Trade Psychology

Let’s say I know a trader from my slack channel. His trading style is aggressive; so is mine. Most of the time our account hits 20-30% in a single day but we’re doubling our quant very often.

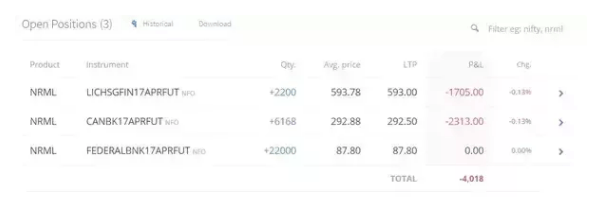

Based on some data-driven analysis (let’s don’t go there) he was expecting Federal Bank to go 90 (from 87); LIC Housing Finance to go 606 (from 593); Canara Bank to go 300 (from 292.88). So here is what he did –

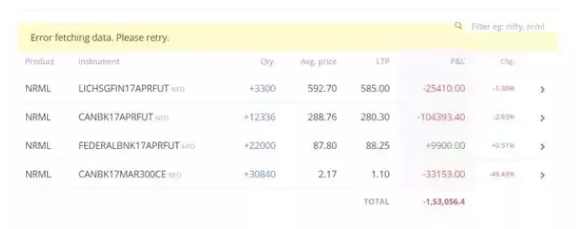

Then Trump trumped and US market ended deep red. It affected Indian market too. All open gap down. So these sentiments are always not calculable and cost the fortune.

Then Trump trumped and US market ended deep red. It affected Indian market too. All open gap down. So these sentiments are always not calculable and cost the fortune.

To make things worst, he had bought tons of call options which ended in the penny.

People were panicking and the market set up a bear trap. The trader was at his wit’s end and it was quite devastating.

What will you do in this scenario?

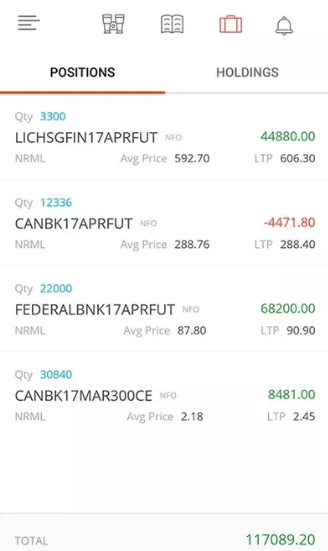

Seeing your hard earned money going into the trash! Will you close your positions and weep for few days? But what did you do wrong? The calculation was perfect. It was just trump effect which means all you need to do is sweat.

Because you need to trust your calculations more than your gut feeling exit strategy and you need to keep your emotions aside.

- I had bought Asian Paints Futures at 980; it fell to 960 and then shoot to the moon.

- I bought that again at 1050; it crashed to 1035 and right now in green.

- Same with IGL. I bought at 1022. It crashed to 980 and then it shot to 1080.

It happens always. Always trust your data or your theory. Or, you will end in deep red.

Originally published on Quora on Apr 22