For stocks, round numbers are called as handles. For Intraday multiple of 50 can be considered as handle too. For Tata Elxsi 1500, 1600 are strong handles. 1550, 1650 are weak handles.

Past Discussion: Example of scalping using Harmonic Trading on Tata Elxsi

Theory – When a stock reaches its handle the first time; it always retraces to an extent immediately. It is because of huge psychological pressure. Post that it consolidates for some time.

Many traders take biased decisions on handles. Like I will close it above 1000. So it creates lots of volatility spike of both sides.

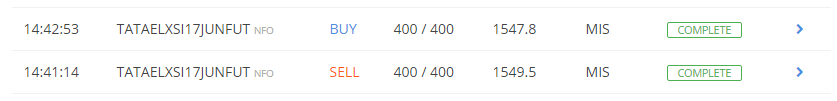

That’s why it is said scalping is an art. It will not behave normally when it is near 1550. Every method, psychology needs to be considered. When this trade was explained live it was a brief pause over 12 minutes on the point of 1549.5-1550.5 zone.

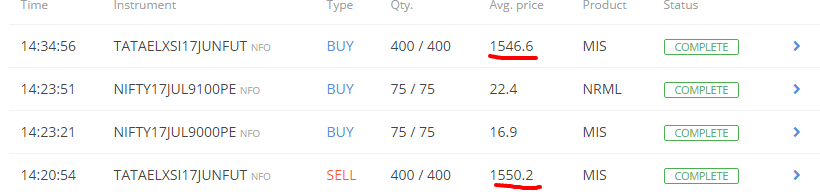

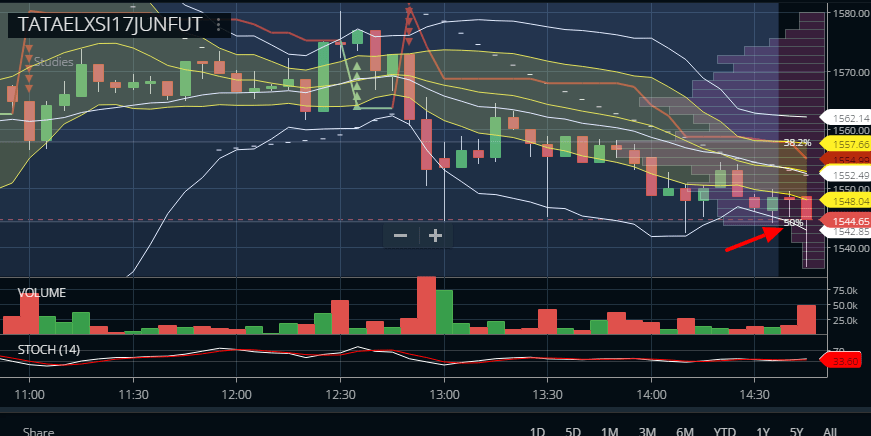

But there are lots of volatility spike. So my bet was to catch a downside spike. So I kept SL at 1555. Here is the trade –

Now market data comes into play. On handles, huge orders are served.

So it always creates volatility spikes when the orders are consumed. As you can see a sell order of 10000. What happens next?

Then VPA came into play making a huge spike –

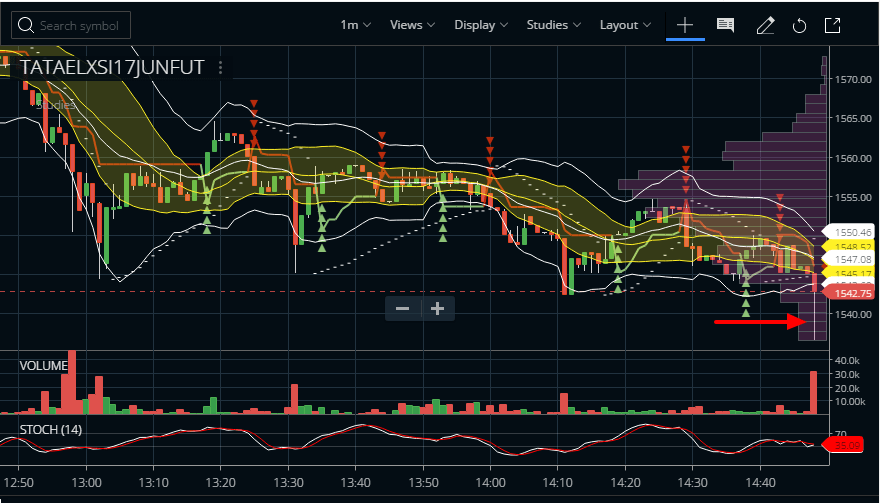

You can always explain this as VPA as well as price action. I will copy the first paragraph of our live trade discussion –

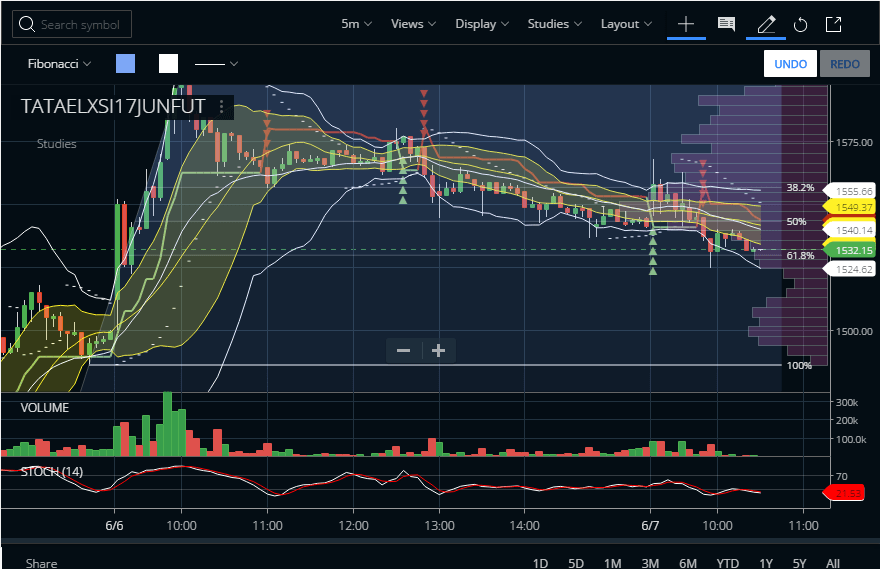

The crack towards 50% zone made a strong reversal. Now what is created is a strong price action point. Now if it falls and if that low of the point is breached, it will break lose.

This happened next –

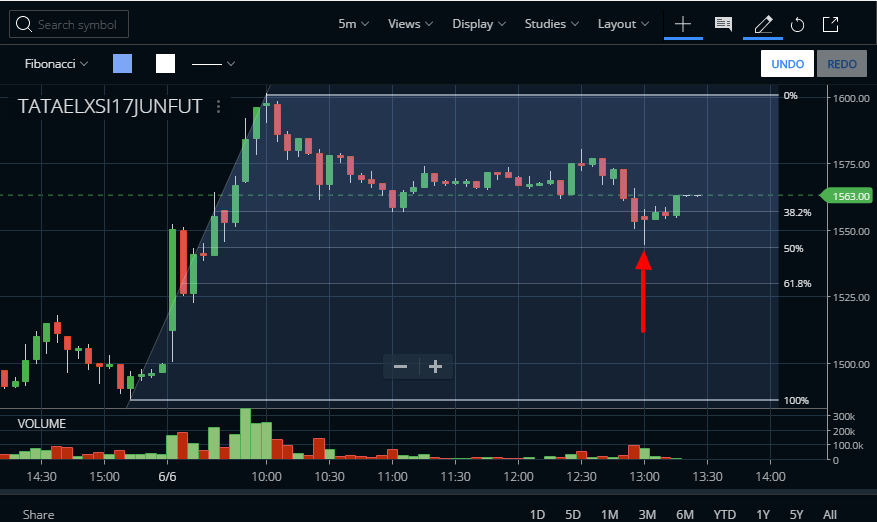

This is the last resistance of Fibonacci Retracement levels –

It’s at 61.8% resistance in the timeframe we share. We have closed the position as of now on 61.8% as we can not risk the short-term volatility post RBI announcement and open the position post announcement to hold until break of 1500.

This discussion happened on 6th June 2017 on Unofficed Chat.