Long Terms Investments or Investing for more than 10 years will certainly eliminate the risk of volatility, but it will not ensure that you will make money out of the stocks.

If you pay an exorbitant price for an asset, which is several times the value of the asset, you may not make much even in the long run.

For example, the investors who bought Infosys in 2000, during the dotcom bubble, at a P/E of more than 200, didn’t see their buying price for the next 10 years.

Also, if you buy a low-quality business, just because it is apparently cheap, you may lose your money, even in the long term.

So the key is to buy a quality business at a reasonable valuation. For Long Terms Investments like holding period of 11 years, you can wait for 1–2 years and buy highly selective businesses during times(fear) when they are available at reasonable valuations.

Some tips for choosing best Long Term Investments

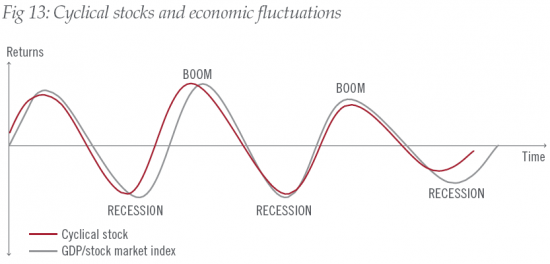

- Don’t buy cyclical stocks like metals, cement, oil, airlines, sugar etc.

- Focus on moats. The company should have some competitive advantages that are hard to replicate. For example: Strong brands, complex research based products, network based moat that will expand with time, switching costs etc.

- Focus on asset light, scalable businesses. These kind of businesses will have high ROCE, decent growth and will distribute most of the profits as dividend.

- Even banking and nbfc sector can give decent returns over the Long Terms Investments. The only requirement is that management should be conservative and should focus on asset quality. Stay away from psu banks.

- Last but the most important point, management should be ethical and transparent. All the growth and cash flows won’t help you if management quality is poor. Some managements are masters in the art of sucking money out of the company.