Bajaj Finserv Limited is a holding company whose subsidiaries are engaged in the business of financial services, insurance and wealth management.

1. Its long-term trend is up as price is making a higher top higher bottom formation and mid and long-term EMA’s are moving upwards.

If you notice, the scripts that I’ve been choosing are always in a strong uptrend on a bigger time frame. Such an uptrend is an indication of higher demand over a period of time.

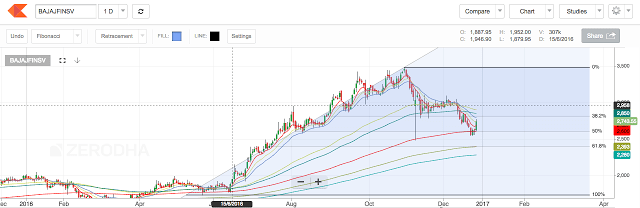

2. If we consider the previous swing of 1725 – 3480 and draw the Fibonacci retracements, we can observe that the price has formed a bullish harami followed by a 4.8% uptick today (27-12-2016) at the 50% retracement level. Any pullback towards the 50% retracement level is a healthy pullback and has a high possibility to result in an upward rally. The Fibonacci extensions project price at 4178 and 4540 (52 % and 65 % respectively from cmp of 2743)

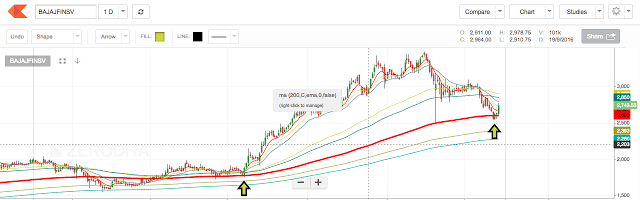

3. To make our case stronger, the price has bounced off the 200 days EMA. This is generally a hotspot for the institutional buyer. The last time price hit its 200 day EMA, the price rocketed from 1762 to 3480.

4. Last but not the least, for the short term trader, the price is bouncing off point 5 in the Bullish Wolfe Wave. Any long setup at cmp might fetch a 16% ROI with Risk-Reward of 1:2.8. If you are not well versed with Wolfe waves, then you can read about it here.