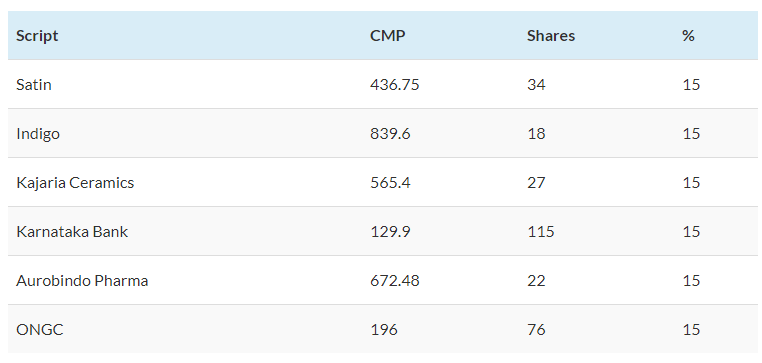

This portfolio is created documenting long term investments stocks to buy in February with a time horizon of 1 year and with an amount of 1L for one year time horizon with the highest drawdown of 5%.

With the focus shifting from emerging markets to developed markets like the US, foreign portfolio investors (FPIs) have started reducing their exposure to Indian equity.

Also, Uttar Pradesh upcoming election and NIFTY’s high valuation made it clear that correction is due. However if you’re looking for short term gain, you can see here Short Term Stocks to buy in February

Long Term Investment Stocks

One of the greatest aspects of long-term investing is that it almost entirely removes your emotions from the equation. A market that jumps 10% in a matter of days isn’t going to have you sitting on the edge of your seat to sell, and a hiccup in US markets that sends NSE stocks down 3% isn’t liable to send you running for the hills.

Stock Portfolio Parameters

Amount to Invest – 1L

Time Horizon – 1 year

Risk Appetite – 10%

Stock Analysis

- Don’t worry if anyone falls. Your holding period is 1 year so they will be up anyways after those corrections.

- Keep 10% to use 5% each time to average out if any stock falls more than 8%.

- ONGC is getting a huge correction. So invest like SIP. 5% at a time. But it has huge upside in a span of 1 year.

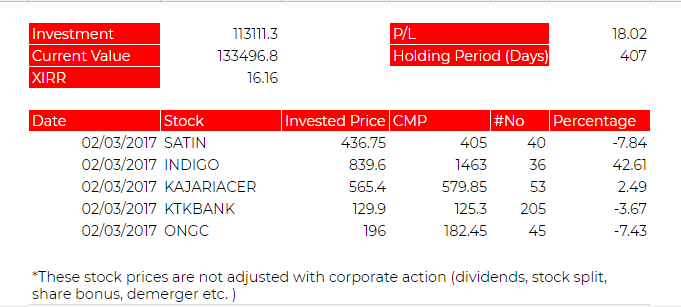

Update (13/04/18)

The stocks were supposed to have a holding period of one year. Since the inception of a portfolio, NIFTY is up by 16% and the portfolio is up by 16.16%. This underperformance is due to the restriction of inability to modify the portfolio (rebalancing in middle). Let’s book profit and move on –