Vinati Organics Limited is engaged in the manufacture of organic and inorganic chemical compounds, specialty organic intermediates and monomers.

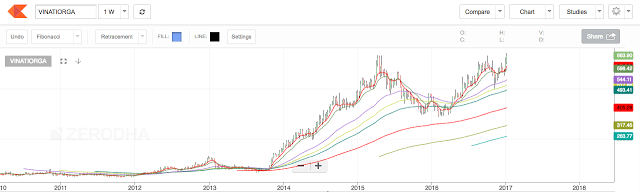

1. Its long-term trend is up as price is making a higher top higher bottom formation and mid and long-term EMA’s are moving upwards.

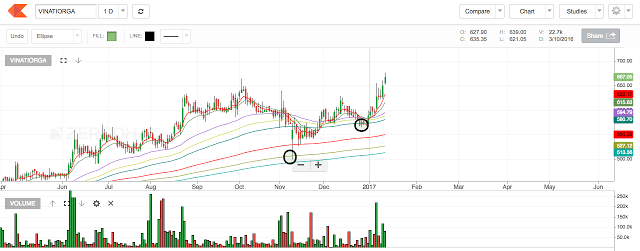

2. This analysis will be a short and sweet one and it will revolve around a pattern called Cup and Handle”

The preceding trend is up. Formation of a Cup and Handle signifies that consolidation and accumulation are going on after a strong uptrend. When the preceding trend is up, the probability of a breakout is high and an up move is most likely to be witnessed.

The breakout will occur when price sustains above 670 with relatively high volumes. Once the breakout takes place, the two targets that would be open would be 828 (23%) and 986 (47%).

3. There was good accumulation with volumes at 100 and 200 Day EMA as pointed out in the chart. This is a sign of entry by institutional investors.

The script has excellent fundamentals and one can take part in the entry on the day a breakout is achieved and other parts when price pulls back towards 670. This will ensure a good average buying price.

P.S: This analysis is invalid below 500.