Security Transaction Tax is a kind of turnover tax where the investor has to pay a small tax on the total consideration paid or received in a share transaction. STT was introduced in the Budget of 2004 to mitigate capital gains tax evasion.

If we buy an option and hold it until the day of expiry, do not close the position and let it expire and make a profit, we’ll get charged 0.125% of the settlement amount as Security Transaction Tax.

Let’s assume I buy a NIFTY 8000 Call option for Rs 5 hoping that the index will close above 8000. On the day of the expiry, either of this two scenario can occur.

- NIFTY expires below 8000; the Call option is now worthless and expires at Rs 0. In this case, no STT is levied, as STT for option worth zero is well, zero. Or,

- NIFTY expires above 8000 at 8010 and the Call option is worth Rs. 10. In this case, I can either you sell the option for Rs. 10 just before expiry or let it expire. Quite a lot of brokers do not charge brokerage if the option expires, so retail investors are automatically inclined not to sell.

If we sell the option for Rs 10, we get charged 0.05% of the premium value as STT. Which is 0.05% of Rs. 10 x 75 [lot size]) = 37 paise

However, if I don’t sell the option and let it expire, I get charged 0.125% of the whole settlement amount, which is 0.125% of 603750 ([8000+10] x 75) = freaking 750.93 rupees per lot. This ends up turning my 750 rupees profit into a loss of 93 paise. Most retail traders inadvertently get trapped in this regulatory black hole.

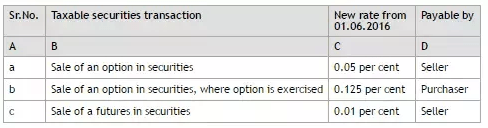

Below is NSE’s Security Transaction Tax computation table –

Note: Security Transaction Tax does not apply for option writers.

Falling into the Security Transaction Tax Trap

Here goes Chirag Gupta’s story from a petition open on change.org by him namely Security transaction tax (STT) -A trap for traders and a systemic risk for capital markets.

Security Transaction Tax anomaly on exercised options – a systemic risk to the entire stock exchange

This is an incident that happened with me on the last options expiry. On 25th Jan 2017, the expiry for January contracts, I had bought 8600 Nifty calls at 3.25 pm for Rs. 0.05 as I was 100% sure that Nifty will close above 8600 based on my 25 min weighted average price calculations. True to my expectations, Nifty closed at 8602.75. I had bought 3000 lots of Nifty 8600 call options at 5 paise, paying a premium of Rs. 11250. By the numbers, you can see that I should have made a profit of Rs. 6,07,500 (2.7* 2.25 lakh) right? But what followed was beyond comprehension.

I did make a profit on this trade because I let the option expire with some value. But much to my surprise end of the day when I received the contract note, found out that the Security Transaction Tax (STT) in the case of exercised options is 0.125% of the entire contract value as opposed to 0.05% of the premium value if I had sold them on the exchange. So even though I did make a gross profit on this trade, to my shock, I ended up with a huge loss of Rs. 18 lakh because I had to pay Security Transaction Tax of over Rs. 24 lakh. If I had sold the options before the market closed, the Security Transaction Tax I would have had to pay would have been a few thousand rupees, but holding it just for a few minutes extra cost me over Rs. 16 lakh in losses. Are SEBI and the Government of India aware of how traders like me can lose their hard-earned savings in this manner?

Are SEBI and the Government of India aware of how traders like me can lose their hard-earned savings in this manner?

Here are the reasons why everyone reading this should sign the petition.

I am sure there are thousands of innocent traders who would have lost a lot of money in similar fashion. I cannot understand how Security Transaction Tax can be over 10000 times higher just because I decided to hold onto the trade for a few minutes extra. Are SEBI and the government blind to the woes of the retail trading community in an already shallow market?

More importantly, isn’t this a systemic risk for the capital markets?

To buy 3000 lots of this option, I required only Rs. 11250. Assume my account had only Rs. 11250, I am guessing the broker I am trading with would have faced a loss of Rs. 24 lakh (since I made a 24lk loss with just 11k in my account). The exchange would debit this money from the brokers account if the client didn’t have funds.

So, if a bunch of clients, like me, say had bought 3 lakh lots with around Rs. 10 lakh, the potential losses just because of Security Transaction Tax would have been over Rs. 24 crores. What if the broker wasn’t liquid enough to make up for this loss? This could easily be Rs. 24 or 240 or 2400 crores, wouldn’t such losses be a widespread systemic risk to everyone in the capital markets.

This is a disaster waiting to happen. SEBI should take the onus of fixing this anomaly immediately. Security Transaction Tax for exercised options should be either bring down to same levels that are applicable when trading on the markets, or else it can open a trading window after market hours on expiry day to close out all in the money options (similar to the post-market trading session for equity).

I don’t know if anything can happen in my case, and I probably will live with this regret throughout my life. But the least I can do is to make an effort so that no other unwitting retail trader has to go through what I am going through.

I request all readers to not only sign this, but also get all your trading friends, broking employees, and whomever possible to support the cause and make sure that the regulators hear this loud and clear.