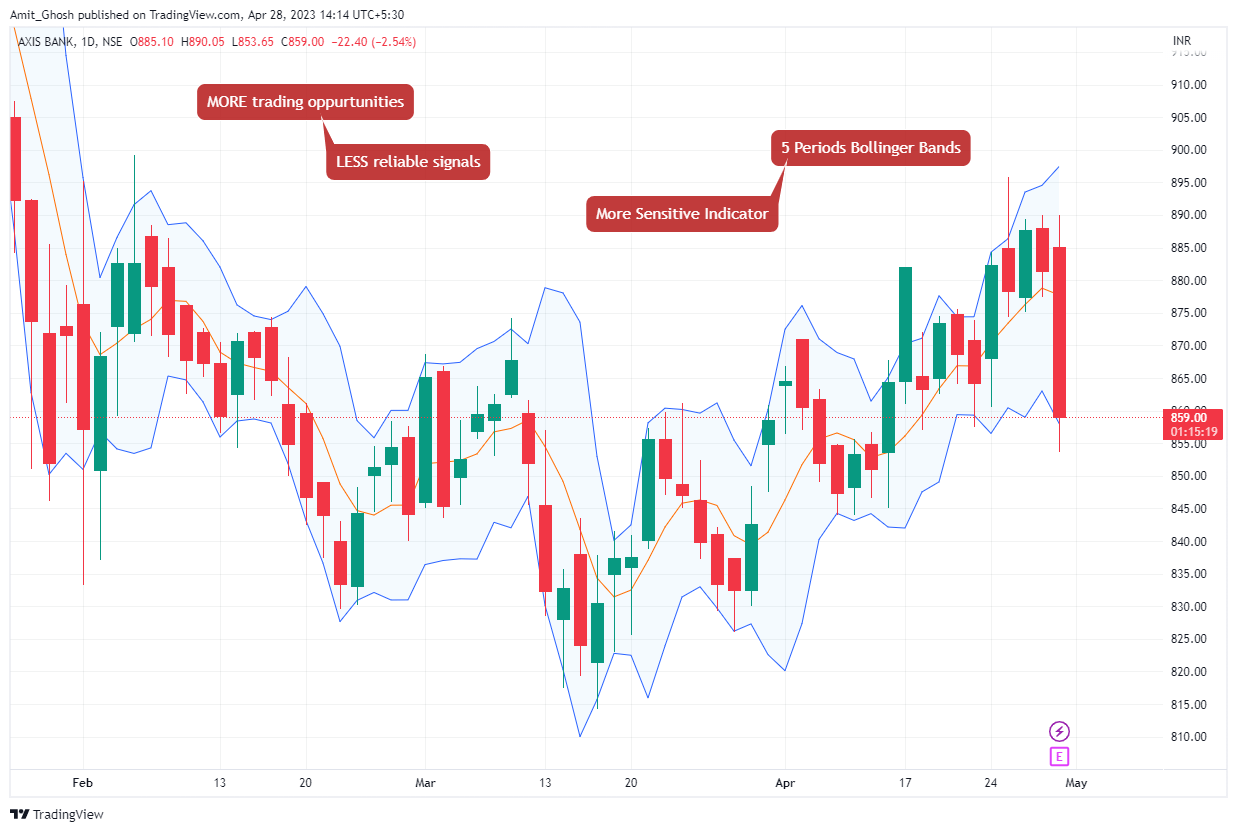

If you change this to a lower setting, 10 periods for example, then the indicator will be more sensitive to price movements.

- This will result in choppy and narrower bands that price will reach and break through more often.

- This will offer more trading opportunities, but the signals will be less reliable.

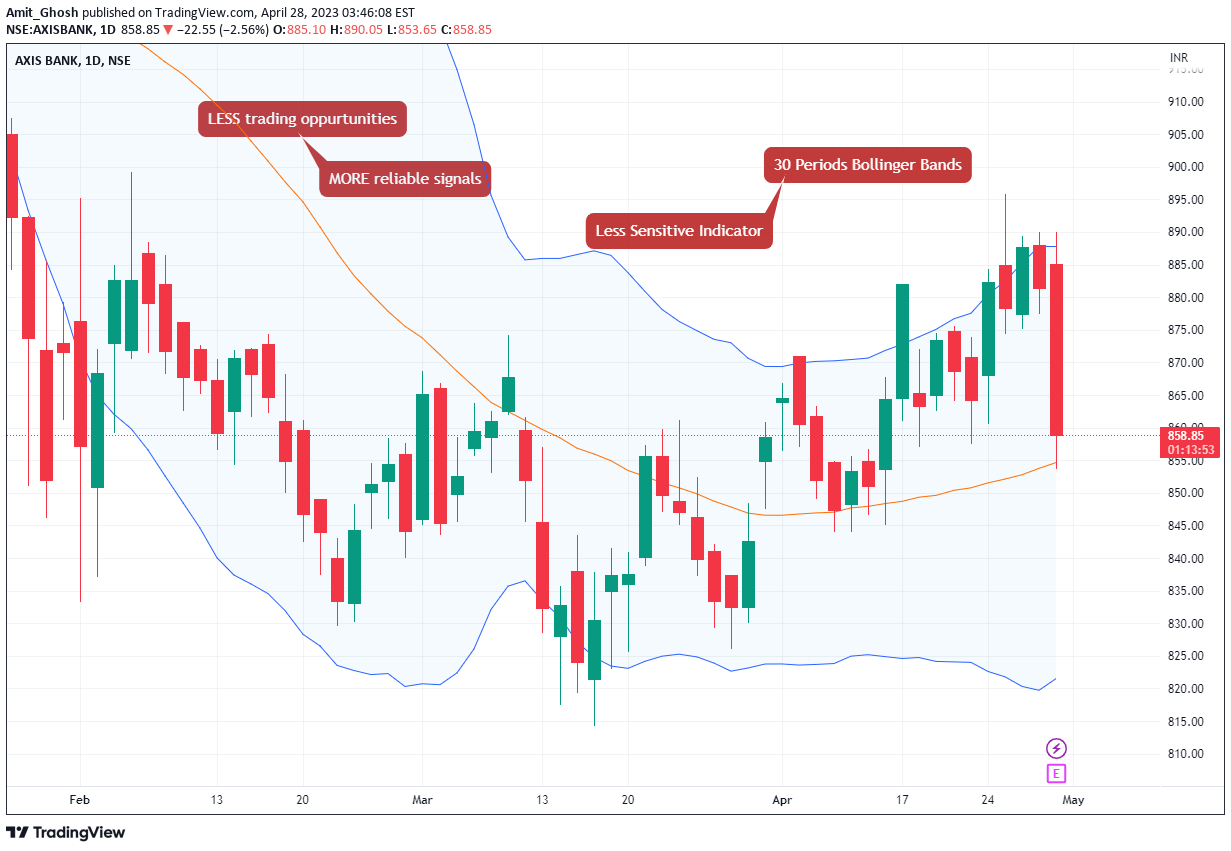

Conversely, if you change this to a higher setting, 30 periods, for example, then the indicator will be less sensitive to price movements.

- This will result in smoother and wider bands that price will reach and break through less often.

- This will offer less trading opportunities, but the signals will be more reliable.

Changing the Bollinger Settings - Standard Deviation

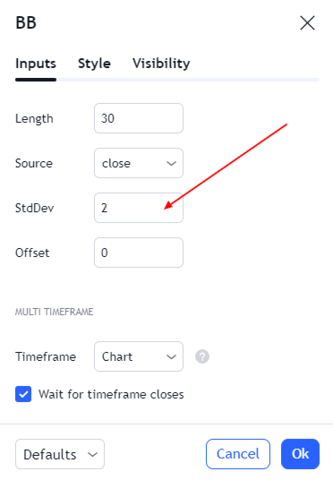

The second setting you can change is the standard deviation setting.

Changing the normal deviation setting will alter how much of the data from the moving average’s normal distribution pattern is included in the bands.

- A standard deviation setting of 1 means that 68% of price action will be contained within the bands.

- A standard deviation setting of 2 means that 95% of price action will be contained within the bands.

The default standard deviation setting for Bollinger bands is 2.

- So, increasing the settings from 2 to 3 will likely give you less frequent but more reliable signals.

- Decreasing this setting to 1 for example will make the bands narrower, meaning less price action will be contained within them. This will likely give you more frequent but less reliable signals.

Summary

- The Bollinger bands indicator is an oscillator indicator.

- It can present selling opportunities when an asset is overbought or buying opportunities when an asset is oversold.

- You can change both the period setting and the standard deviation setting.

- Depending on how you change these settings, the Bollinger Bands indicator will give you “more number of less reliable signals” or “less number of more reliable signals”.

Frequently Asked Questions

If you are hearing the term “Standard Deviation” first time –

Standard deviation is a measure of how much the values in a set of data vary from the average value of that data set. In the context of Bollinger bands, the standard deviation setting refers to the amount of price action that is included in the bands.

If you set the standard deviation to 1, it means that 68% of the price action will be contained within the Bollinger bands. This means that the bands will be relatively tight around the moving average line, and they will not include as much of the price action as they would if the standard deviation were set to 2.

To put it simply, when the standard deviation is set to 1, the bands will be closer to the moving average line and will include less of the price action. When the standard deviation is set to 2, the bands will be wider and will include more of the price action.

- 68% of the data falls within one standard deviation of the mean

- 95% of the data falls within two standard deviations of the mean

- 99.7% of the data falls within three standard deviations of the mean

We generally prefer to choose ‘exponential’ as our moving average type in the settings of Bollinger Bands Indicator because it reacts quickly to the newest data points. In fact here are the whole settings once again –

- Field – Close

- Period – 20

- Standard Deviations – 2

- Moving Average Type – Exponential

- Channel Fill – Yes

- Middle Band = 20-day exponential moving average (EMA)

- Upper Band = 20-day EMA + (20-day standard deviation of price x 2)

- Lower Band = 20-day EMA – (20-day standard deviation of price x 2)

It’s ma(20,ema,0,n). Period = 20 ; Field = Close ; Type = Exponential ; Offset = 0 ; Underlay = No

Period = 10 ; Field = Open ; Type = Exponential ; Offset = 1 ; Underlay = No ; Generally we assume field is closed.

![]() If we tick the underlay or mark it as yes; it means the candlesticks will appear above the moving average. In this picture the white lined moving average has its underlay as no while the red lined moving average has marked its underlay settings as yes.

If we tick the underlay or mark it as yes; it means the candlesticks will appear above the moving average. In this picture the white lined moving average has its underlay as no while the red lined moving average has marked its underlay settings as yes.