Tail Risk

In the realm of financial markets, the pursuit of profit often goes hand in hand with the acceptance of risk. However, not all risks are created equal. One particularly elusive and potentially devastating form of risk is known as “tail risk.”

The Foundation: Traditional Portfolio Strategies and Normal Distribution

Traditionally, investors and financial models have operated under the assumption that market returns follow a normal distribution. This conventional wisdom forms the basis of various financial theories and models, including Harry Markowitz’s modern portfolio theory and the Black-Scholes Merton option pricing model.

According to this assumption, market returns are distributed symmetrically around the mean, forming a bell-shaped curve.

Under the normal distribution framework, it is widely accepted that the probability of returns moving between the mean and three standard deviations, either positively or negatively, is approximately 99.97%. In simpler terms, the likelihood of returns straying more than three standard deviations from the mean is a mere 0.03%. This notion has been a fundamental pillar in risk assessment and investment decision-making.

The Challenge: Stock Market Returns and Excess Kurtosis

However, when we shift our focus to the world of stock market returns, we encounter a significant deviation from the idealized normal distribution. Stock market returns tend to exhibit excess kurtosis, which means that the tails of the distribution are fatter than what the normal distribution would suggest.

In essence, this implies that extreme events, or tail events, occur more frequently than the 0.03% probability implied by the traditional normal distribution.

Understanding Tail Risk

Tail risk, as the name suggests, refers to the risk associated with events occurring in the tails of the return distribution curve. These events are rare but can have profound and often negative consequences for investors. Tail risk encompasses scenarios where market returns move beyond three standard deviations from the mean, which was traditionally considered highly improbable.

One prime example of tail risk materializing is during major fundamental events or geopolitical upheavals, such as the Brexit referendum. Such events can trigger massive market volatility and sharp price declines that extend far beyond what conventional models would anticipate. Investors who are unprepared for these tail risk events can suffer significant losses.

Mitigating Tail Risk: The Importance of Hedging

Given the potential severity of tail risk events, prudent investors often employ risk mitigation strategies, and one of the most prominent among these is hedging. Hedging involves taking positions or employing financial instruments that offset potential losses in the event of adverse price movements.

One common approach to hedging against tail risk is to use options. Options provide the holder with the right, but not the obligation, to buy (call option) or sell (put option) a specific asset at a predetermined price (strike price) within a defined time frame. By holding options, investors can protect themselves from extreme price movements. For instance, during a market downturn, holding put options can limit losses by allowing the sale of assets at a higher, predetermined price.

Tail Risk in Gap Downs and Gap Ups

Another facet of tail risk is associated with gap downs and gap ups in the stock market. Gap downs occur when the opening price of a security is significantly lower than its previous closing price, while gap ups are the opposite, with the opening price substantially higher. These gaps in price can be the result of overnight news, earnings reports, or other unforeseen events.

Investors holding positions in securities that experience gap downs or gap ups can face substantial losses or gains depending on the direction of the gap. To mitigate the impact of these events, it is advisable to employ hedging strategies, such as options or stop-loss orders, which can limit losses in the case of gap downs and lock in gains for gap ups.

BankNifty and Tail Risk

The BankNifty, a key benchmark index in the Indian stock market, is not immune to the dynamics of tail risk. In fact, given the inherent volatility of financial stocks and the broader economic factors influencing the banking sector, tail risk can manifest in particularly significant ways for BankNifty investors.

Consider the scenario of a major financial crisis, where banking stocks plummet due to systemic issues. In such cases, tail risk events can lead to substantial declines in the BankNifty index, causing significant losses for investors. To protect against such tail risk scenarios, investors in the BankNifty may choose to implement hedging strategies, including the use of options or diversification into less volatile assets.

Taleb’s Turkey Reference: Preparing for the Unexpected

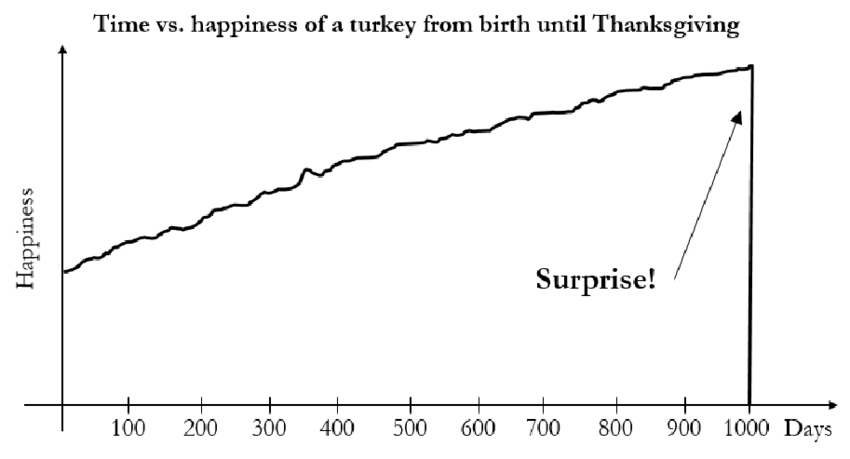

Nassim Nicholas Taleb, a prominent figure in the world of risk management, introduced the concept of the “turkey problem” to illustrate the dangers of over-reliance on historical data and the failure to anticipate rare but catastrophic events. In Taleb’s analogy, a turkey is fed and cared for by a farmer for a thousand days, leading the turkey to believe that it will always be well-fed and safe. However, just before Thanksgiving, the turkey’s expectations are shattered as it faces an unexpected and irreversible fate.

This parable serves as a stark reminder that relying solely on historical data and conventional models may lead investors to underestimate tail risk. Like the turkey, investors may become complacent and fail to prepare for rare but high-impact events that can have devastating consequences for their portfolios.

Conclusion

Tail risk is a phenomenon that underscores the unpredictable and occasionally perilous nature of financial markets. While it may be rare, the impact of tail risk events can be severe, making it a critical consideration for investors