Bullish Engulfing Chart Pattern will be discussed in this session but before we begin, I would like you all to avoid reading about candlesticks from the internet. There are a lot of sources with contradictory/conflicting data. The data that I am presenting is after years of backtesting and personal experience in each and every time frame. I’m simplifying and presenting it in the best way possible for a beginner to comprehend in one go.

Today, I shall cover Bullish Engulfing, Bearish Engulfing, Tweezer Top, and Bottom. Support Resistance and Trendlines.

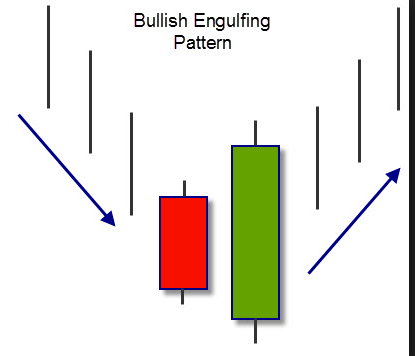

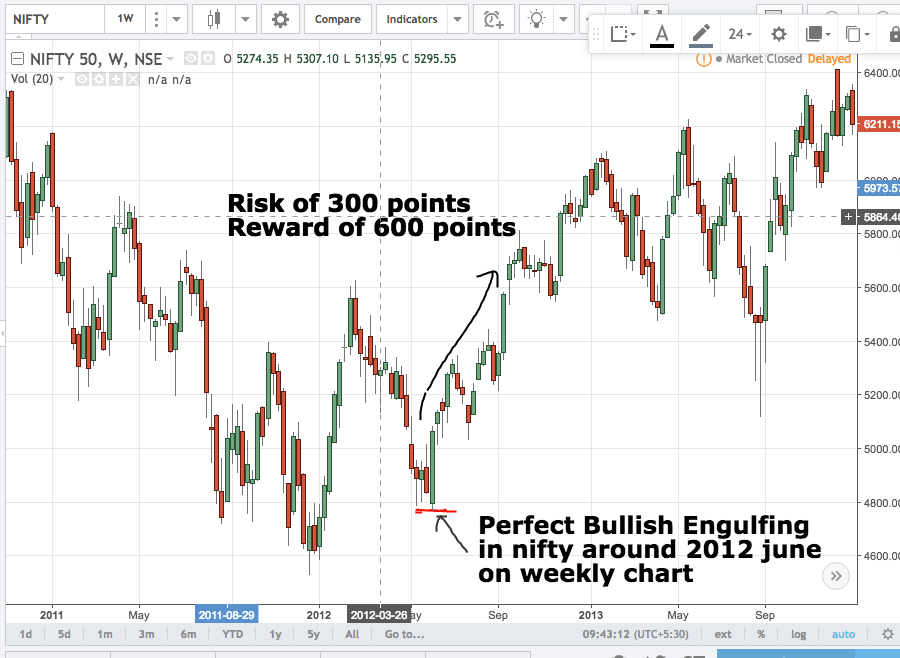

Bullish Engulfing is a 2 candlestick pattern. As the name suggests, a candle Engulfs or Eats the other. Here is an illustration The red candle is completely surrounded by the green candle. This is a massive sign of change in power from bears to bulls. This pattern is undoubtedly the most powerful pattern in my experience. I shall share a real life example too.

Psychology: Imagine that there was heavy selling for a week, after a series of red candles, one fine day, the market just opened gap down and bears were even happier. They shorted even more! (these are the uninformed ones) Then all of a sudden, the supply started getting absorbed by Bulls and fresh buying started taking place. Now that gap down was filled and the candle turned green.

The show doesn’t stop here, the fresh shorters had their stop losses hit and they started buying as well. The buying is sort of a panic buying and nobody knows why they are buying but they are just doing it. Every moment the price is shooting up, every second the bids are going up.

There is such an acute demand due to this avalanche effect of buying that the candle now has reached the top of the red candle from the previous day and by EOD, it covers it completely. No shadow is out of the body of the green candle. Remember, it is the green body that should engulf the entire red candlestick! This is the pinnacle of a short term recovery and it signifies that the downswing is over!

Structure: In Bullish Engulfing, the 1st candle is always small and red and the second one is massive and green. The Engulfing candle’s body must engulf the entire red body. It’s reverse of harami. I can think in this way. A child comes first then the mother.

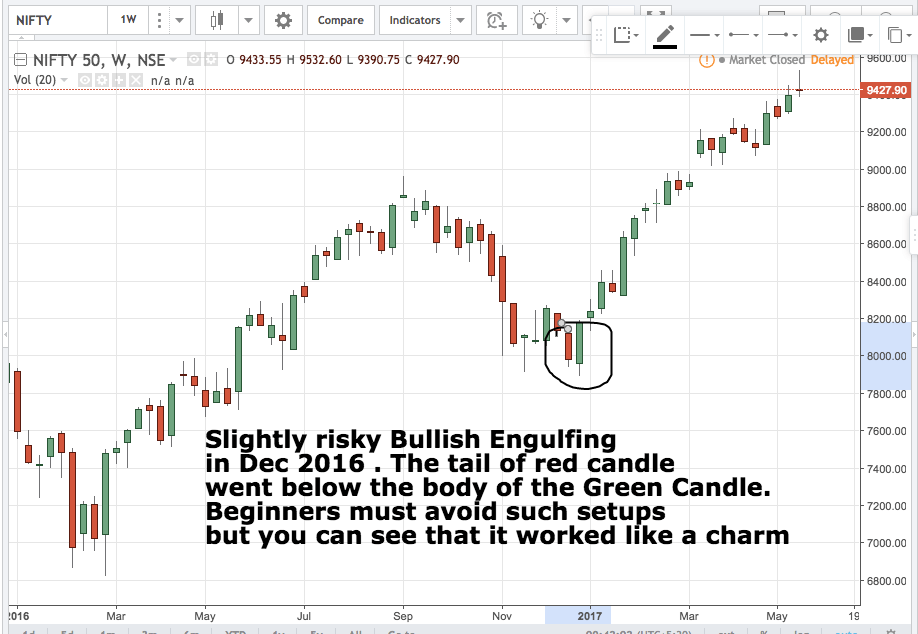

Location: Always trade this setup in a Higher bottom area. (It can be traded in a Lower bottom area but that will be against the trend. Beginners must avoid).

Trade Setup: Wait for 2 days to get a proper candlestick setup. The clearer the candlestick pattern, the better it is. The shadows of red candle must not get out of the body of the green candle. The third day, you can start buying with the SL as low of the engulfing candle. The green candle’s low will be your stop loss on the closing basis. Go for minimum 1:2 Risk reward ratio. My BAD guys, it is engulfing, Harami doesn’t get out of my system so easily XD.

Both the trades are BULLISH ENGULFING

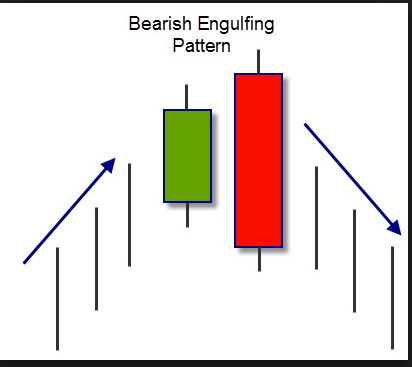

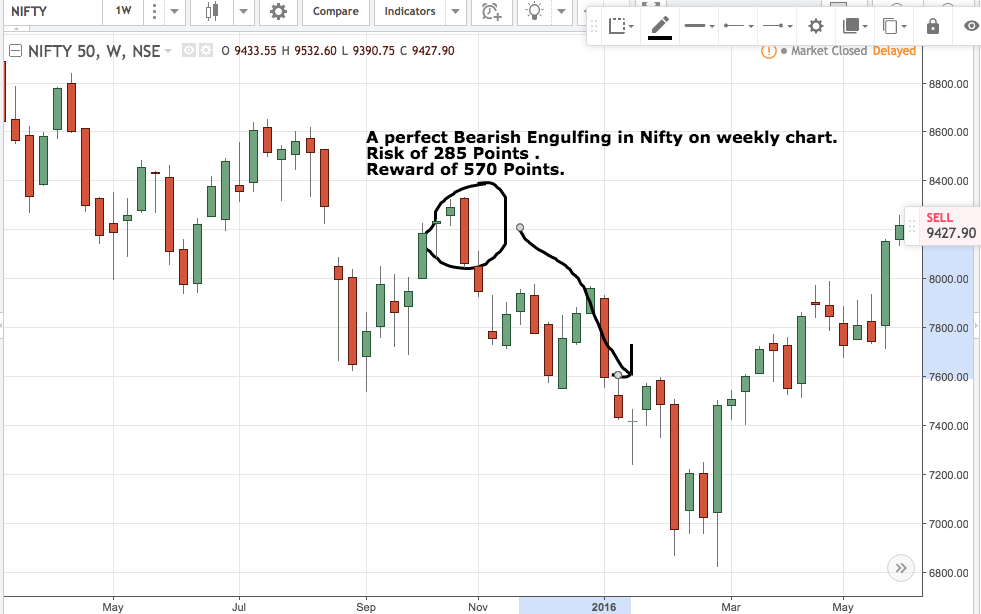

Moving on to bearish engulfing, the psychology is exactly the opposite. After a brief period of an up move, the bears start showing their muscle and they bring a gap up to its knees.

Location: It should only be traded at a Lower top location. (A Higher top location shouldn’t be taken for a fresh trade. If you are already long then take this bearish engulfing as a signal to book profit and close the position).

Structure: In Bearish Engulfing, the 1st candle is always small and green and the Engulfing red one is massive. The body of the red candle must cover the entire green candle. The shadows of green candle must not go beyond the body of the red candle

Trade Setup: wait for 2 days for the candlestick pattern to be established. The third day, go short and keep stop loss on the closing basis at the high of the engulfing candle ( red candle ). Risk Reward should be minimum 1:2

This one is the best possible setup. There was a series of a lower top lower bottom, The bearish engulfing was achieved at a Lower top. Nifty made a lower bottom and hit our target of 570 points bade aaram se.

Q. Should be observed on a weekly chart?

A. Daily and weekly give best results in candlesticks.Weekly is the strongest but it will test your patience. For intraday, I go for 30-60 mins.

Q. It seems like a positional setup…Any suggested time frame working with this for intraday?

A. Positional works best with price action concepts. For intraday, you may stick to 30 – 60 Mins

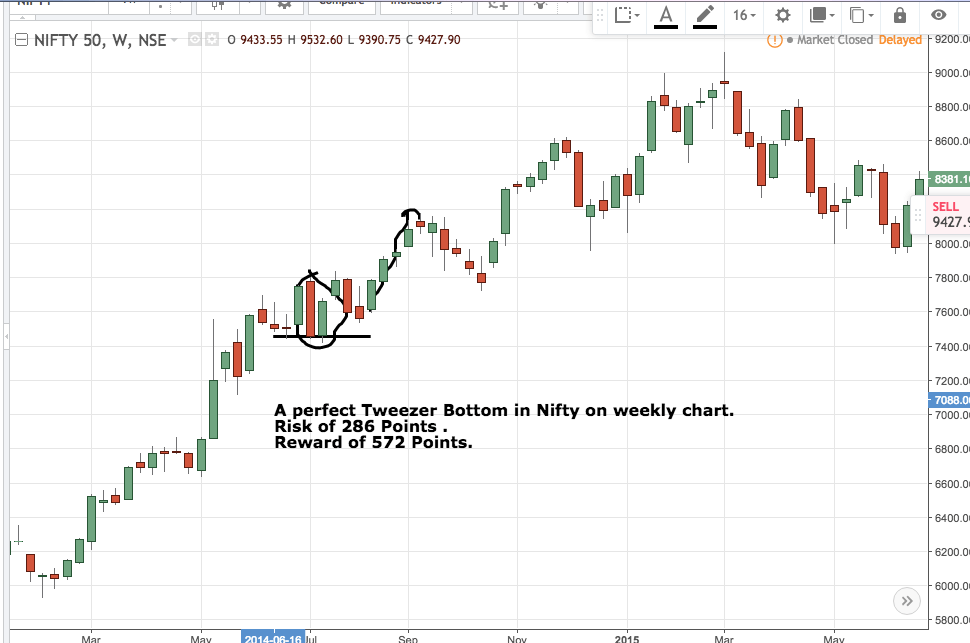

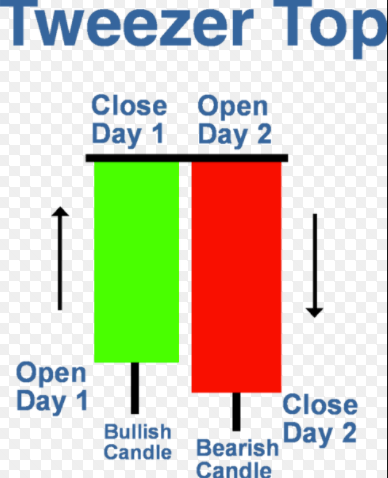

Starting with the next setup, Tweezer Bottom, and Top

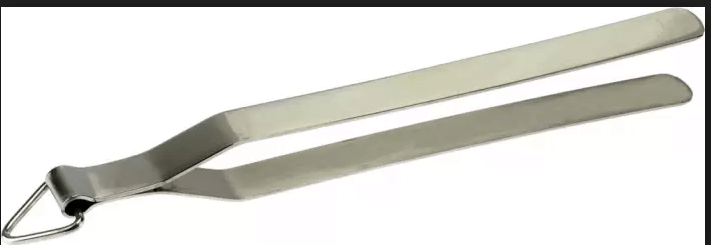

The above image is of the tweezer bottom. Tweezer means a “CHIMTA” in Hindi. Observe how the both the tips of a tweezer are aligned. Similarly, the bottoms of the tweezer bottom setup are aligned. They are at the same price level.

Psychology: This is a real ” Kaante Ki Takkar ” kind of a candlestick pattern. After days of a down sell, market refuses to go down further. It opens from the same level it closed the previous day. The closing is almost equal or slightly plus minus as compared to the red candle. We can see that the green candle is giving a good fight to the red one. This one might be slightly weaker than engulfing where it shows the red candle, who is the boss! In Tweezer you get a rock solid bottom where buying can be initiated.

Structure: The first candle is red, the second candle is green.The most important point to be noted is CLOSING OF RED = OPENING OF GREEN (slight deviation of 0.1%-0.2% may be ignored but not appreciated . The tighter the setup, higher the chances of success).

** The bottoms ( close of red and Open of green) are important. The shadows have no significance. The height of both the candles should be more or less the same.

Location: They should only be spotted in Higher bottom areas (Lower bottom areas provide a counter trend trade which must be avoided).

Trade Setup: Buy on the 3rd day when the candlestick pattern is formed properly. By properly, I mean there shouldn’t be any deviation.

Stop loss = Lowest low of either of the candles (it can be possible that tail of red is lower than tail or green or vice versa so choose the lowest of them).

Target with minimum 1: 2 Risk Reward Ratio.

Their Green candle is probably 65% the height of the red candle but that is acceptable. It should at least be 50% the size of the green candle.

Q. How is the risk of 286 pts? The SL is the lowest low between the both, in this case, it is the low of the green candle can u plz explain?

A.Take price from open of the third day to the low of the green candle.

Q. just adjacent to the section you have pointed out, is it tweezer top?

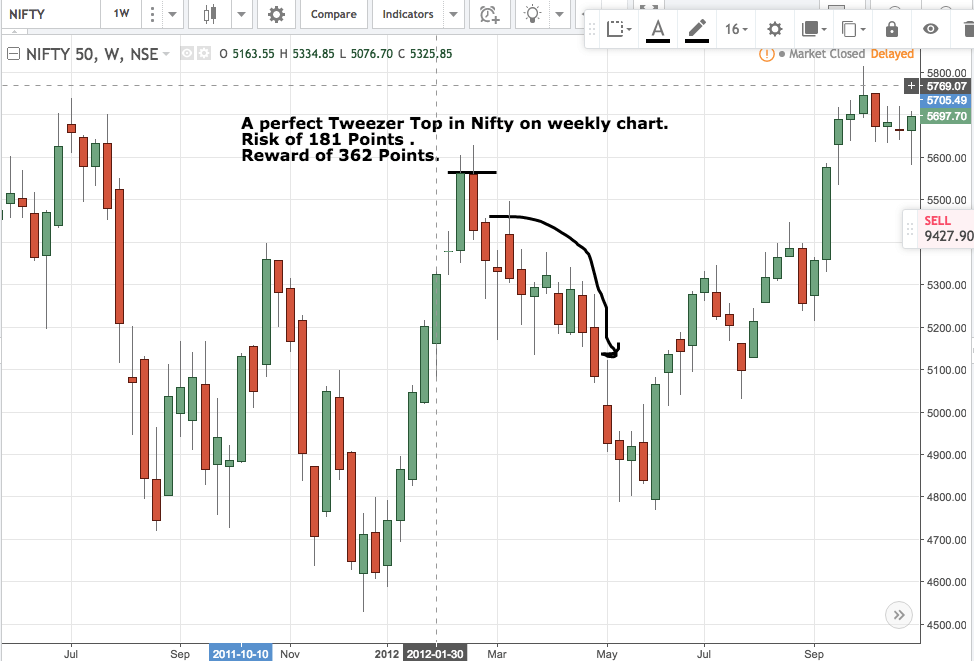

A. It is a tweezer top but not at the higher bottom area. It is in the middle so ignore it. Positional trades on the weekly chart has some amazing results!

You will trade 2-3 times a month and probably make more money than some one who spends his/her full time looking at the tic by tic market.

The next setup is Tweezer Top. The psychology is exactly opposite to that of Tweezer Bottom

This is where Bears stand up to the bulls at the end of an upswing!

Location: Always trade it on a lower top (higher top trades will be the counter trend so avoid fresh shorting . It can be used to book profit in the case you are long at the higher bottom area).

Trade Setup: Wait for 2 days for the candlestick setup to be formed completely and properly.On the third day, go short keeping SL as highest high (Which ever candle has a high greater than the other). Keep Risk Reward at 1:2 and set your target accordingly.

Comment on image –

Q. On the fifth day the price is moving up but we are short on this trade from 3rd day. So should we keep adjusting our SL once we take a position during market hours or the SL is decided EOD?

A.Though price spiked on the fifth candle, it was below the stop loss so nothing to worry.SL is always EOD. After the candle is formed.

Q. For positional trading, out of strict SL/target and trailing SL, which one works best?

A. Strict Stop loss on the closing basis to begin with. However, once u are in profit, trail your stop loss to secure profits as the price keeps on going up.

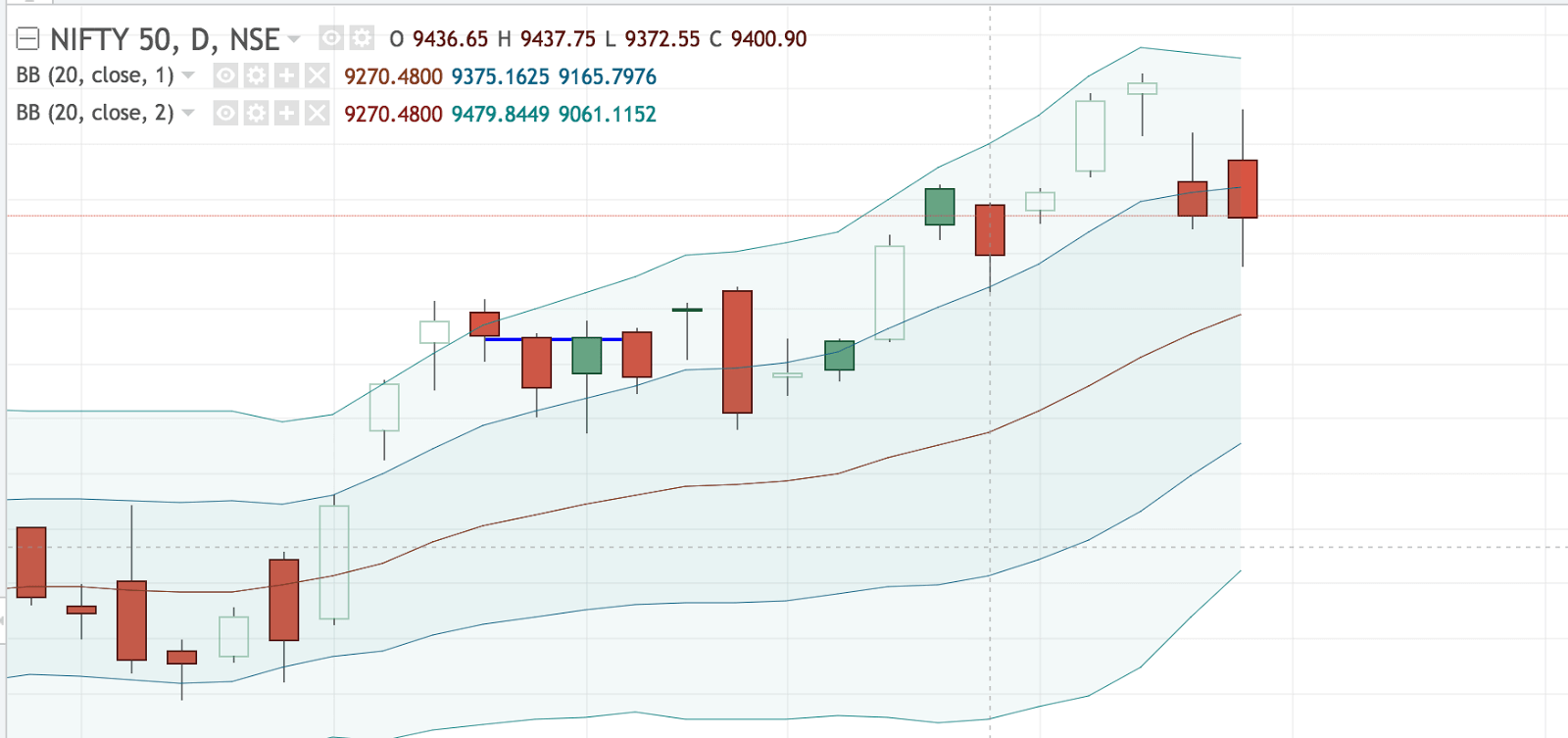

Q. Is this Tweezer Top?

A.It is a tweezer top but a failed one. These patterns can fail once in a while. But if the location is perfect then they will not fail. Perfect zones are found out using advanced concepts.

Q. In the tweezer top set up is it mandatory that a red candle is followed by a green candle? Or the color of the candles doesn’t matter? Cuz in this picture green candle is followed by a red candle

A. Tweezer Top: first Green then Red. Tweezer Bottom: First Red than Green strictly!

Q. How to spot these patterns from so many stocks?

A. Practice! Initially, you will struggle to spot them. After few days of practice, you will spot them in minutes and in weeks of practice you will spot them in seconds.