Core Satellite Portfolio is widely followed method of Modern Day Portfolio Management. How much you invest in the stock market never matters. What matters is how much you’re willing to put on stake; the precise term is risk appetite as well as it depends on your expertise on the stock market.

Risk Appetite

Your risk appetite derives from how you view the stock market. Most people see stock market as an instrument of alternative investment but most people see it as a source of income. Obviously second one has significant higher risk and needs dedication.

Active investment has high reward as well as high risk and requires higher amount of time commitment.

It generated a new generation of businesses –

- Advisory Business – They generally give recommendation of stock or future or options or other instruments. There is no trustable review of this kind of business found anywhere because they are not indeed successful at all. If they were so, they would have earning hefty profits doing those trades themselves and making billions.

- Portfolio Management – Now there are two kind of portfolio managers. One takes your money into their firm and doesn’t let you know of their investments and another makes you open demat account and do trades on behalf of you. You can monitor your trades all the time. Some companies take profit based on the ‘amount of the money managed’ and ‘profit made on the money managed’. Brokers always gives a good percentage of the brokerage fee to these managers as they drive good amount of business from them. I’ve personally invested in some of them but I will not recommend as I need more time to study this industry. Some made consistent profit but some make steady loss promising hefty returns in future. Some promises like 70-80% return a year. So it is indeed fishy.One such was making consistent loss dragging drawdown to 30% which is a sign of bad trader. Then I found the returns and data used to plot their profitability chart is wrong. Some were forcefully interpolated and modified to show hefty returns. No comments but it is certainly a scam!

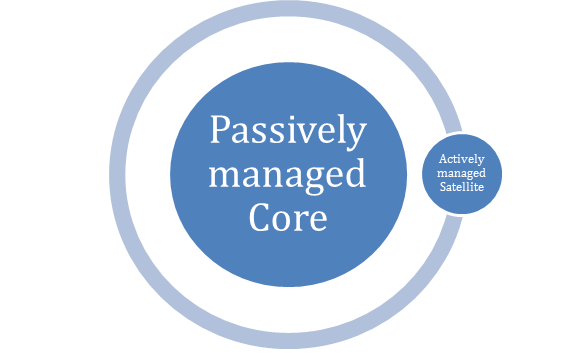

Core Satellite Portfolio

Generally, Core & Satellite Portfolio Management is one of the popular and most followed investment strategy that allocates the majority of the portfolio to fixed-income securities (“core” portion) and rest of the portfolio to more volatile securities known as the of the portfolio (“satellite” portion), with a percentage based on the risk appetite.

Generally, Core & Satellite Portfolio Management is one of the popular and most followed investment strategy that allocates the majority of the portfolio to fixed-income securities (“core” portion) and rest of the portfolio to more volatile securities known as the of the portfolio (“satellite” portion), with a percentage based on the risk appetite.

Actually we all unknowing follow this Core Satellite Portfolio strategy.

Most Indians put their 90% of investment in Real Estate, Commodities (Silver and Gold mostly), Mutual Funds and Fixed Deposits.

Those who have demat accounts (less than 2% Indians have demat account) use the rest in equities and those who haven’t use it in their business or startups. Average person doesn’t love risk. We all love safe money.

Wise traders allocate 60% of their portfolio to the core and 40% to the satellite part. My trading style and risk appetite is very very aggressive. In my Core Satellite Portfolio, I consider my core as equities and my satellite as derivatives and high volume (or high frequency) short term stock trades.

I believe in thematic investments. Thematic investments are based on the fundamentals strongly and make small basket of stocks. It is best to keep the portfolio in very less drawdown.

Let’s say in the case of demonetization (which I have discussed in detail later), My Thematic investment was ‘shorting Delta Corp, cement stocks, real estate companies, FMCG companies, shorting housing finance companies.’ Each had their certain weightage and deadlines and I was alert on their reversal patterns. Delta Corp shorting had highest weightage and LIC Housing had the least. But I have squared off and reversed the some of the investments (didn’t reversed cement stocks).

Some thematic investments are short and some are long. I have a bunch of stocks which follows ‘The Shopkeeper Strategy’ and they have an average target of more than a year and I do not apply stop loss on them.

I’m bullish with Pharma and they will be hold for a span of 2 years. Like I’m targeting Biocon to touch 1500. My Satellite part which hedged the pharma investments in the recent pharma downfall (also mentioned later how) saved my core part to optimize towards more profitability and less draw down.