Combining Parabolic SAR with ADX

Integrating with the ADX

How to integrate the SAR and ADX?

Be cautious with a high ADX reading. If the ADX reading hits 50 or above, there’s a strong chance that the asset might pause and change direction, so be careful when the ADX shows a very strong reading.

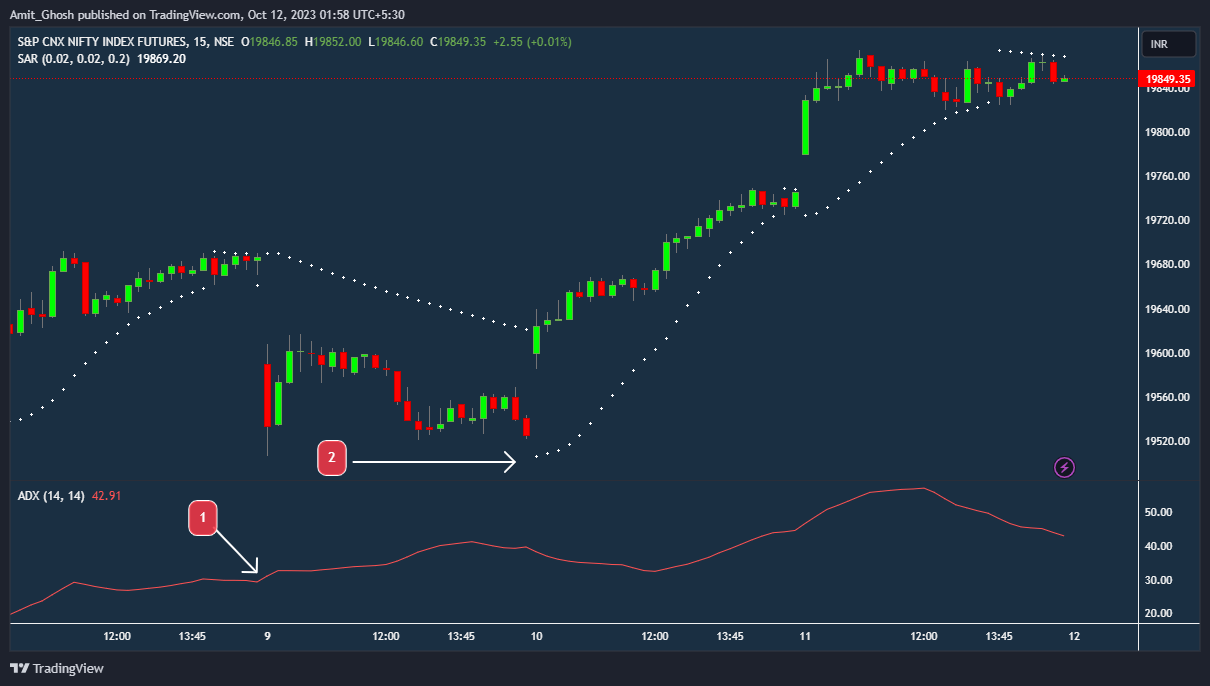

Reading the ADX and SAR Together

- ADX Below 25

- Price is stable; SAR isn’t giving accurate trend signals.

It’s evident that the market is stable and the SAR isn’t offering helpful insights.

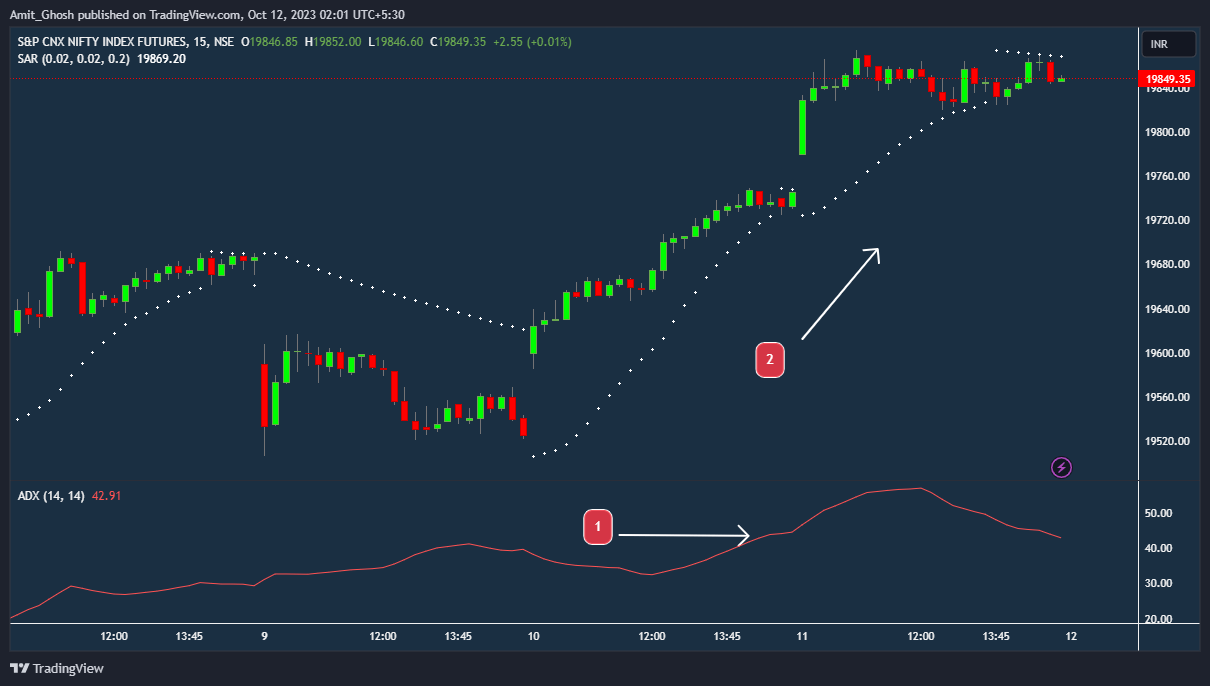

However, in the following image, the ADX value exceeds 25, creating favorable market conditions to make trading decisions with the SAR. It’s clear that the market is on a trend, and thus, the SAR can assist in entering a trade as well as setting a trailing stop loss.

- ADX Above 25

- Price is on a trend; SAR is giving accurate trend signals.

Adjusting the Parabolic SAR Settings

When using the parabolic SAR, settings can be changed to match personal preference.

Setting the SAR farther from price action results in slower reactions and fewer signals, but they are likely to be more reliable. Bringing the SAR closer to the price action leads to quicker reactions and more signals, although they might be less reliable.

Testing the SAR Settings

Once you’ve chosen the settings you want to test, you’re all set to start gathering data for comparing the outcomes of each setting.

- A good starting point is to trade with the SAR on its default settings.

- Your trading journal is an excellent resource for this kind of analysis.

After collecting enough data from trading with the default settings, you can repeat the process with various settings, analyzing the outcomes of a series of trades each time and comparing them with the original set.

It’s worth mentioning that including more trades in each sample over an extended period will make the analysis results more reliable and beneficial.

Summary

So far, You have learned –

- The Parabolic SAR (SAR) is a versatile tool that can be paired with many indicators to identify the direction and changes in a trend.

- It’s beneficial to pair the SAR with indicators that measure the strength of a trend rather than the direction, with the Average Directional Index (ADX) being a common choice for this purpose.

- The ADX indicator provides a reading based on price movements to indicate whether a trend is strong or weak, assisting traders in making informed decisions.

- Readings from the ADX can be integrated with the SAR to evaluate market conditions: a reading between 0 and 25 indicates a weak trend not ideal for trading, while a reading above 25 suggests a stronger trend conducive for trading.

- Adjusting the settings of the SAR can tailor its responsiveness to price actions, thereby affecting the reliability and frequency of the signals generated.

- Testing and analyzing various SAR settings through a trading journal over an extended period with more trades can lead to more reliable and insightful results, aiding in the refinement of trading strategies.