The Parabolic SAR Trading Strategy

The Parabolic SAR (Stop and Reverse) is a technical indicator used by traders to determine the direction of a market’s trend and to provide entry and exit points. This chapter delves into a trading strategy revolving around the Parabolic SAR, elaborating on its core principles and how it can be utilized for making trading decisions.

The indicator is wildly famous and available in all major trading platforms. For our discussion, We will use Tradingview! Also, We shall use the default settings of the indicator without discussing them in details in this current chapter.

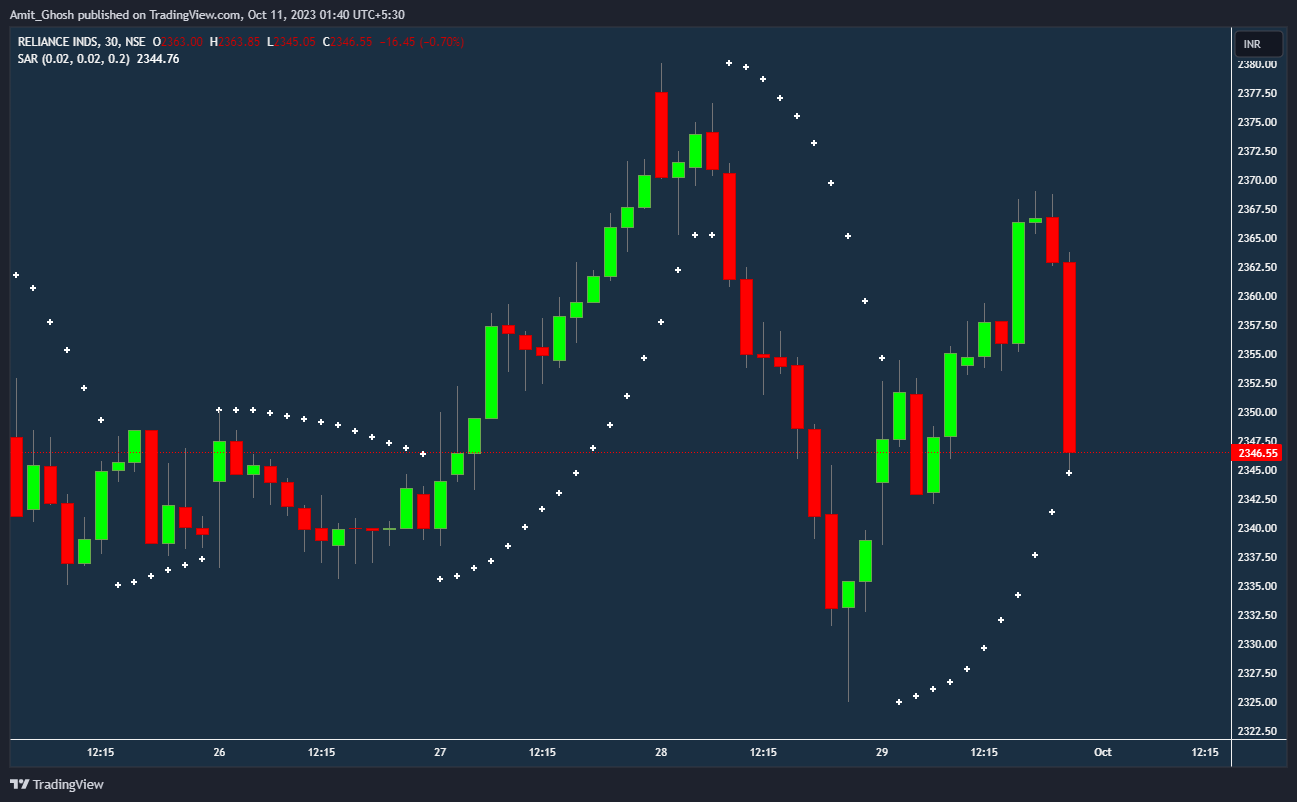

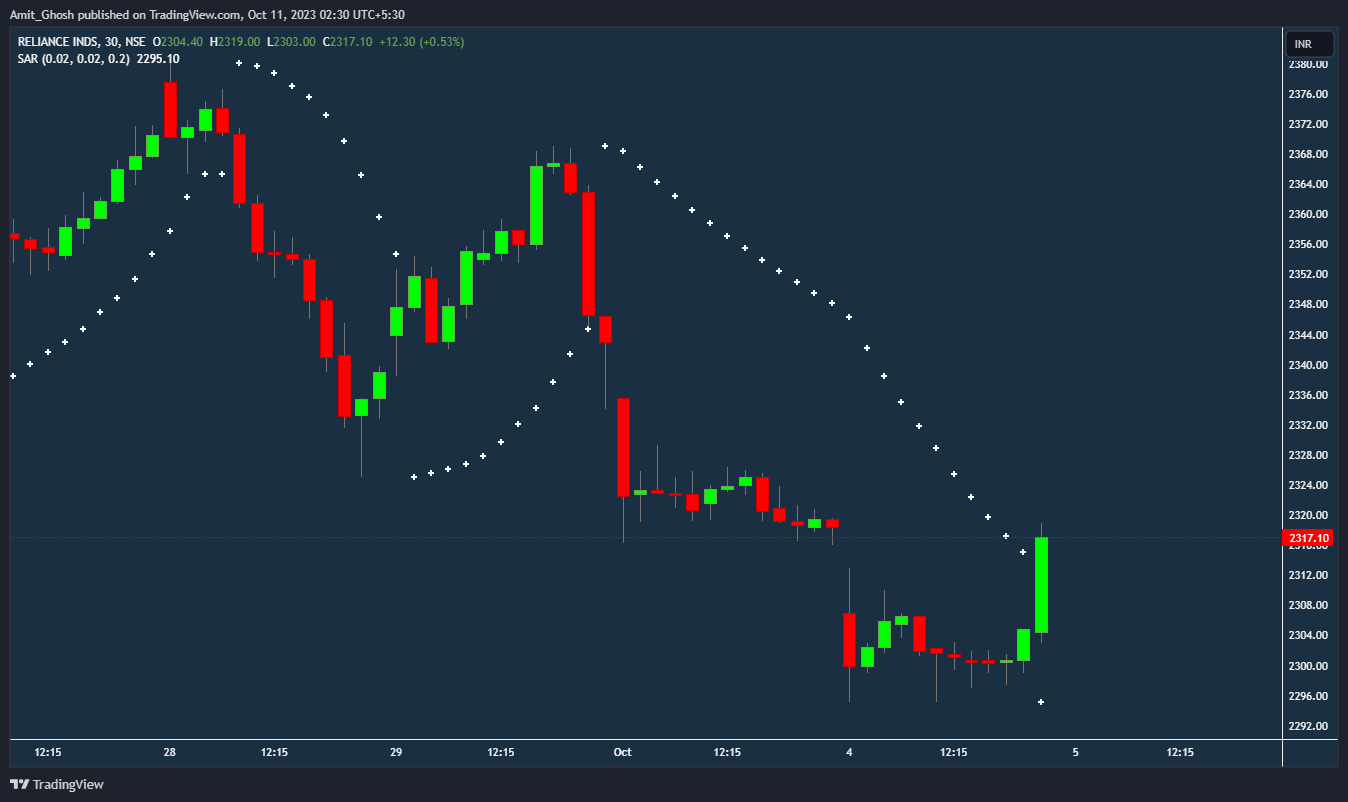

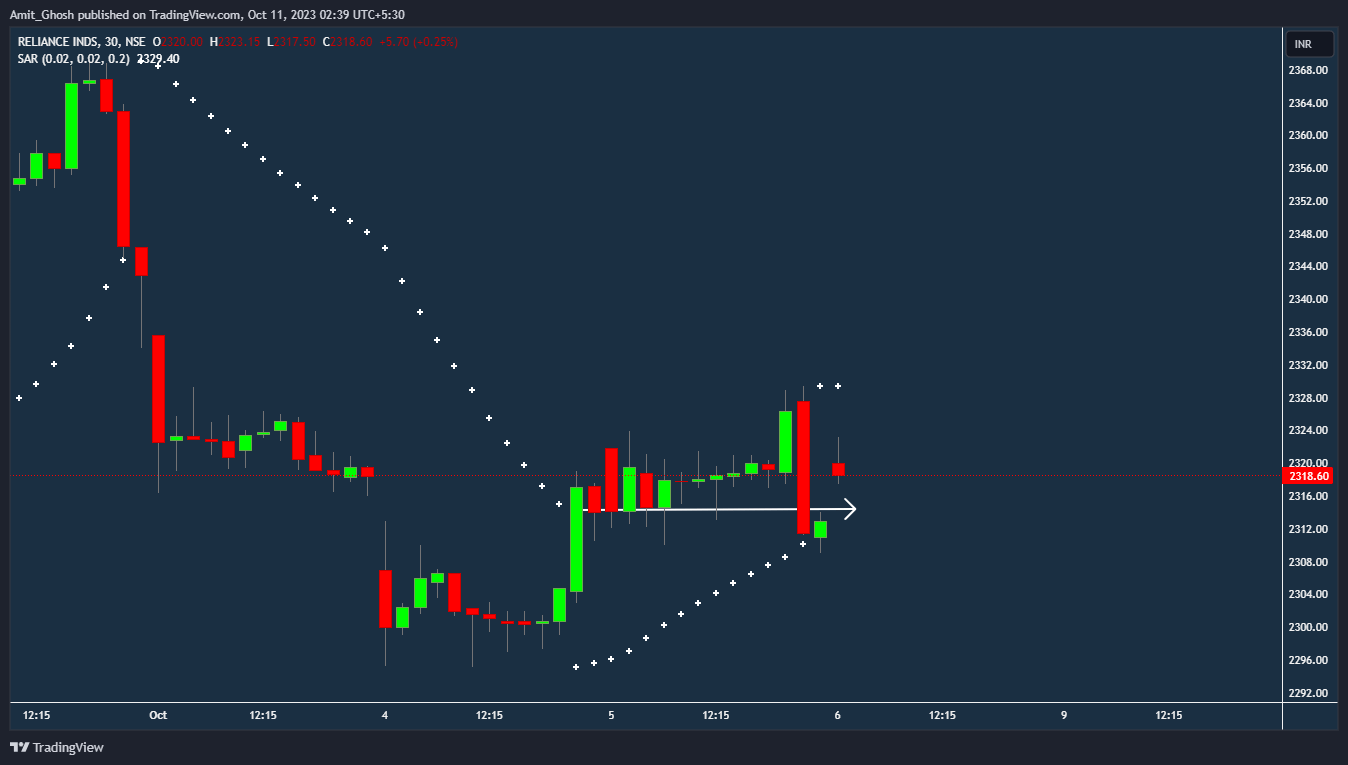

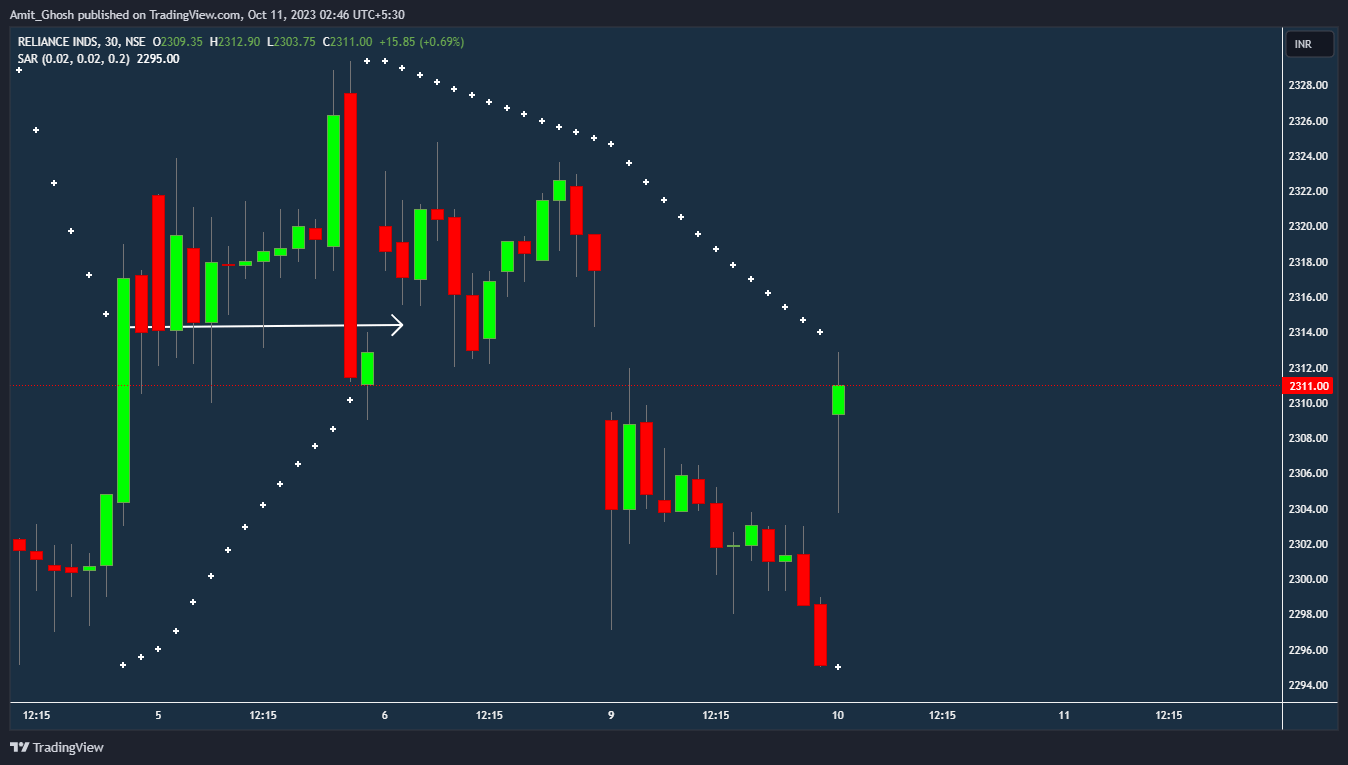

In this following chart, You can see Parabolic SAR indicator is deployed in Reliance into 30 minutes timeframe.

Have a look –

From now on, Let’s refer the Parabolic SAR as PSAR.

In this candle, You can see the PSAR is almost about to touch the candle’s low. So it means We need to be cautious now i.e. the trend can reverse and we may need to take short position.

In the next candle, it actually happens! The short triggers.

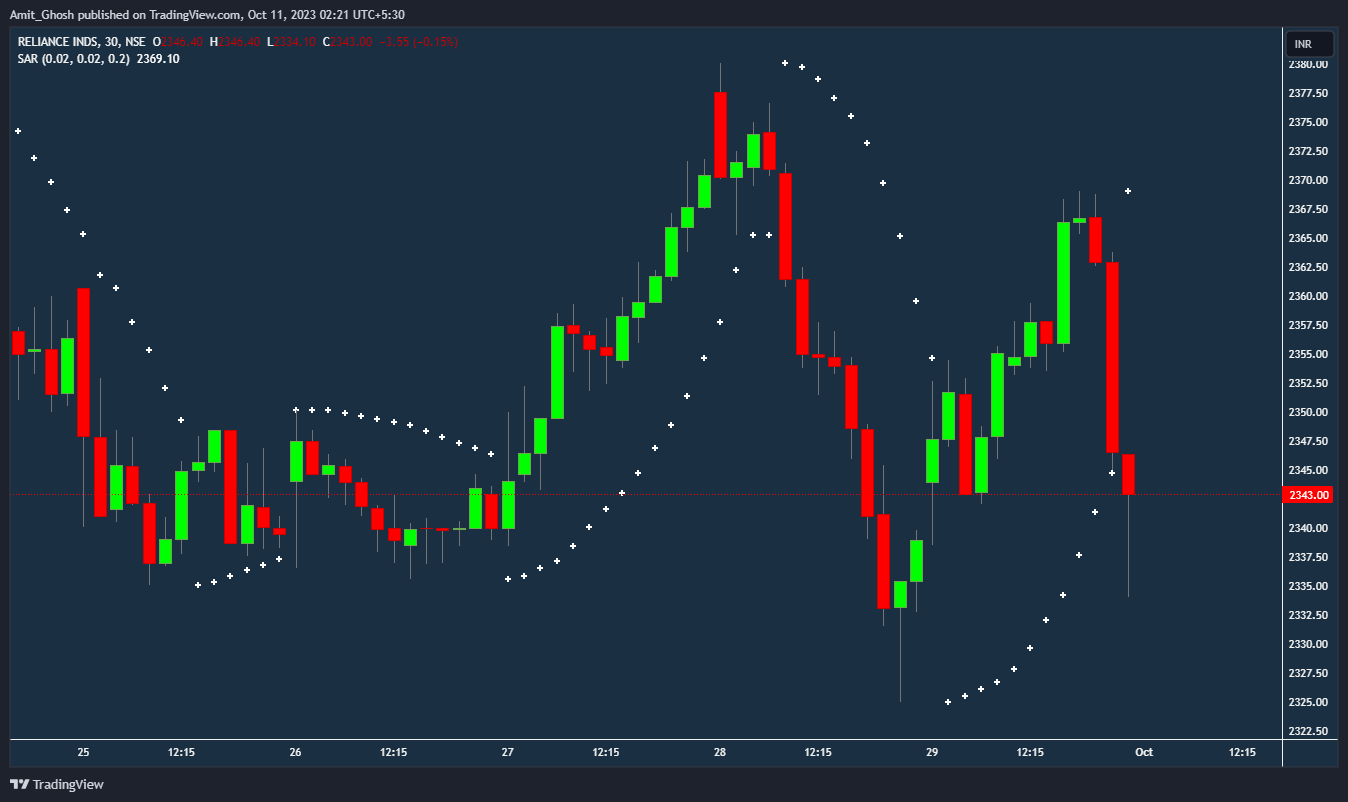

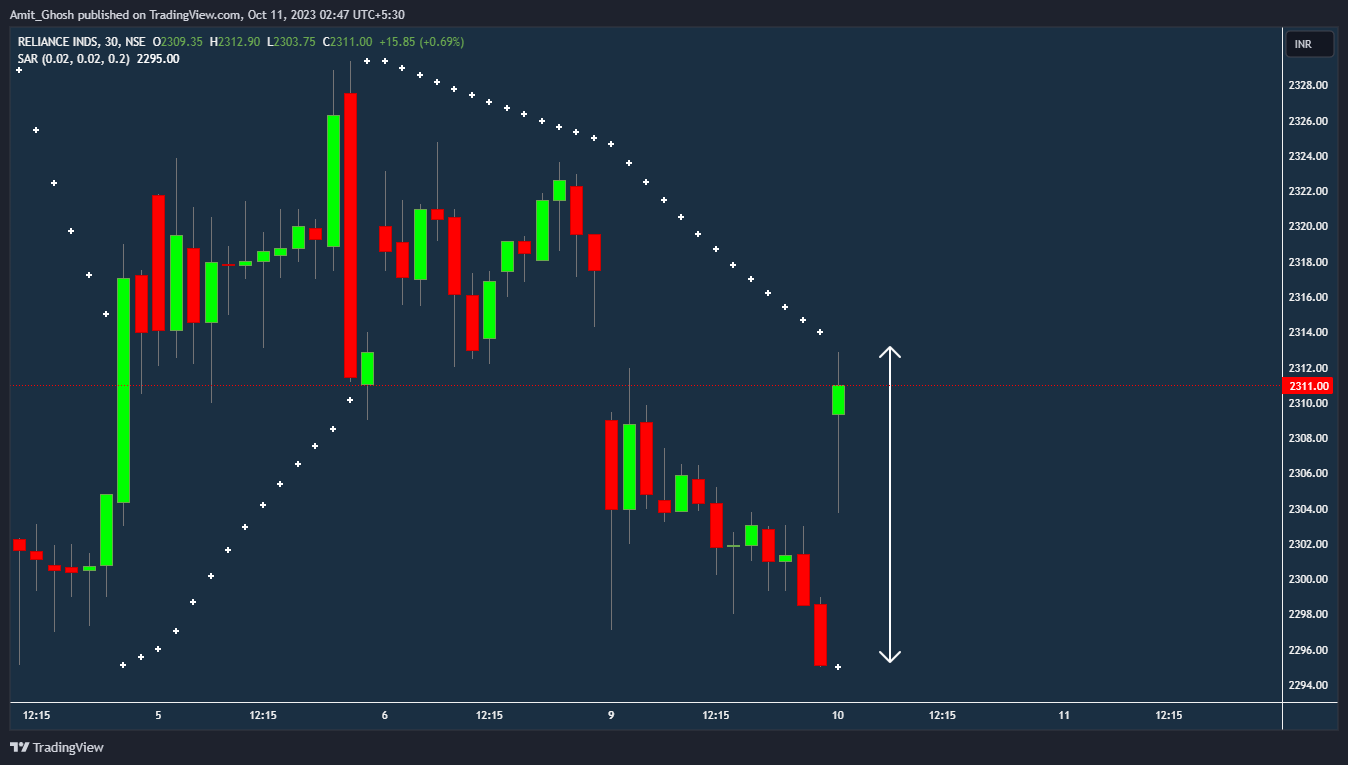

The brilliance of this PSAR strategy lies in the way the stop loss and the target of a trade serve as the entry point for the subsequent trade. Also, when a trade is initiated, the stop loss or target is not predetermined. So, We do not have pre-calculated risk and reward. Its dynamic!

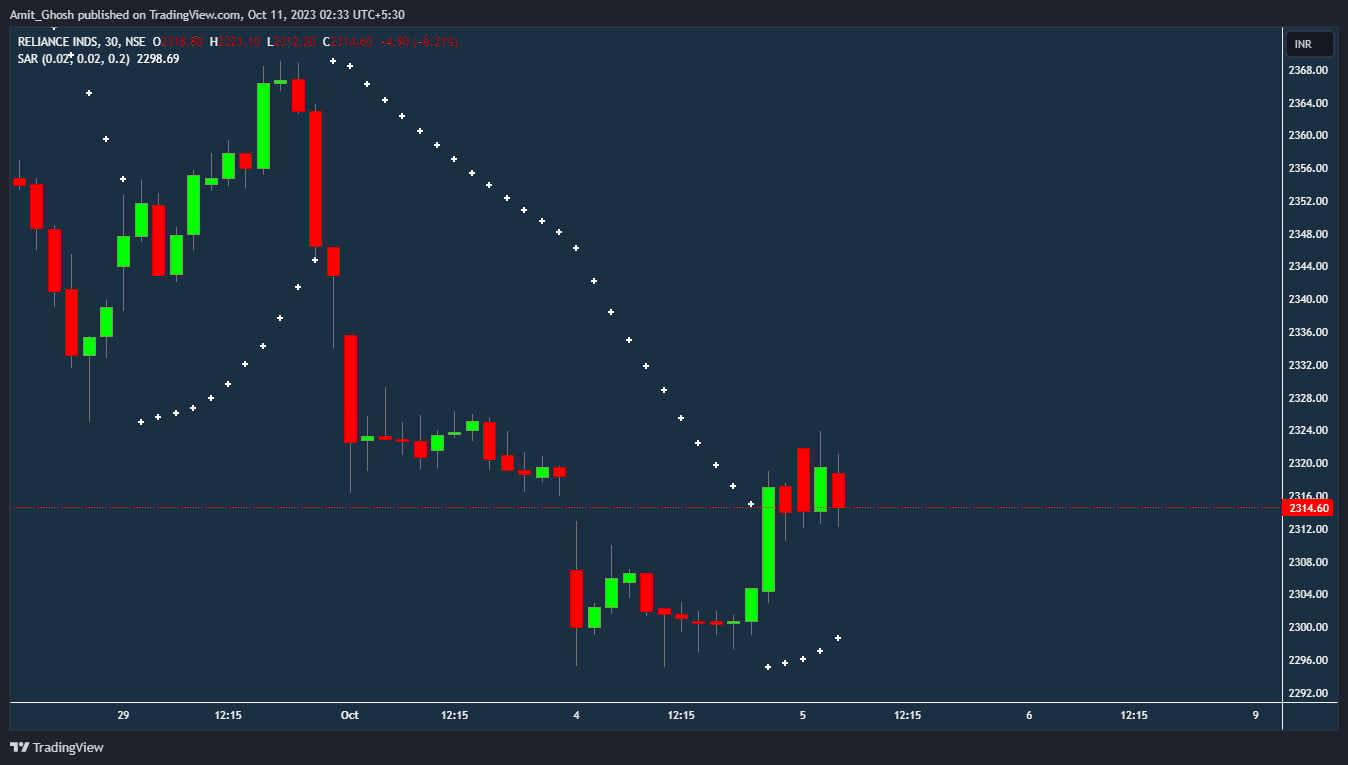

Fast forward to few candle later, the trade is still going on and is at good profit.

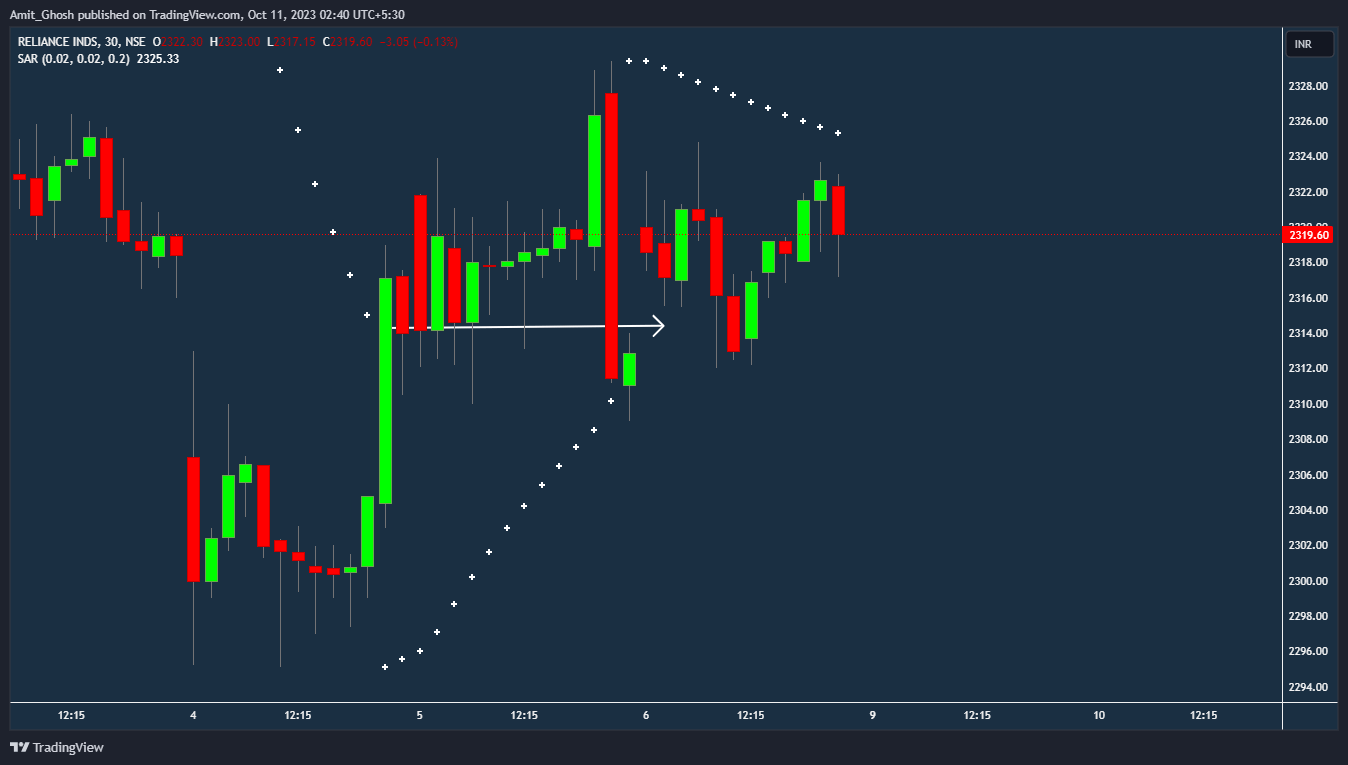

When we began talking, we saw that the short trigger was almost there since the candle was very close to the PSAR. But does this happen every time? Is there a mechanism to anticipate a trend reversal ahead of time? Such foresight could indeed conserve a considerable sum of money.

Well the answer is No!

In the snapshot taken after 4 candles, it’s evident that it’s off to a weak start. When our short trade commenced, the initial drop was sharp! However, in this case, it appears to have started consolidating!

Even if we count the spike in the last candle, it is still consolidating after few candles as it can be seen here –

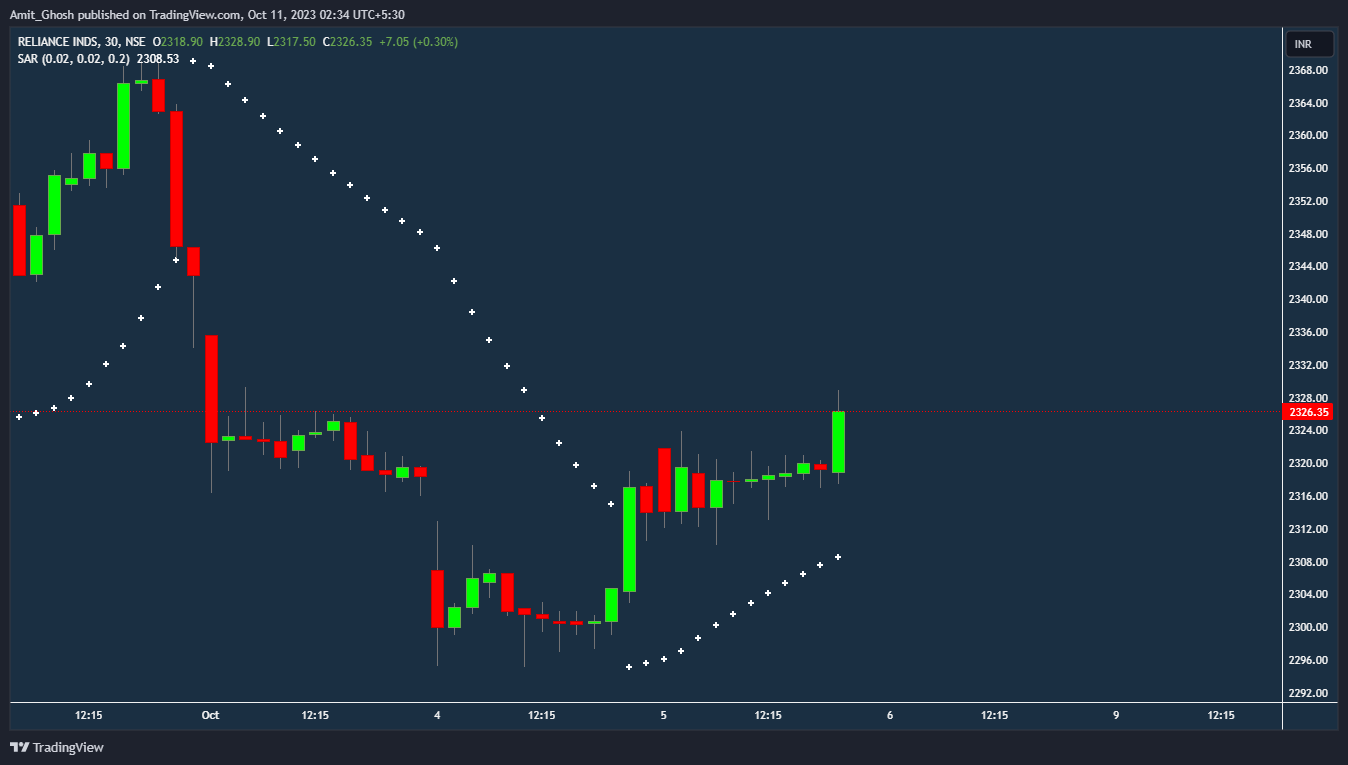

While the short trade hasn’t triggered again yet, it retraced back to the starting point and is on the verge of breaking the PSAR. Even though it’s rare for it to move back up from this level—given its earlier shown weakness when it began consolidating instead of climbing—it’s always wise to stick to the strategy mechanically.

This is because there are numerous instances when it actually reverses from here, which would then result in an early exit or let’s say a bad case of micro management.

Anyways, as expected, Sell is triggered.

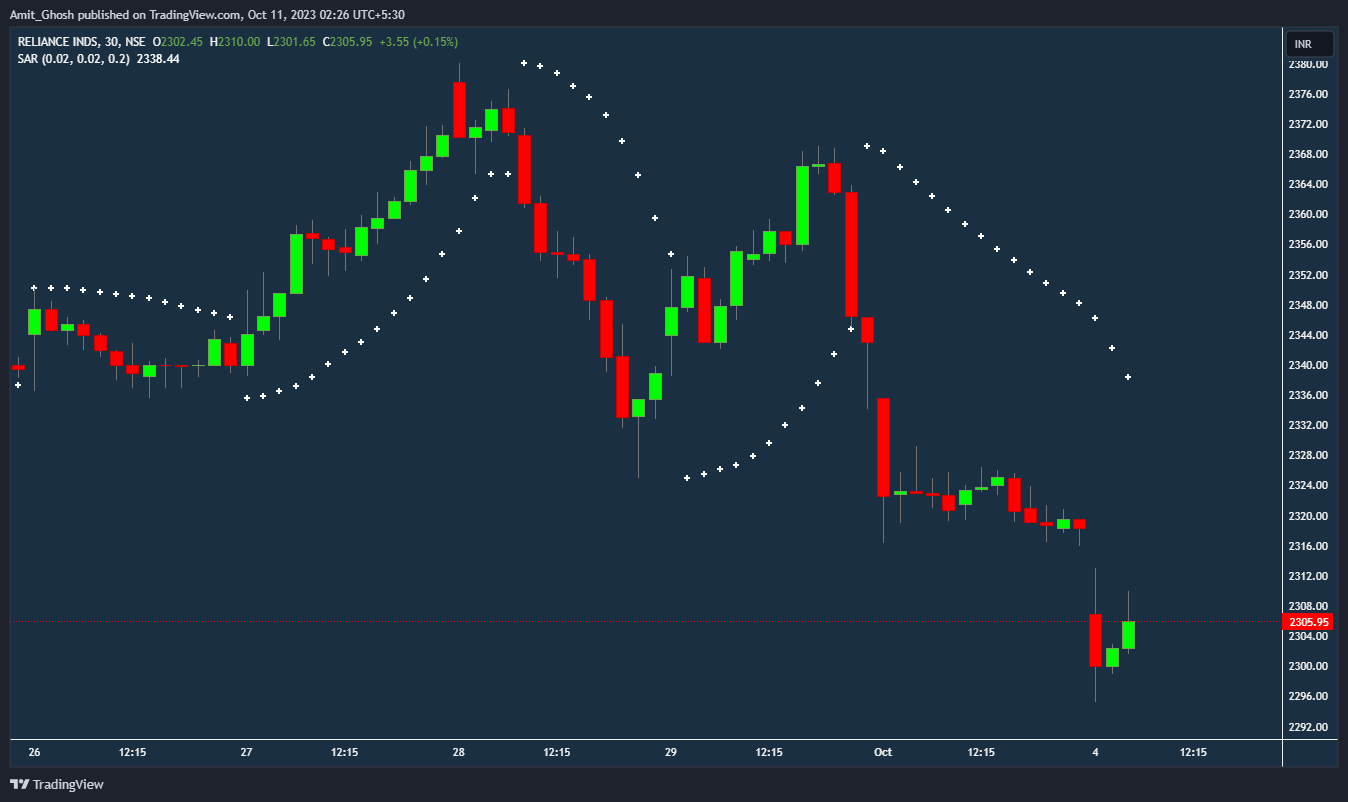

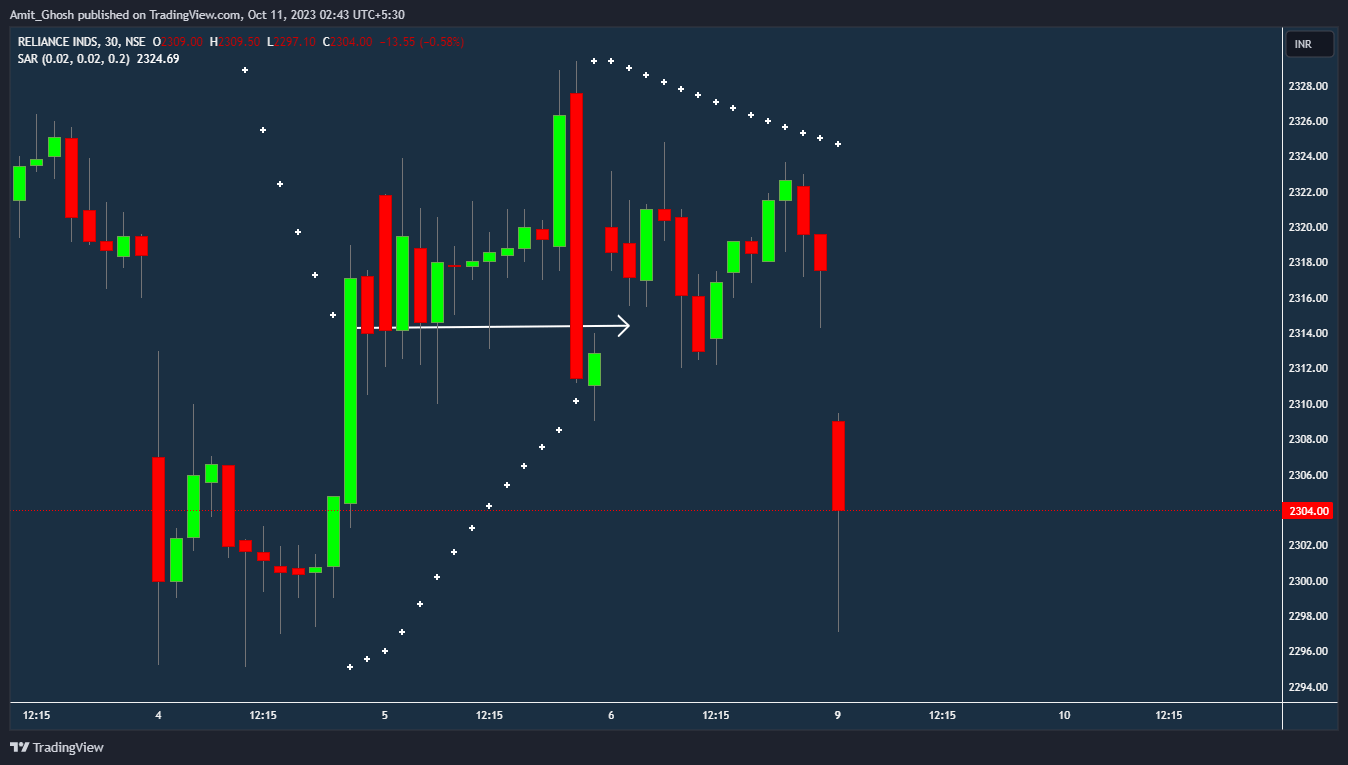

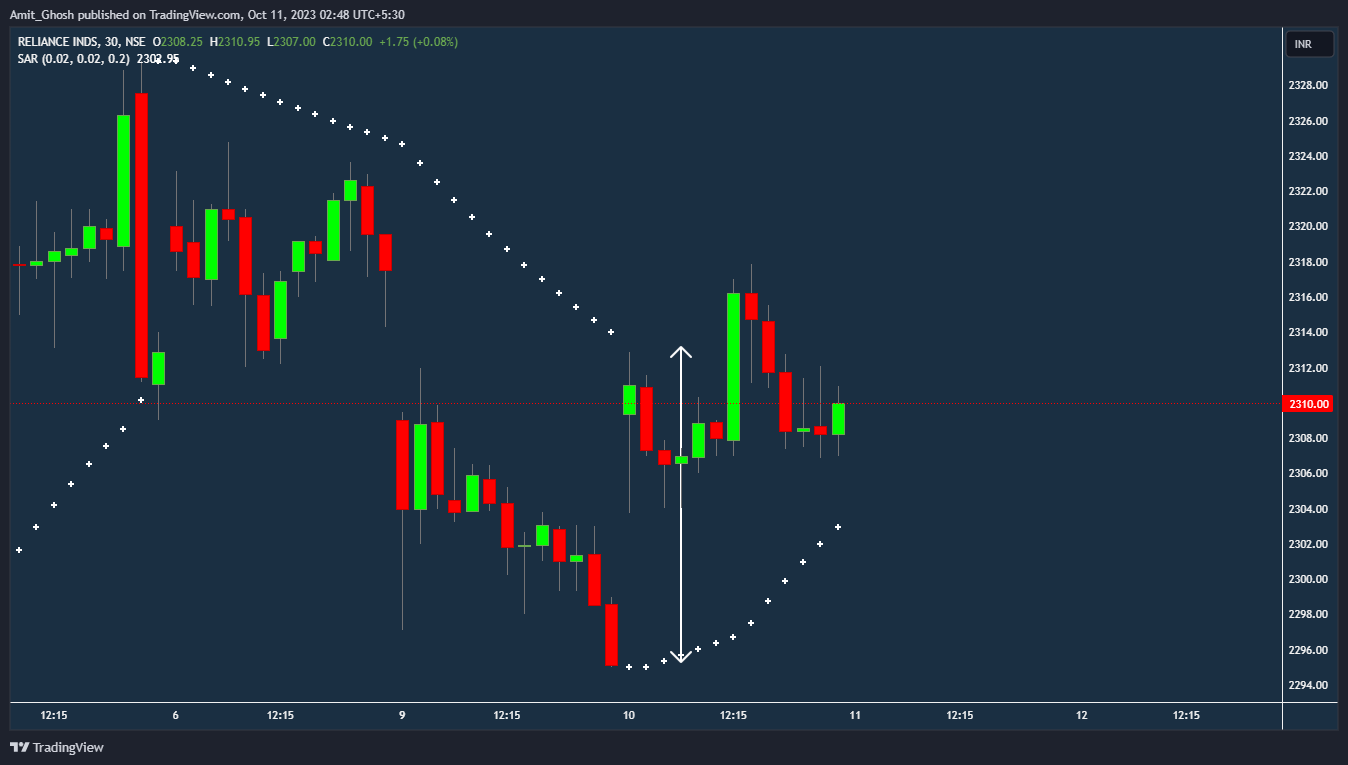

But then we got a gap up in the next day!

The gap in this scenario adds an extra layer of complexity! It has returned to that same consolidation zone. You can see, the price action theory is used everywhere to make sense and interpret of what’s happening.

The fear became the truth.

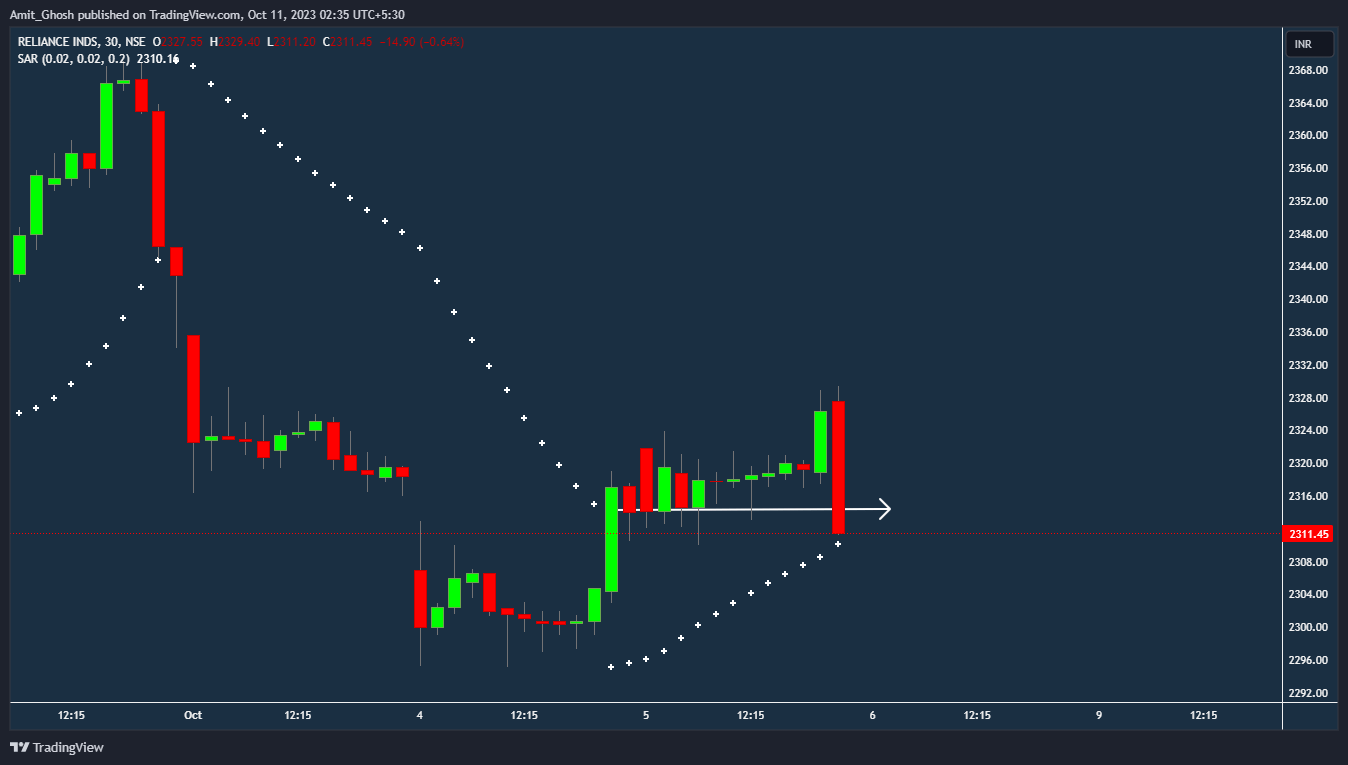

Here’s a picture after a few candles, showing that it’s started to bunch up again in the same range as expected!

Now this is a typical sideways market where stop losses get hit on both sides. Since this indicator tracks trends, it’s not really smart to use it in these conditions. But, let’s still follow it mechanically.

And we got a gap down and huge fall adding to our profits.This immediately tells how wrong our psychology was as it is designed to manipulate to betray the trading system. The trading system is a slave of probability.

There was always odd that it would have hit stop loss because the consolidation was itching towards the PSAR value but ultimate the mechanical approach wins. So far so good.

As you can see from the chart, the trade is in good profit.

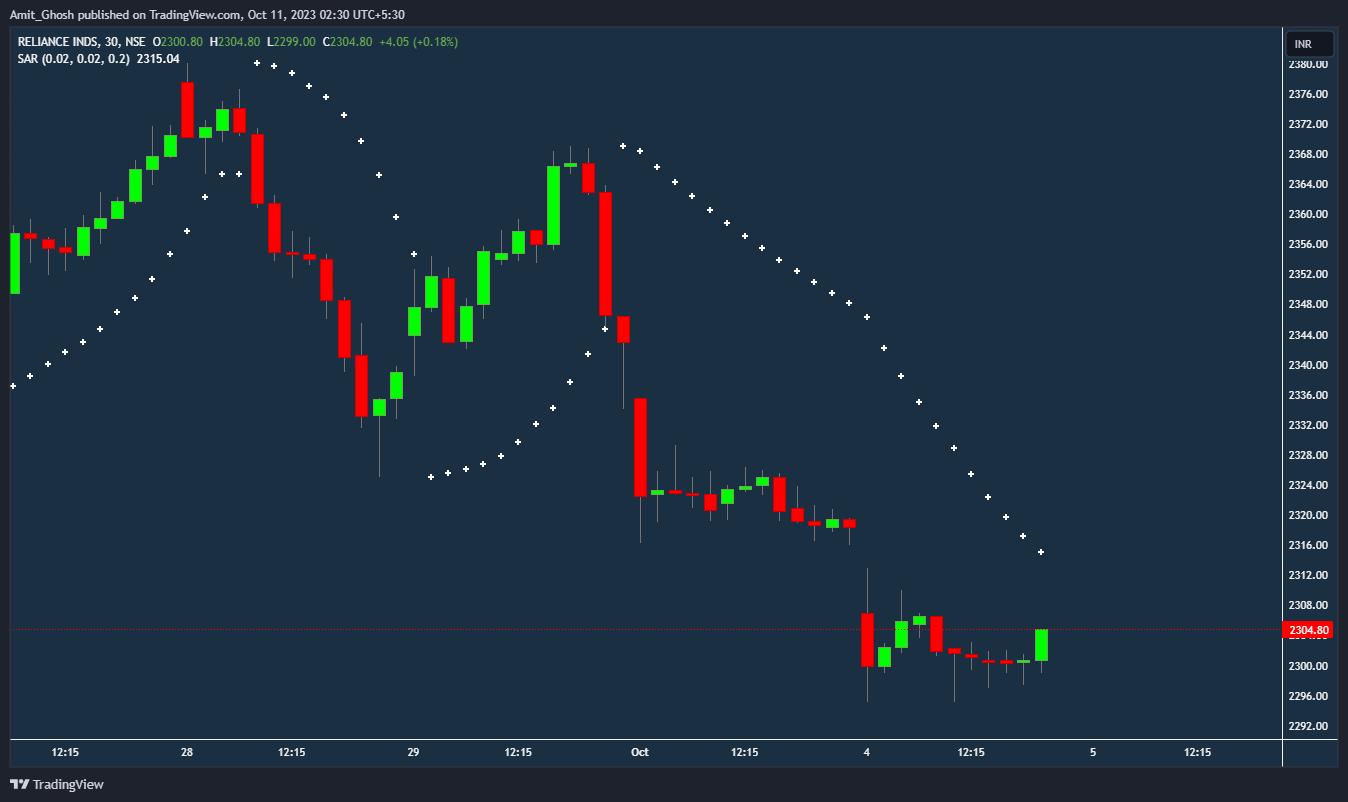

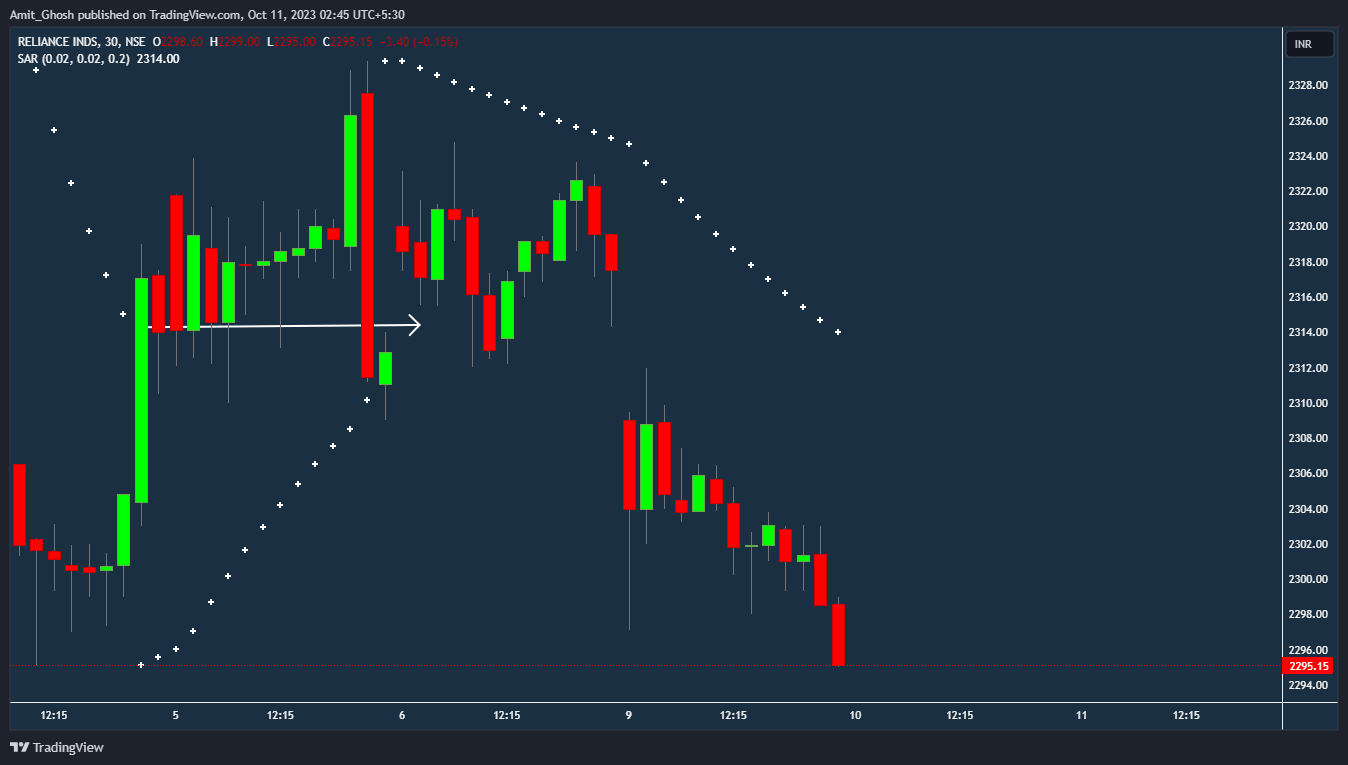

The spread is huge.

The entire previous’s day’s profit which made us happy as it was falling slowly slowly adding to our profit snaped into loss in a single candle.

And, right now it is again consolidating!

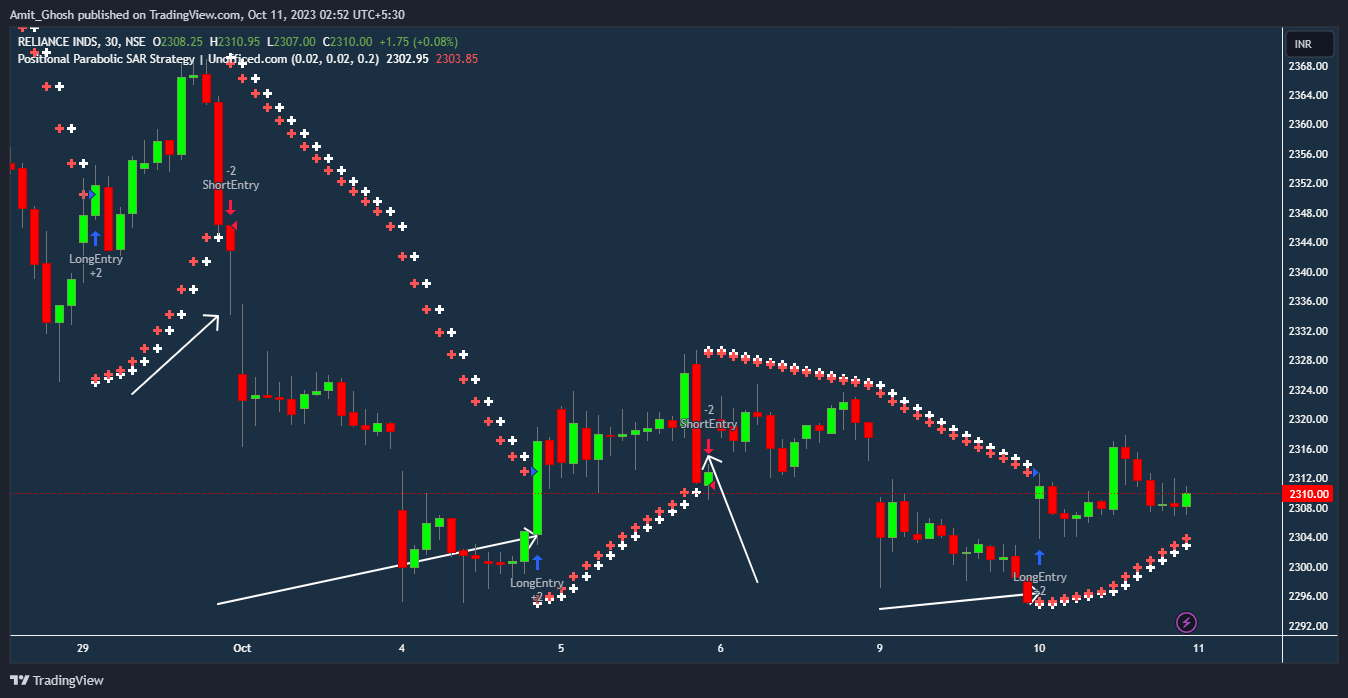

Here is the chart combined with the strategy doing exactly what we discussed.

The reason for picking Reliance as an example is that it covers all the scenarios and, as you can see, the entries here are in very uncomfortable positions!

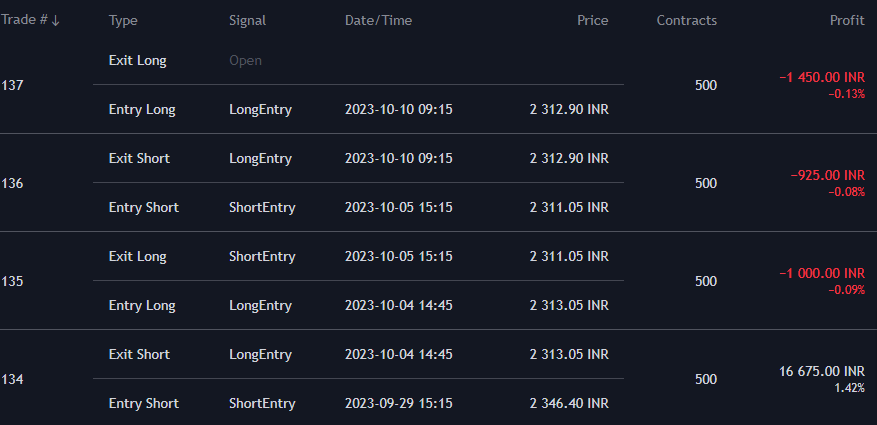

- The four trades discussed are visible.

- The initial short trade yielded a good profit of 16K.

- The following two trades (and, to some extent, the current trade too) fell prey to consolidation, resulting in a small loss!

- The ongoing open trade is also showing a small loss at the moment.