Aurobindo Pharma Limited is a pharmaceutical company. The Company is engaged in producing oral and injectable generic formulations and active pharmaceutical ingredients (APIs).

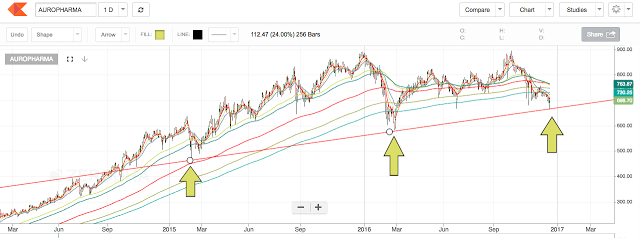

1. Its long-term trend is up as price is making a higher top higher bottom formation and mid and long-term EMA’s are moving upwards.

2. The long-term trendline is being respected.

3. Price has a tendency to make an up move when it trades below its 365 EMA. This occurs due to accumulation by institutional buyers at cheaper prices which gives them value.

4. Price has bounced off its weekly demand zone of 673 – 582. We can expect an up move from here.

5. Apart from the oversold levels, RSI is indicating an up-move is in the offing. A bullish divergence i.e. Price making lower lows and RSI making higher highs is seen. This phenomenon is generally followed by a surge in the price.

6. All the above observations point out that Aurobindo Pharma can be accumulated at current prices for a potential upside of 27% ( 890 which is its previous major resistance )