Naked Batman Spread

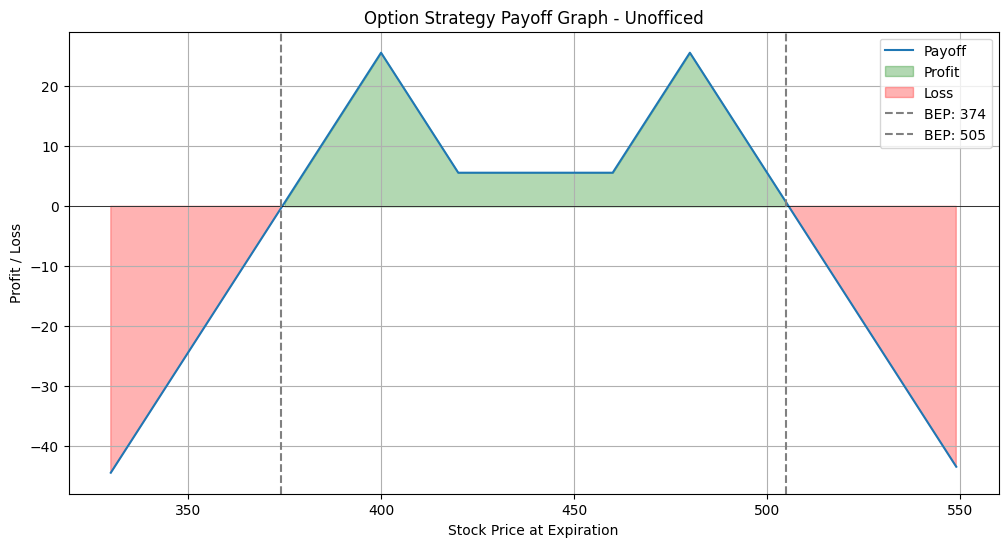

This strategy represents an adaptation of the previously discussed Batman Condor Spread where instead of limited risk, we have unlimited risk and a better reward.

The easiest way to achieve a similar payoff graph to Batman is by omitting the purchases of the farthest out-of-the-money (OTM) call and put options.

However, there’s an alternative method to construct a strategy with a comparable payoff structure:

A Call Ratio Front Spread where you utilize the same strikes for the distant OTM calls + A Put Ratio Front Spread, also employing the same strikes for the distant OTM puts.

This configuration maintains the twin-peak profit structure, similar to what we see in the BatmanCondor Spread, while potentially offering a different risk-reward balance tailored to specific market expectations.

Let’s look at both of the parts separately before we combine them.

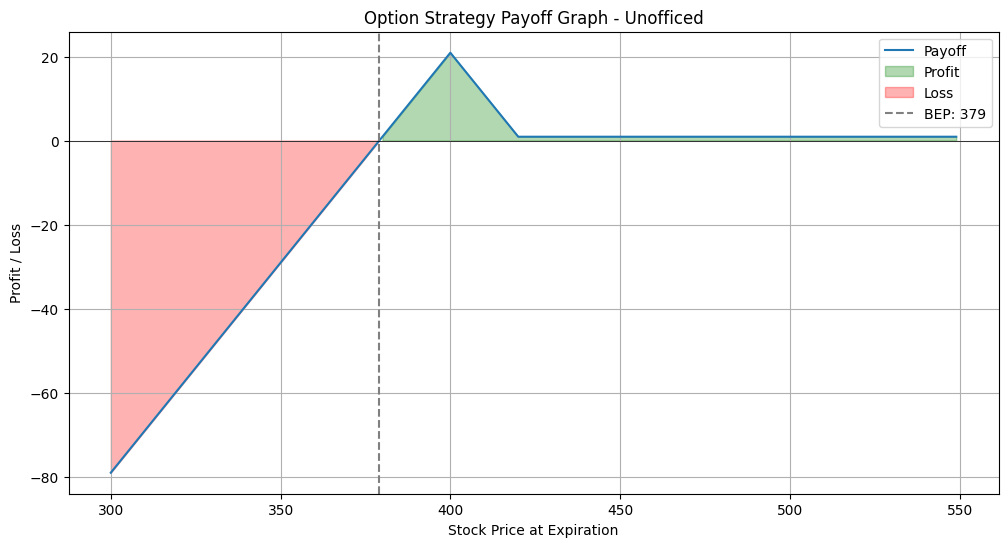

Put Ratio Front Spread with Different Strikes for Distant OTM Puts:

- If both of the sold distant OTM puts are at the same strike, the strategy remains a Puts Ratio Front Spread.

- This approach simplifies the management and understanding of the position, as both sold puts react similarly to changes in the underlying asset’s price.

Example –

- Buy 420PE at 11.9 – 1 Lot

- Short 400PE at 6.4 – 2 Lots

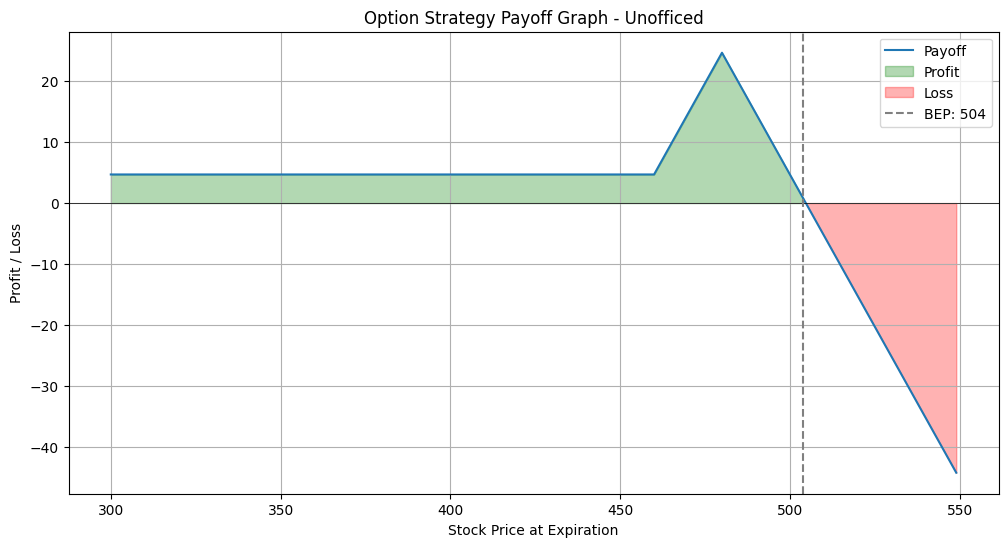

Call Ratio Front Spread with Different Strikes for Distant OTM Calls:

- If both of the sold distant OTM calls are at the same strike, the strategy remains a Call Ratio Front Spread.

- This approach simplifies the management and understanding of the position, as both sold calls react similarly to changes in the underlying asset’s price.

Example –

- Buy 460CE at 16.6 – 1 Lot

- Short 480CE at 10.65 – 2 Lots

Payoff Graphs

The payoff graph for the Put Ratio Front Spread with the Same Strikes for Distant OTM Puts looks like this –

The payoff graph for the Call Ratio Front Spread with the Same Strikes for Distant OTM Calls looks like this –

Now, If we combine them, We get –

This exactly looks like Batman Condor Spread but it has a higher risk (unlimited) but also has a higher reward.