Trade 1

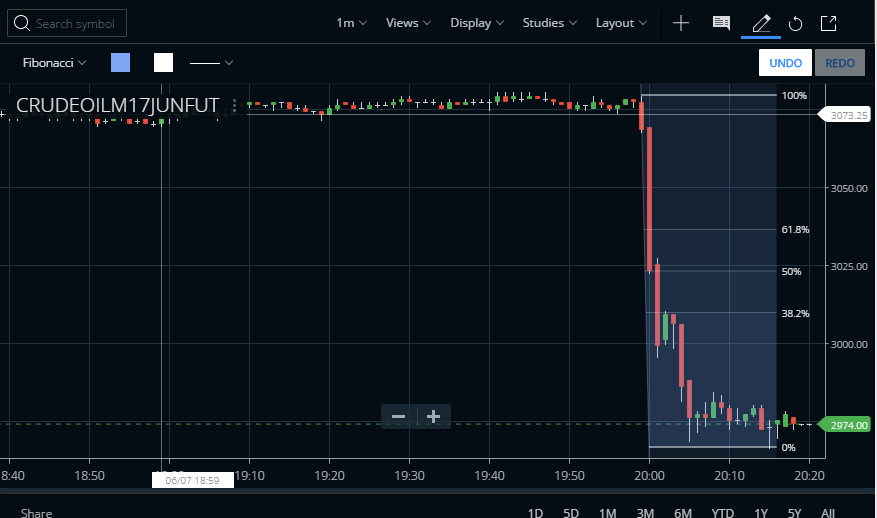

Look at the above chart which just shows fall of Crude Oil. Every Wednesday crude oil inventory reports come from the US. Layman term – They have more crude oil in their inventory than expected. Oil will fall as supply is more and demand is same.

It’s a fundamental move. Indicators went haywire as indicators are based on the assumptions that stock market follows a normal distribution.

So here are the Fibonacci retracement levels as shown above. As it is showing a bit resistance. Current price is 2972. I just bought here. You know my exit as you can derive out of fibonacci retracement setup.

It’s 2980 now. I am setting my trailing stop loss at 2974 so that I end in profit anyways and leaving it.

My Trailing Stop loss hit.

Trade 2

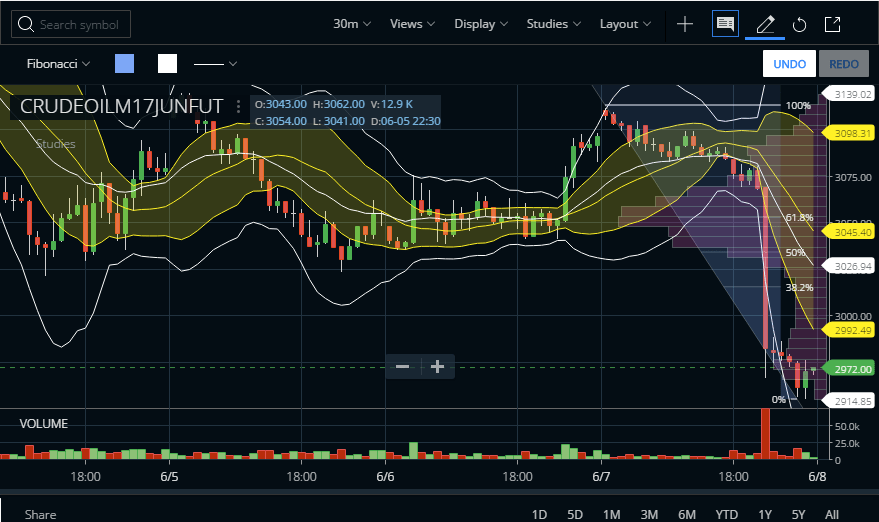

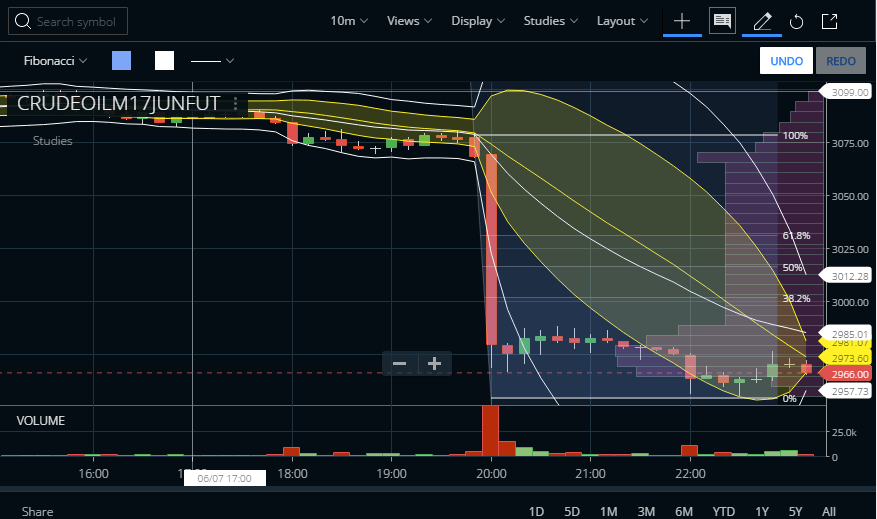

Now based on 3BB setup I will again enter into positional long on 2970.

Here goes the proof –

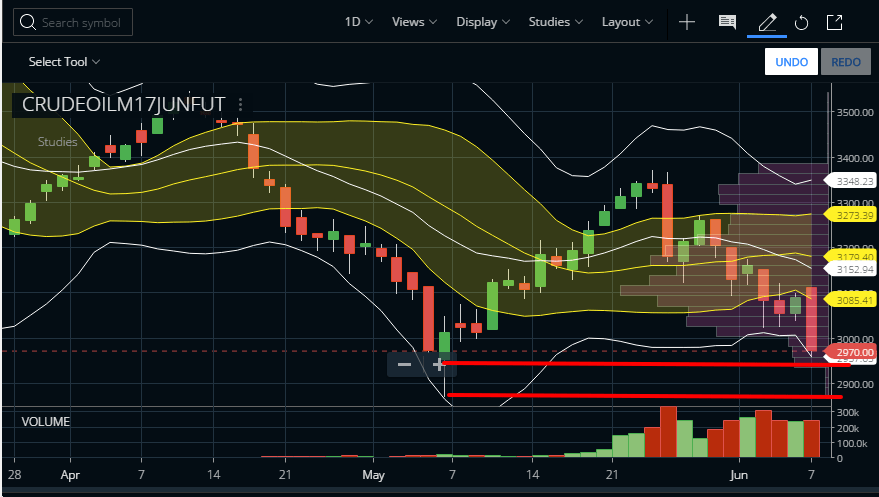

There are two resistance zones in the higher timeframe as you can see below. I will exit based on Fibonacci levels and price action trailing stop losses.

After some time, based on the pattern made on the shorter timeframe, we put the stop loss –

Our bet is on the retracement. It’s positional. So our stop loss is at 5 points below from 0% (to avoid volatility spike).

So, in short –

Entry reasons:

- Candlesticks

- 3BB

- Support Level based on Fibo on short time frame

- Support Level based on VPA on large time frame

Exit reasons:

- Fibonacci

- Median Bollinger method won’t work as it falls out of the basic definition of normal distribution with this massive move

Fundamental events like RBI Policy, Crude Oil Data messes with the definition of normal distribution and make the system tail huge. Technical indicators like Bollinger can not work there.

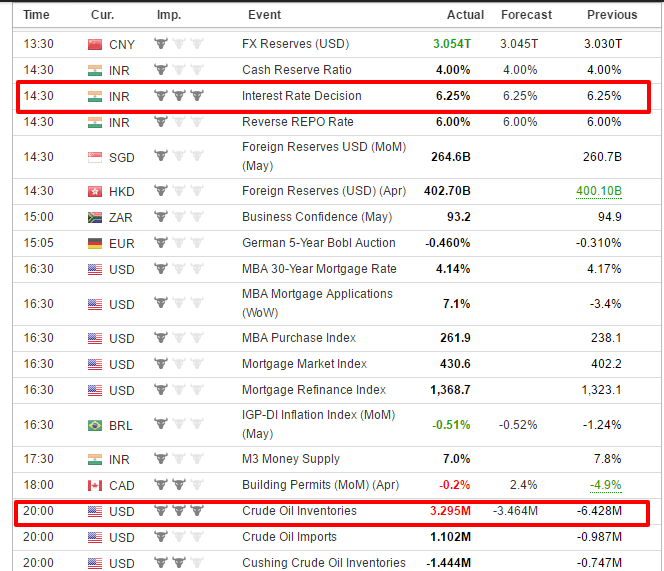

This is the best place to track such events is Economic Calendar of investing.com. As you can see in the below image –

Extreme volatility was caused in these two zones. We have also experienced volatility spike on NIFTY on the time of RBI discussion. Major events like these are marked with three bulls.

Update: Closed on 3008

This discussion happened on 7th June 2017 on Unofficed Chat.