Outside Bar:

An outside bar is a candlestick pattern that forms when the price range (both the high and low) of the current candlestick completely engulfs or “covers” the price range of the previous candlestick. In other words, the current candlestick is larger and encompasses the entire price action of the previous one.

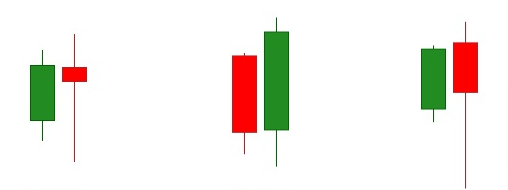

There are two types of outside bars:

- Bullish Outside Bar (Bullish Engulfing): This occurs when the current candlestick is a bullish (green or white) candlestick that completely engulfs the previous bearish (red or black) candlestick. It suggests a potential bullish reversal, indicating that buyers are gaining control and may drive prices higher.

- Bearish Outside Bar (Bearish Engulfing): This occurs when the current candlestick is a bearish (red or black) candlestick that completely engulfs the previous bullish (green or white) candlestick. It suggests a potential bearish reversal, indicating that sellers are gaining control and may push prices lower.

The outside bar pattern is considered a strong reversal signal. It reflects a shift in market sentiment, with one side (bulls or bears) overpowering the other. Traders often interpret this pattern as a potential indication of a trend change.

Note –

- It’s essential to consider the context in which the outside bar forms. The significance of the pattern can be enhanced if it occurs near key support or resistance levels, or after a prolonged trend.

- Like other candlestick patterns, traders typically use outside bars in conjunction with other technical analysis tools and indicators to make well-informed trading decisions. Confirmation from other factors, such as volume and trend analysis, is often sought to increase the reliability of the signal.

- Keep in mind that while outside bars can provide valuable insights into potential price reversals, no pattern is foolproof, and risk management is crucial when trading based on candlestick patterns.