Divi’s Laboratories Limited is engaged in manufacturing and sale of active pharmaceutical ingredients (APIs) and Intermediates. Its products include Generic APIs, Intermediates, Peptide Building Blocks, and Carotenoids.

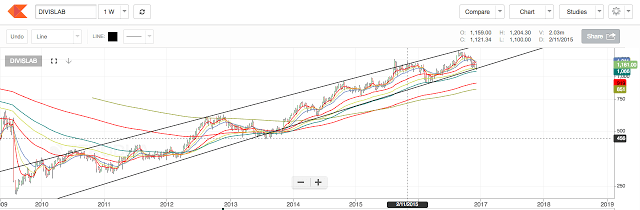

1. Its long-term trend is up as price is making a higher top higher bottom formation and mid and long-term EMA’s are moving upwards.

2. Since late 2009, the script has been moving in an ascending channel. This depicts it’s strong uptrend as investors are ready to add this script at a higher price in a consistent manner.

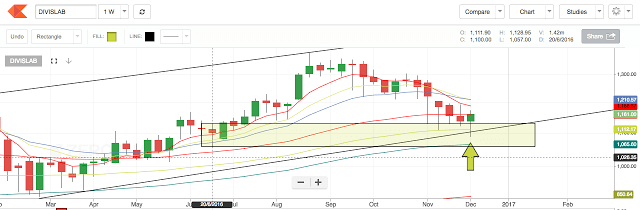

3. As we can see that the price has hit the channel resistance, we will fine-tune our entry point using demand zones and candlesticks. The price bounced off the weekly demand zone of 1129-1057 while making a hammer type formation.

4. The Fibonacci retracement of previous swing (917.8 – 1381.6) shows that buying action is witnessed at the 61.8% retracement which shows that there is demand for a healthy correction.

The Fibonacci extension tool shows that the next higher top can appear around 1574 – 1684.

and does not react much to instabilities in the market. A must add to the portfolio for a potential upside of 35%-45%.

P.S.: This analysis is invalid below 1000 on closing basis!