Who is an investor?

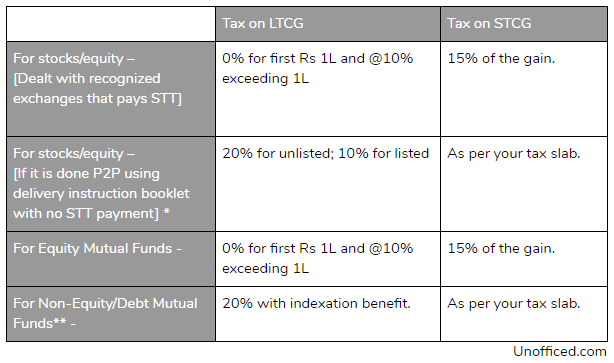

- If you hold equity investments for more than 1 year and show the income as Long Term Capital Gain.

- If you hold equity investments for more than 1 day less than 1 year and show the income as Short Term Capital Gain provided that the frequency of trading is not high.

* Stocks can be transferred person to person using DIS slip. DIS refers to “Delivery Instruction Slip”. Like the checkbook for your bank account, the DIS is for a DEMAT account. You can use DIS for transferring shares from one DEMAT to another. Note that a gift from a relative through DIS slip is not considered as a transaction and hence not capital gain.

Check here for more details on indexation benefit.

** You need to hold Non-Equity/Debt MF for 3 years; otherwise it falls under STCG.

For filing advance tax, one should use realized profits. If you make less profit from the paid-up tax, you can claim a tax refund later anyways.

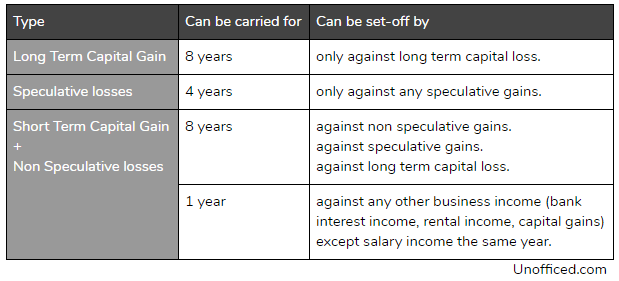

Short-Term Capital Losses if filed timely can be carried forward for 8 consecutive years and set off against any gains made in those years.

Who is a trader?

Trading is seen as a business in India. There are two types of income here.

Speculative Business Income –

- If you do intraday equity trading without taking delivery of the contract.

Non Speculative Business Income –

- If you do FnO trading (both intraday and delivery). or,

- If you hold equity investments for more than 1 day less than 1 year and show the income as Short Term Capital Gain provided that the frequency of trading is high.

So, for STCG on equity investments, you have two options based on the frequency of trading. The frequency of trading is not quantified. So equity investments for more than 1 day less than 1 year can be used as STCG as well as business income.

Example:

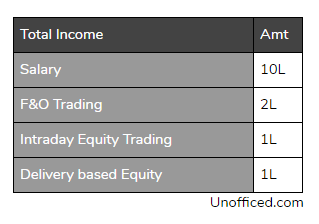

Speculative and non-speculative business income is taxed under normal tax slabs and are treated as other income. Here goes an example –

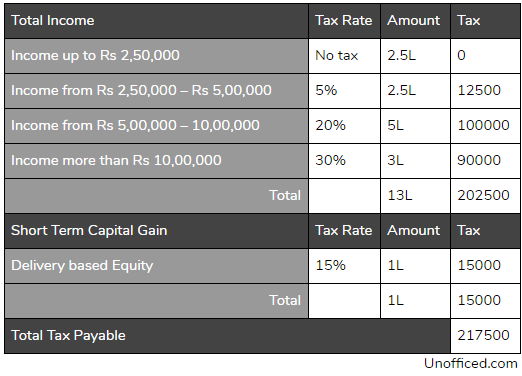

By, Delivery based equity we are meaning equity trades lasting more than 1 day and less than 1 year! Here is how the tax is calculated in this above-mentioned case –

Now the trick here is –Delivery based Equity (>1day <1year) can be shown either STCG or business income! STCG is taxed 15% but if your taxable income is below 5L; then you can show it as business income and can avail 5% tax benefit.

But once you show Delivery based Equity (>1day <1year) as either of business income or STCG or business income. It can not be changed.

Carry Forward Business Loss:

To carry forward losses, one needs to file the tax on time which is July 31st for the non-audit case and Sept 30th for audit case. We will discuss audit later on.

BTST (Buy today Sell tomorrow) or ATST (Acquire today sell tomorrow) can be considered as STCG because STT is charged similar to regular delivery based trades.

Audit

As trading is all digital transactions, an audit is required

- 2 Crore Mark – If there is business income and the business turnover is more than 2 Crores. (For non-digital it is 1 crore.)

- Section 44AD –If the turnover is less than 2 Crores but profits are lesser than 6% of the turnover and total income is above the minimum exemption limit i.e. 2.5 Lakh.

- Last year 44AD was used and this year we are not using it.

Business Expenses

If you show trading as a business, you can show all expenses incurred as a cost which can be used to reduce your tax, and if it is lost after all these costs, it can be carried forward as well. You can show any of these following things as expenses –

- All charges incurred in trading (STT, Brokerage, Exchange Charge, Call, and Trade charge and all other taxes). STT cannot be shown as a cost if you declare income as capital gain but you can do it in case of business income.

- Internet/Phone bills if used for trading.

- Depreciation of computer/other electronics (used for trading)

- Rental expense

- Salary paid to anyone helping you trade

- Advisory fees, cost of books, newspapers, subscriptions and more…

ITR Forms

- ITR1: Salary / Interest Income / Rental Income (From one house property) [Max income up to 50L]

- ITR2: Salary / Interest Income / Rental Income / Business / Capital Gains

- ITR3: Salary / Interest Income / Rental Income / Business / Capital Gains / Trading (Speculative + Non Speculative) / if there is Audit

- ITR4: Same as above but use it only if section 44AD and 44AE is used for computation of presumptive schemes. Losses cannot be carried forwarded in this case. Also, You can get away without maintaining books or getting audited if declare 6% of the turnover as your presumptive income.

Here is how people save money of auditing –

The audit is costly.

Suppose a person having a salary of 5L has an F&O loss of 50K on a turnover of 4L. Since the profit (Well, its loss) is less than 6% of turnover, he has to audit which is costly! He can avoid this by declaring 6% of turnover i.e. 6% of 4L = 24K as presumptive trading business income even though he has incurred a loss.

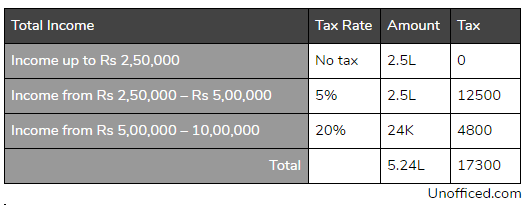

The total income stands as 5L+24K = 5.24L

Hence, by declaring additional presumptive business income of 24K and paying an additional tax of 4.8K, the person is saving audit fees! But using ITR4 means you can not take forward losses.

So, most traders who trade files ITR3. If he is not an F&O person, it is ITR2. Please consult with a chartered account. This page gives a general idea of taxation for Indian Traders. Income Tax rules also change frequently.