Dalmia Bharat is a cement manufacturing company.

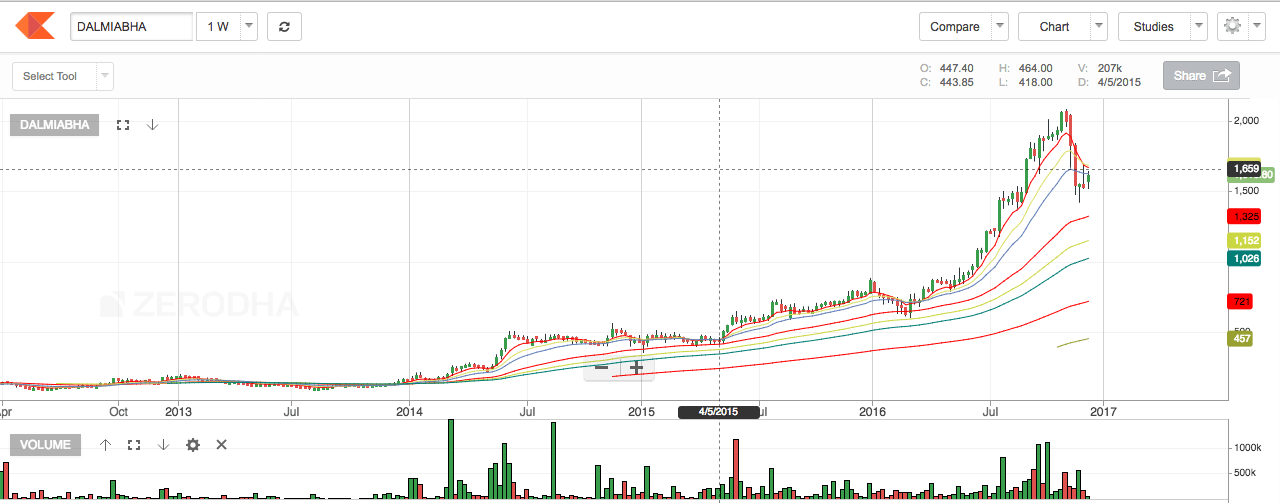

1. Its long-term trend is up as price is making a higher top higher bottom formation and mid and long-term EMA’s are moving upwards.  2. The best strategy to trade this script is to buy on dips. To spot appropriate dips we resort to daily, weekly and monthly demand zones.

2. The best strategy to trade this script is to buy on dips. To spot appropriate dips we resort to daily, weekly and monthly demand zones.

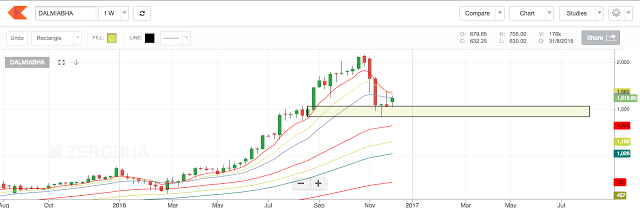

1528 – 1417 was a weekly demand zone which is reacting well. The price made a dragonfly doji at the demand zone and it gives a confirmation about buying action.

3. On the daily time frame, the price has made a higher bottom and is edging towards the recent top. Once the top (1691) breaks, a short-term uptrend is confirmed. One can add the small position at every such higher bottom to ensure that the overall trade is profitable and the entry price is averaged.

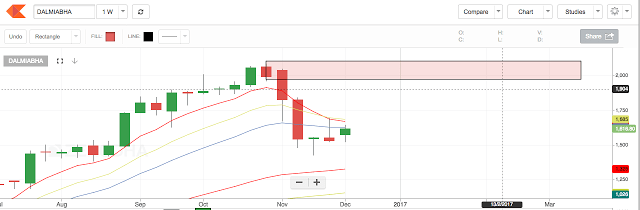

4. The weekly supply zone lies at 1961 – 2085. The price has a potential upside of 21% from CMP ( 1616 ).

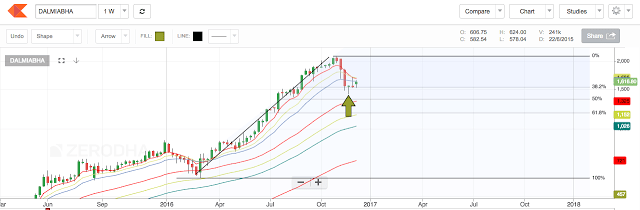

5. Another tool that we can use to support our buying on dips strategy is the Fibonacci retracement.

Considering the previous swing to be from 602 to 2070, we can observe that there is buying action at the 38.2% retracement zone. To get a rough idea as to where the next higher top might be, we check Fibonacci extensions and they give us a region of 2678 – 3020 ( 65% to 86 % upside from CMP of 1616 )

This High Beta stock can give a phenomenal upside in the days to come if the market is in an uptrend.