Artemis is a trading community under Unofficed managed by Ankit Jain. Here, We approach to trade BankNIFTY and NIFTY Weekly Options in a Systematic Approach with Open Interest Analysis and Option Greeks. There is no use of Price Action or any other Indicators. Its pure OI Analysis.

Three Systematic options strategies

We will follow three strategies here. All strategies will have defined set of rules that you can apply for you to get used to trading with Bank NIFTY and NIFTY Weekly options.

- Model I: The OI Quantitative Model / Depression Model

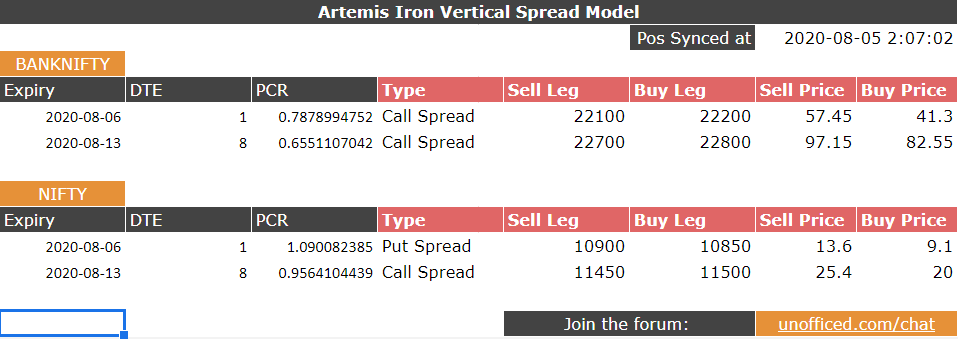

- Model II: Defined risk Directional Strategy – Vertical Spreads

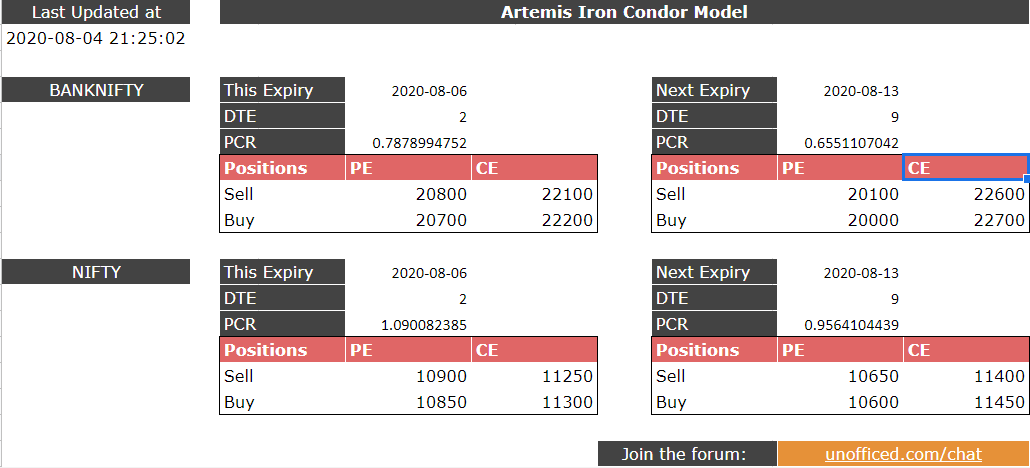

- Model III: Defined risk Non-Directional Strategy – Iron Condor

In the right side, You can see the the OI Quantitative Model completely done from start to end with all vivid details in the video but this system is made before the new margin system kicked off. It is a great strategy for passive portfolio which can be done over a pledged capital. You will also get a fair idea on what to of the genre expected from the community.

Model I: The OI Quantitative Model / Depression Model

You can see the trade details of Model 1 here (and see how it performed in the market crash due to Corona Virus) –

These are all real trades. We call it Depression model because it is very depressing for the traders to watch the whole week and not doing any such action. You can see that – It is making good returns on an amount of 60,000 INR. But now with the New Margin system, we designed two new models.

What you'll learn

- The first step towards Quantitative trading

- How you can build simple Trading models using Google Sheets

- How to trade model-based risk defined strategies taking benefit of the new margin system.

- How to deploy Directional and Market Neutral Strategies

- How to decide options trades with their entries and exits

- How to use one of the most powerful and simple methods of trading.

The recommended capital to trade –

- The Model 1 is naked strangle and hence, the margin is quite steep! About 130k. You can check with margin calculators.

- Model 2 and Model 3, You can start with as low as 30K.

What you will get

Course + DashBoards + Community (Access for 1 year)

- Complete Explanation of the strategy in proper course manner as you can see below (You can see how Ankit delivers from the video)

- A mini-community under Unofficed of Three Discord Channels (Will be later linked to private Slack Channels) dedicated to Three models.

- Systematic Trading in all three strategies and any subsequent updates.

- Ankit’s commentary and interaction on them.

Requirements

- The student should have a basic understanding of excel functions like sum, average, etc. (Anyways, it is well documented and google away.)

- A google account to create Google sheets

- We recommend trading with Upstox. You can read why here.

- And Patience 🙂

Artemis Dashboards

This board only shows the current trades as per the The OI Quantitative Model as shown the Youtube Video. However, You will get access to all the models within 24 hours once you pay!

Vertical Spread Trade Setup

Iron Condor Trade Setup

Artemis Community

Nothing beats a community of like minded traders.

Artemis strategies were developed from Theta Community and then become significant enough to branch out!

You can discuss on the trades with Ankit and other traders. Also, You modify the strategies and seek validation from the rest of the community.