- Founded in 1946, they work with a unique business model across the Agchem value chain from R&D to distribution providing innovative solutions by partnering with the best.

- Known for their technological capabilities in Chemistry/ Engineering related services and on the other hand, they have built leading brands over the last 60 years and connected with more than 40,000 retail points pan India.

Trading Rationale –

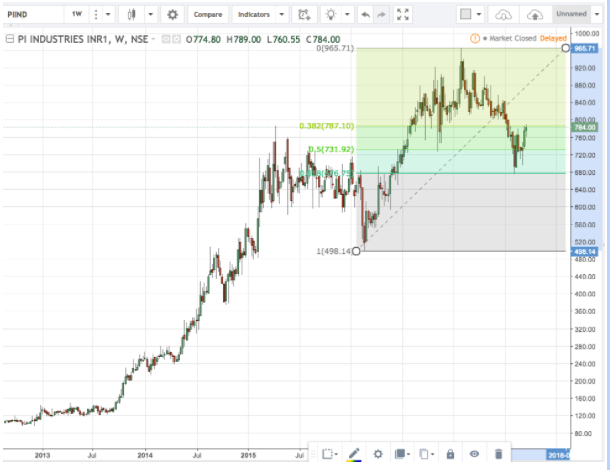

1. The long-term trend of the stock has been up. It has been making constant Higher Tops and Higher Bottoms since inception. This is an indication that after brief periods of down move, bulls find value in this script and they buy those dips.

2. On applying principles of Fibonacci retracement, we gain surety that the current bottom is a higher bottom as a bullish action is seen in the candlesticks in the 50% – 61.8% retracement zone.

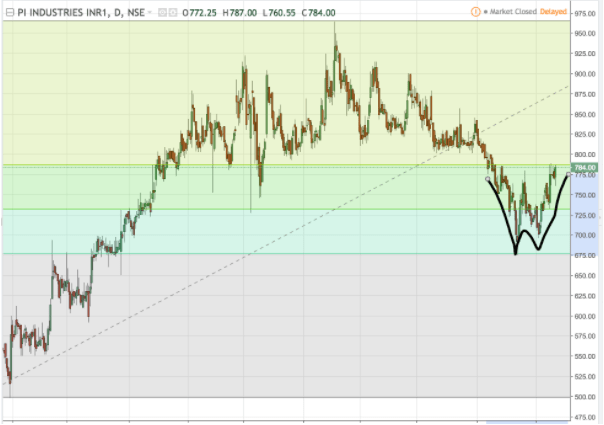

3. If we switch into the daily time frame, we can clearly observe a double bottom formation which indicates bullishness. The double bottom is almost on the verge of a breakout. A successful breakout will result in a change in short and mid-term trend from down to up.

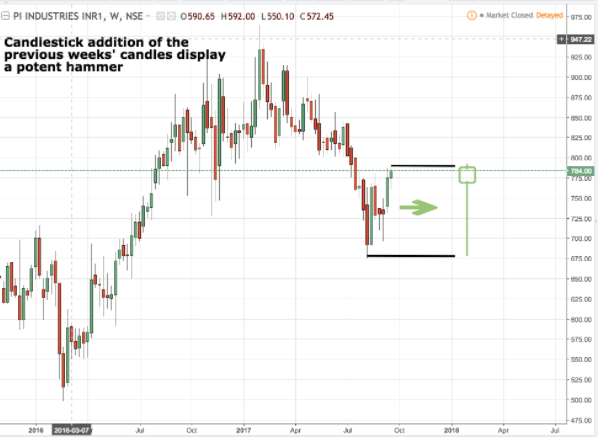

4. On further analyzing the weekly candles at the current higher bottom location, we observe that there is a strong presence of smart money/bulls / informed and learned investors. The candles do appear to be somewhat chaotic, however, on close observation post candlestick addition, we can see that the previous weeks’ candles are equivalent to a hammer candlestick with a sizable tail. This alone indicates that stubborn bulls reside at this level and they will bring demand into the script and take its price up.

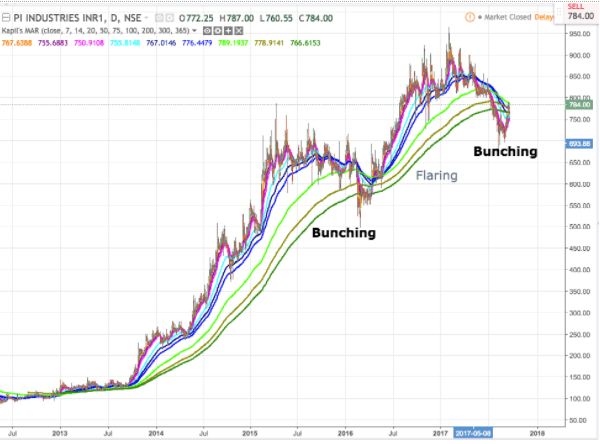

5. A moving average rainbow (MAR) analysis paints a clear picture about the dynamic support that the script entertains in the long term. The script has a tendency to dip down to such an extent that the short, mid and long-term EMAs bunch and this is where the accumulation of the smart money occurs. The bunching phase is followed by a flaring phase where price shoots up to form a Higher High. Currently, we are witnessing a bunching phase which will lead to a speed & power breakout thus setting the pace for an up move.

So far, we have established that the direction of this script for the long term is upwards which automatically makes it a buy candidate and the current location for buying possesses robust demand which makes it a good time to buy this script.

Let’s look at what type of targets can we aim for.

1. Since the script is in a fierce uptrend, the first target that we can aim for is the previous higher high of 964 which is 23% of the current price of 784.

2. To arrive at a target beyond the previous higher high, we draw a Fibonacci retracement on the downswing from 965 to 674 and mark the 1.382% Fibonacci projection. This is an important level for intercepting the next higher high. According to the projection level, the next target lies at 1080 which is 38% above the current price of 784.

Considering the above points, PI industries appears to have a bright and bullish prospect for a mid-term investment of a couple of months.

23 and 38% ROI can be expected from the current price.

Note: Exit from the stock should be taken if price quotes below 670 as it will lead to the formation of a lower bottom thus changing the trend.

For more details on the company, Click here!