Options Trading. Turtle trades are always short, always hold to the expiry, always with no stop loss. But, as people screws when it comes to risk management, We share limited loss setups starting from October 19.

Reference –

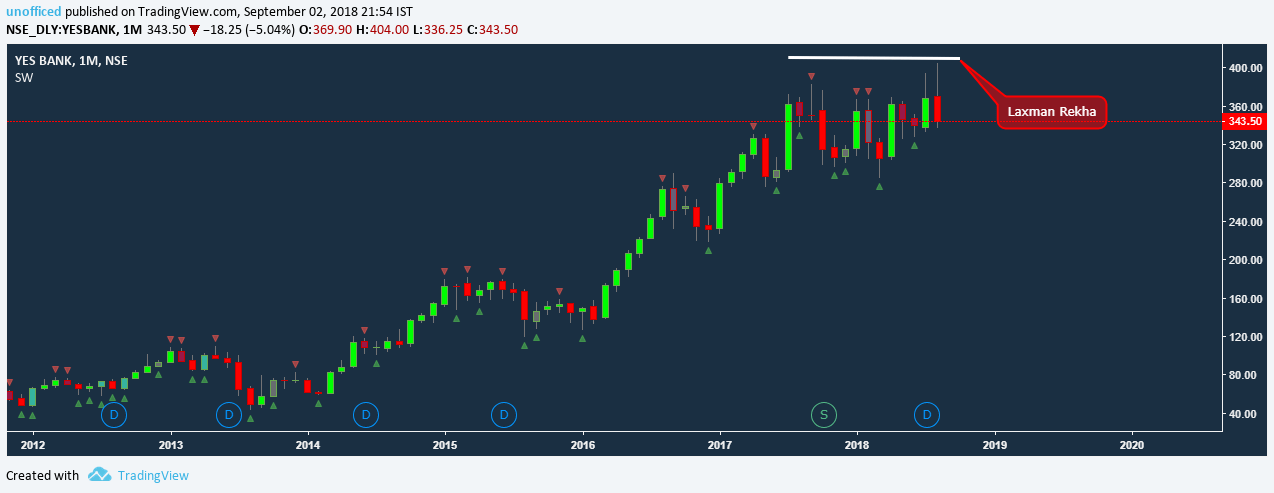

Let’s discuss the entry strategy of one of such trade ! In the image of Yes bank, our bet is simple. As there is no fundamental cue (no corporate results or other drama, it will stay range-bound below that white line! This is a char in the monthly time frame. The line is at 410.

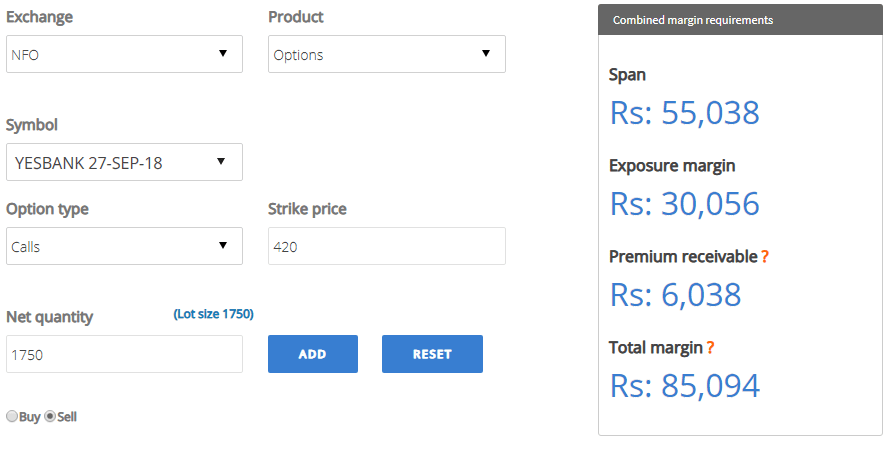

We’re taking, even more, safer zone. We’re betting that it will not end above 420 this month. In that sense, it will be safer! Do note – Being a stock option, it will expire on the last Thursday of this month.

If we sell Yesbank 420 CE at the current price, It will cost us 85,094 and We can make 6,038 from this trade if our assumption goes right! It is about 7.1% profit in a single month. Now we can have different risk management systems.

Here goes one example – We close the trade if Yes bank closes above 410 at any day. So, basically, you can set alert and sleep till you get some notification. Also, another example of risk management is, You’re cutting the trade if the trade reaches 10K loss. As simple as that.

Now the question arises, why the name – Turtle? Rabbits jump and they live for 8 years. Dogs run and they live for 15 years. Turtles do nothing and live for 500 years. Learn the lesson!

Also, You can sell the turtle options on the pledged margin because if the market goes up your stock makes money anyways and when it goes down or stays at the same level, Turtle options make the money!