This Hedge fund strategy belongs to Minance. In short, Customers open their accounts with Minance and put money. Minance does the trade and make the money grow for you taking only 20% profit when you withdraw your profits. You can read a detailed review on Minance in Unofficed.

We’re using eCommerce data to predict automobile sales. In principle, it’s very straightforward. We use a Python web scraping [1] script to collect star ratings of products that people are likely to buy if they have just purchased, or planning to purchase a new car. We’re assuming that 12.5% of the people buying these products and writing reviews are planing to purchase a new car, while the others are existing owners. Products such as:

- Display monitors and reverse camera

- Speakers

- Sub woofers

- Car air-freshners

- USB charger for cars

- Alloy wheels etc

We’ve selected about 7000 products and keep a real time check on the number of reviews being written on Flipkart, Amazon and Snapdeal. The hypothesis is: more sales equate to higher number of reviews, and vice versa (with reviews being the independent variable).

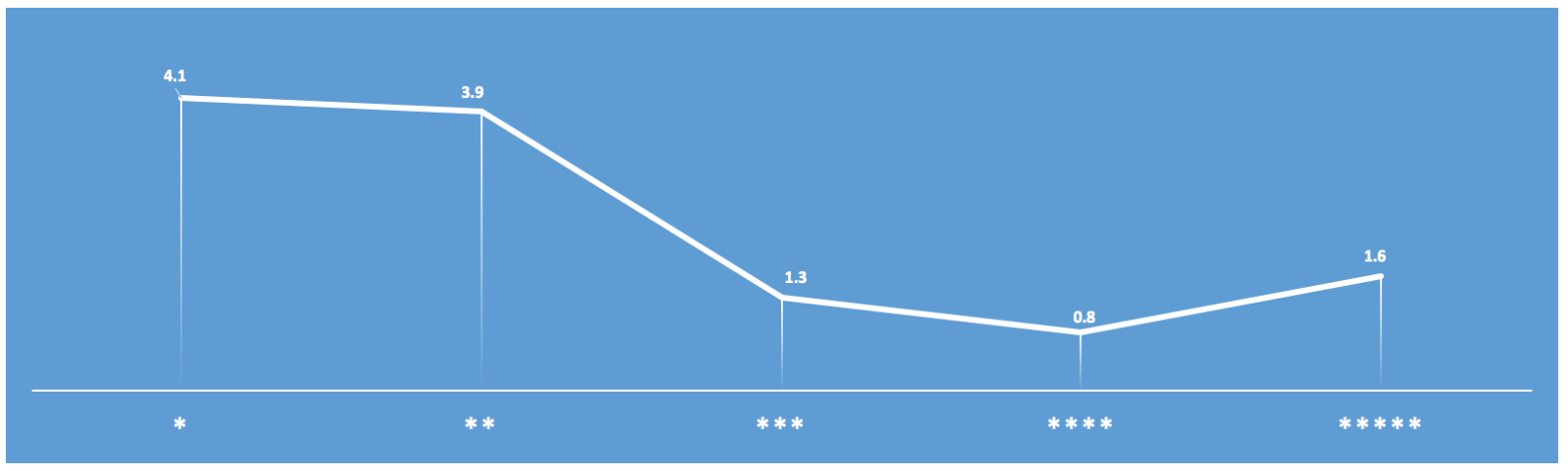

However, this is not a linear equation. If you buy a product which turns out to be terrible, you’re more likely to write a review. You’re not likely to write one if the product works great. We quantified this using an anthropological survey. The results are below:

Fig 1: Numbers are in percentages. There’s a 4.1% change of you writing a bad review and giving a one star rating if the product turns out to be terrible. This number reduces as the quality keeps getting better and only slightly increases when there’s customer delight. [2] Once you’ve normalised for this, you can get a real time number of the number of people who might be interested in buying cars.

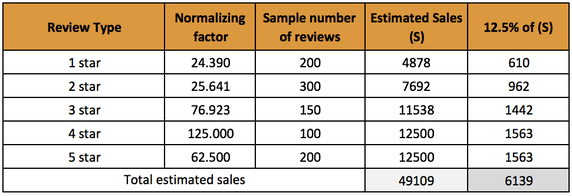

Fig 2: Here are the normalisation value with a sample calculation of how to estimates sales.

The margins of error is high, but this hedge fund strategy is as a reliable indicator of quarterly sales trends of Indian car manufactures. For longer time-frame investments, that’s all an investor need.