Moving Average Rainbow

Today we take an advanced concept which is quite a hidden secret. It is next to impossible to find material on this technique. This deploys an indicator but we won’t use it as an indicator. We will twist and turn it to use it for Price Action. The technique is called as Moving Average Rainbow ( MAR ). There are various uses of this technique. You can find the Stock Personality with this method. This is the only method which can tell you about the personality of a stock. Let me emphasize on why stock personality is important. You might have heard of this advice

Trade with only 4-5 scripts, you will understand them perfectly and at the back of your head.

This is because the more you trade a script, the better you understand its moves. Your *judgment* gets better and you make better decisions. Haven’t there been times where ace traders/investors start buying a falling knife and the beginners just keep on wondering what the heck is up with this guy! However, the ace trader/investor turns out to be right and the stock price starts moving out of nowhere. Where there was no support, no demand zone.

How do they manage to spot such buying prices?

First, let’s understand what is a moving average. A moving average is just an indicator which shows the average price of the last ‘x’ number of days. This is also called as a simple moving average. However, it is a lagging indicator and to reduce the lag, we use Exponential Moving Average.

The technique is called *moving average rainbow* because it has multiple moving averages at the same time and rainbow because we will give them different colors for purpose of identification

Construction : Plot the following EMA’s 7, 14, 20, 50, 75, 100, 200, 300, 365 and give them different colours. Important note *This method should be used only on daily chart* (Reason will be explained later).

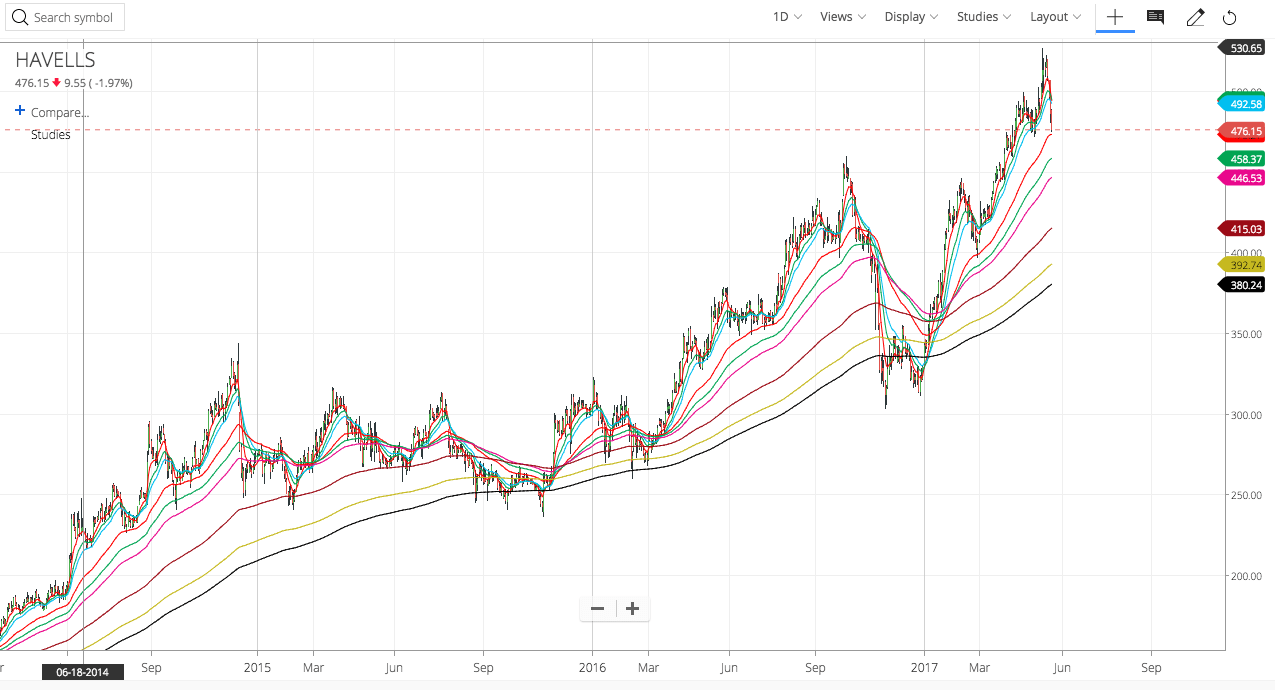

You will see a chart like this –

Colorful strings of moving averages

Now, remember one thing that we will not use moving averages the traditional way i.e. to find a trend or using crossovers to buy or sell. We will use Moving Averages as Dynamic Supports. There are 3-time frames: Short, Medium and Long. In every time frame, every script has its own favorite moving Average. Depending on this favorite moving average, we find out the personality of any stock within seconds!

Knowing the personality of a stock helps you to make a better trading decision.

Q. You applied “moving average” study with the Periods: 7, 14, 20, 50, 75, 100, 200, 300,365 and type – *exponential*? Are these the correct settings?

A. Yes

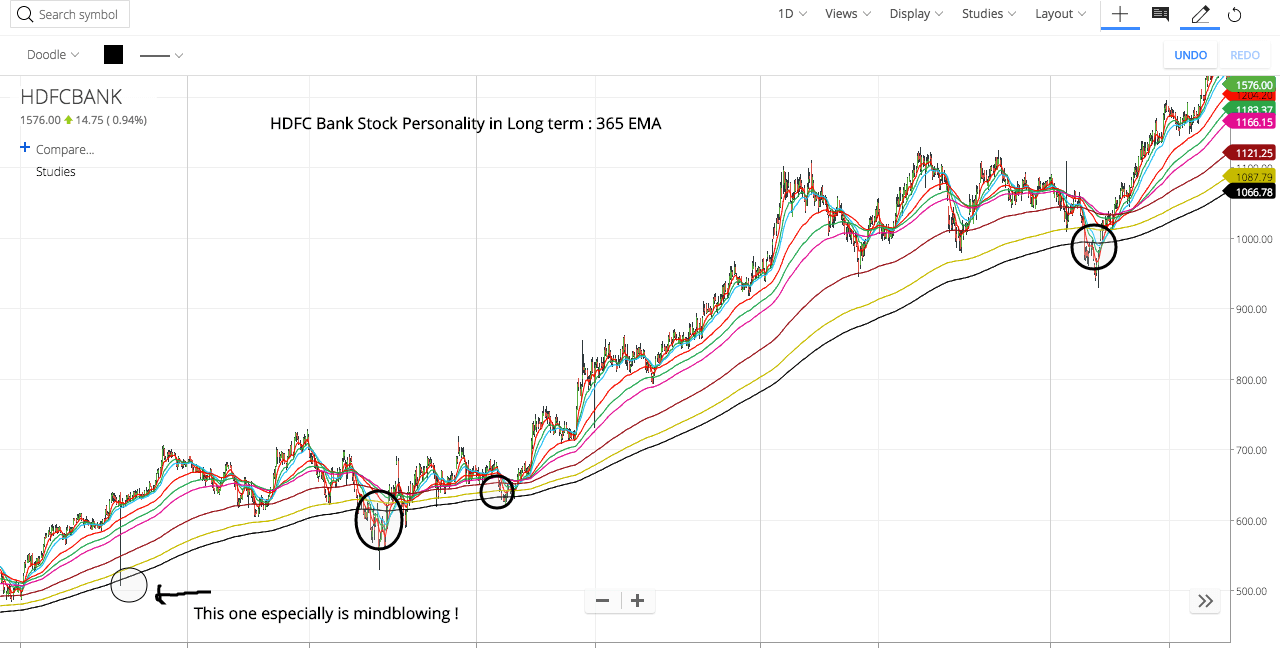

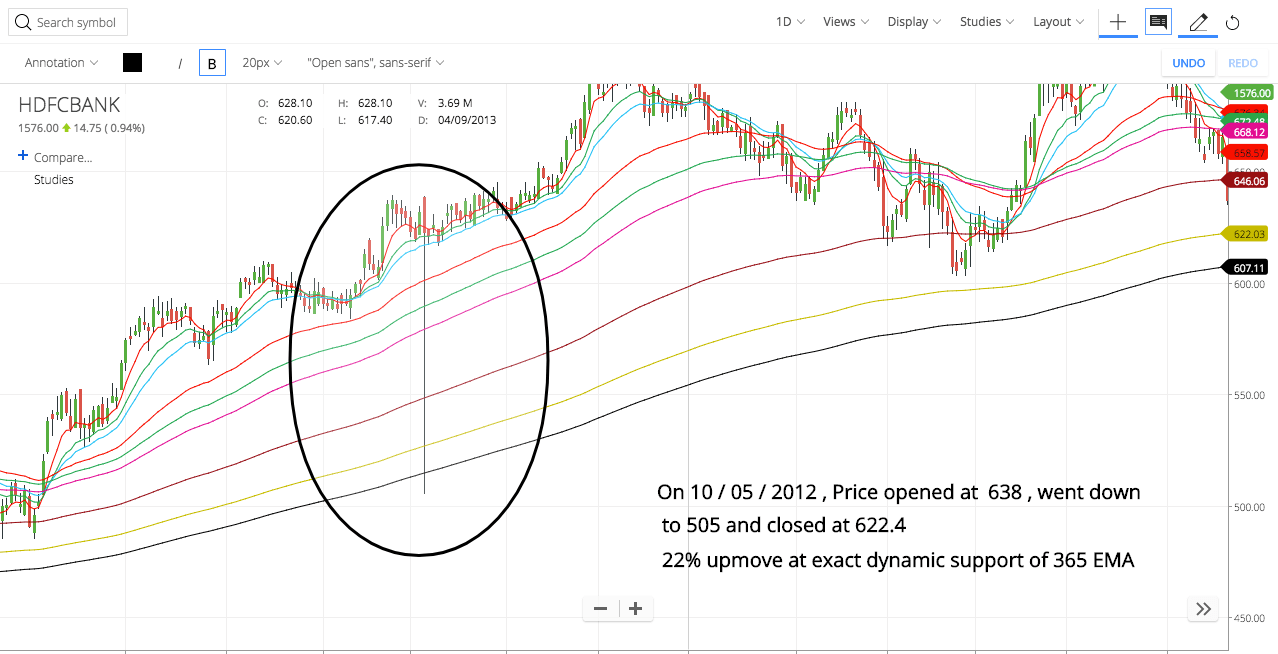

Look at the chart of HDFC Bank. In the long term, every time the price hits the 365 Day EMA, the price shoots up by 60-80%

Let’s find HDFC bank’s Short-term personality. As per observation, we can see that whenever price hits the blue line, it bounces up by a good 5-7%. These EMAs are acting like dynamic supports. Providing support in thin air where no horizontal support or trend line is in sight! The reason why this method works wonders is that it is one of the few concepts which intercepts the buying pattern of “FIIS / DIIS/ Smart Money.”

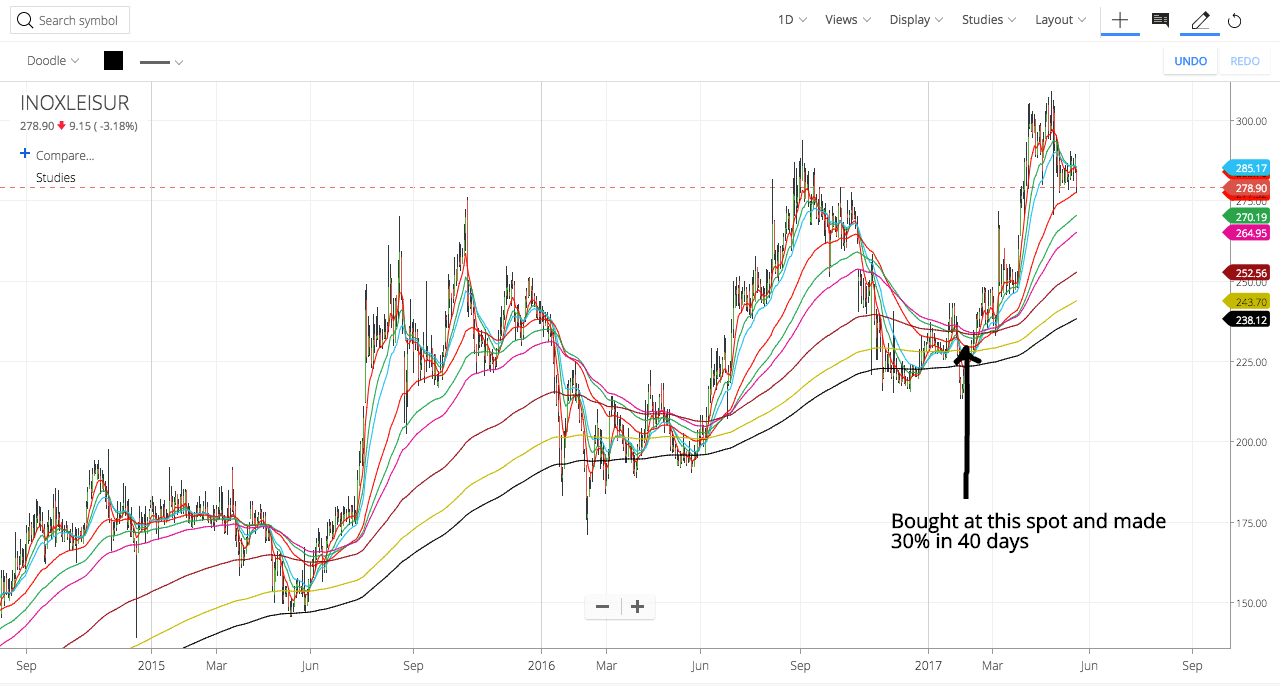

The logic and explanation will be provided later but first, take a moment to understand that this method wields a lot of power. If u use it well, this method alone can make you super rich. Apart from personality, it can help you find a systemic change in the trend. It can help you with finding positions where Potential Energy converts into Kinetic Energy and the stock starts flying. Illustrating an example for a spot where PE turns into KE.

Inox Leisure: Bought at 226 and sold at 293

Q. What it suggests ‘this one especially mind-blowing ‘ in first chart example?

A. This is whats so impressive .. look at the image

All your doubts have some or the other advanced concepts! I’d love to explain but there is a constraint of time

You all have good observation skills 🙂 Analysing patterns and trying to make sense out of it. This approach is highly useful.