Well yes.

Day trading is an emotional battle. Couple days back I was devastated taking a bad trade while shorting Mahindra and Mahindra Financial Future shares. There was a bullish crab. I was shorting on top of the retracement. Refer – TradingView Analysis

My strategy is a negatively skewed system consisting of high win ratio and low profits but huge unrealized losses. It shorts stocks that are on the breakout.

![]()

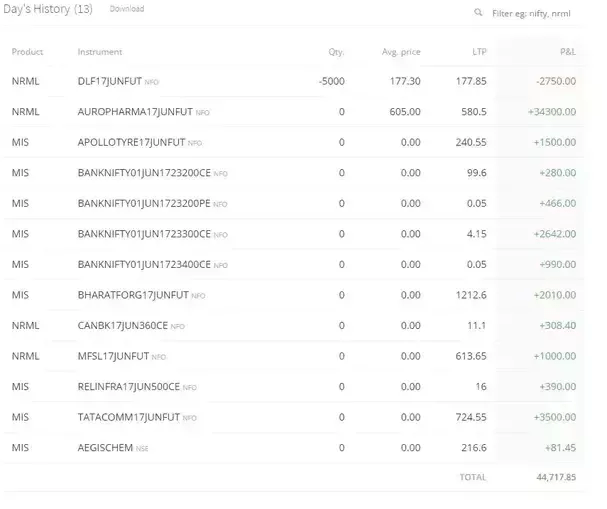

So this happened.

What will most people do? I used to cry in pillows, yelling and blaming on each other. But a calm day trader should still trade because if you lose faith in yourself, you should stop trading at all. You’ve to be consistent.

“If you don’t bet, you can’t win. If you lose all your chips, you can’t bet.” So I dumped more money instead of booking loss to support margin of that previous trade. The reason of up move was the synthetic effect of its parent company’s good results.

The new rule has been made – Never trade a sister company on parent company’s results. Today was a good day 🙂

You need patience, persistence, and trust on your system. It’s the trade psychology that makes a people fail.

PS: Now it formed a Doji. Breaking that will create a price action downside or vice versa. Let’s see what happens next.

Edit: It went into profit. Now I am about to again short it