Markets have recently come out of the chaos of global news events that made it turn topsy-turvy and now we are at a very critical juncture. At a point which can make or break the markets. As we follow a price action form of analysis, let’s keep news out of the purview of our analysis.

Let’s discuss the possibility that nifty possesses and formulate a trading plan to make hay while the sun shines!

- A 10% correction/Crash

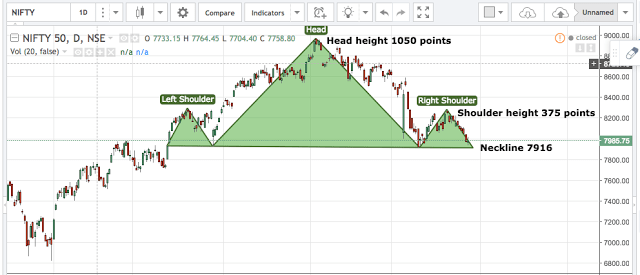

Nifty is forming a Head and Shoulder pattern. Once the pattern breaks below the neckline, it corrects as per the height of the shoulders and the head. Previously Nifty had formed this pattern and a breakdown below the neckline gave a 13 % correction!

The image depicts the Head and Shoulder pattern which is almost on the verge of a breakdown.

However, at any point, we can’t predict whether markets will complete this pattern with a breakdown as markets are supreme and our thought has no bearing on the way price will move. We will analyze certain conditions and see how to trade them.

If the Neckline 7916 is broken on the closing basis and the move is decisive, then we should brace ourselves for two targets :

- Shoulder Target: The target for shoulder will be calculated as Neckline minus Shoulder Height i.e. 7916 – 375 = 7541 ( A 4.7 % correction from the cmp of 7985 )

- Head Target: The target for Head will be calculated as Neckline minus Head Height i.e. 7916 – 1050 = 6866 ( A 13.15% correction from the cmp of 7985 )

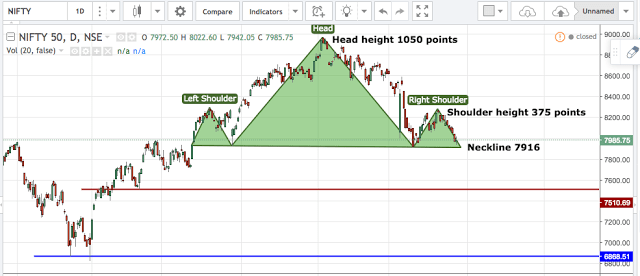

To support our mathematical calculations with graphical support levels, let’s see if the following two levels coincide with the support levels on the chart of Nifty.

- The red line at 7510 is close to the shoulder target of 7541

- The blue line at 6858 is even closer to the head target of 6866

Calculations and graphical observation suggest that a steep fall will be followed once 7916 in the spot is broken!

Trading Plan : For a confirmed breakdown, we need to have heavy volumes in Nifty futures on the day of the break, down and the closing in the spot should be below 7916.

Once these two conditions are fulfilled, we will wait for a pullback towards the neckline and short Nifty Futures or buy put options. One should always remember that trading n derivatives possess a huge amount of risk due to its leverage. Only those who are seasoned traders should attempt such trades. The conservative ones can go for bearish option strategies. These strategies provide hedged entries, thus reducing the risk factor.

Once a short near the neckline of 7916 (spot) is initiated, book profits at every support i.e 7712, 7676, 7510, 7401 and finally 6858.

NEVER should we short at 7916 (spot) with a hope of pocketing 1050 points in one trade. This is an amateur way of trading and it is not realistic. Always short at resistance and book profits at support. Once you get a pullback, short again for the next resistance.

When multiple lots are shorted, do use the trailing stop loss to maximize our profit potential. In such situations, avoid going long in high beta stocks. The next year can give us a superb entry point for going long in quality stocks after the correction is over!

* This analysis is invalid above 8274 spot in nifty