I learnt about this Price Action Trading Strategy from Trade Academy. It took some time to grasp it properly but it works like a charm. My probability of profit with this strategy is 78%. I’ve optimized it further combining other technical strategies into it.

Swing Trading

Swing means fluctuations. Swing traders use technical analysis to look for stocks with short-term price momentum. Short-term generally refers to a holding period of 1 day to several weeks.

Swing High and Swing Low

The strategies on Trade Academy was based on the concept of Swing High and Swing Low. I over complicated the basic concept and it took me couple of days to figure it out.

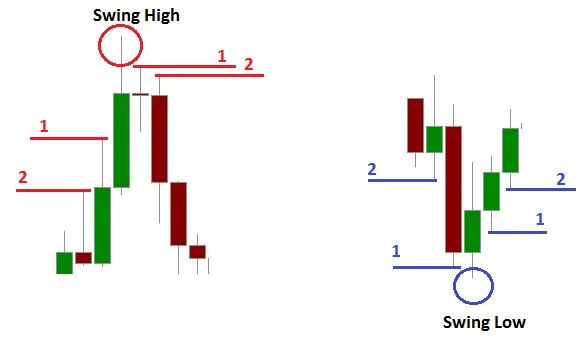

A Swing High is a candlestick with at least two lower highs on both the left and right of itself.

A Swing Low is a candlestick with at least two higher lows on both the left and right of itself.

This image solves it all.

There is an indicator in metatrader (an awesome trading platform) which identifies the swings automatically – it’s called fractal. But I wanted an price action indicator on meta trader which works exactly like the above image. I managed to get an indicator which you can download here which works perfect as far as I have tested for H4 chart.

The Price Action Trading Strategy

The main practical suggestion that comes of this course is the chapter named – The 15 min Option Trader. The main tagline is -” Spend 15 mins a day and trade options.”

The Strategy is simple – When a candlestick crosses the last swing high 15 mins before the market closes buy call options; if a candlestick crosses the last swing low 15 mins before the market closes then buy put options. Risk:Reward ratio is 1:1. Hence target profit and stop loss is both at 30%.

Here is my modification to it. Instead of buying call options sell the put options and instead of buying put options sell the call options. Replacing the call options with put options gives us advantage over time decay.

I personally use higher reward and lower risk manually. Also you can go for long options too. In the daily chart, follow the same and buy At-the-money call options for bullish nature and vice versa.

Results

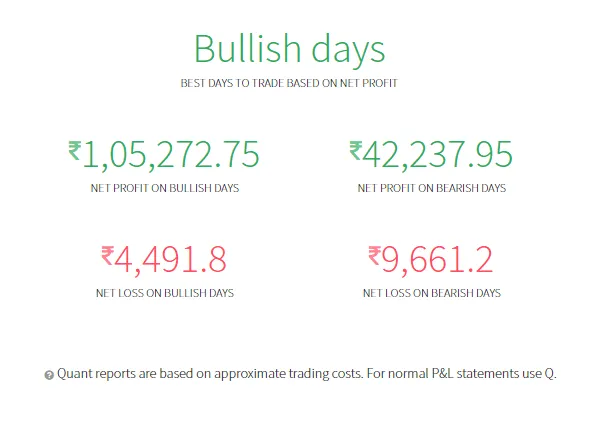

Here are the back testing result of Price Action Trading Strategy mentioned there on July-September trades of Reliance –

Reliance June Trades:

- 1st June – Bought 900 CE @ ₹ 22.85 – Stop loss – ₹ 16.00 – Target – ₹ 29.70

Target hit on 2nd June with Profit +30% - 11th June – Bought 880 PE @ ₹ 28 – Stop loss – ₹ 19.6 – Target – 36.4

Stops hit on 12th June with Loss -30% - 17th June – Bought 920 CE @ ₹ 39 – Stop loss – ₹ 27.3 – Target – 50.7

Target hit on 18th June with Profit +30%

Reliance July Trades:

- 15th July – Bought 1000 CE @ ₹ 27.85 – Stop loss – ₹ 19.5 – Target – 36.2

Target hit on 21st July with Profit +30% - 22nd July – Bought 1040 CE @ ₹ 28.30 – Stop Loss – ₹ 19.8 – Target – 36.8

Target hit on 22nd July with Profit +30%

Reliance August Trades:

- 4th August – Bought 1000 PE @ ₹ 26.35 – Stop Loss – ₹ 18.45 – Target – 34.25

Target hit on 10th August with Profit +30% - 20th August – Bought 920 PE @ ₹ 13.65 – Stop Loss – ₹ 9.55 – Target – ₹ 17.75

Target Hit on 21st August with Profit +30%

Reliance September Trades:

4th Sept – Bought 840 PE @ 28.05 – Stop Loss – ₹ 19.64 – Target – ₹ 36.45

Stops hit on 8th Sept with Loss -30%

Though if you do not understand what is option, swing high or swing low; I strongly recommend you must sign up there and learn the whole course. It will take you couples of night to gallop all the videos up there.

Here is what I have made recently with NIFTY OCT 8700 CE.

I made one Zerodha account just to make money using this Price Action Trading strategy. It ran pretty well. But I’ve made my own modifications to the take profit and stop loss. You can make it to a trailing profit if you’re greedy like me.