Alligator Spread

An alligator spread in options trading is a colloquial term used to describe a situation where the costs of commissions and fees eat up any potential profits, much like an alligator’s powerful jaws would.

This term is often associated with complex options strategies that involve multiple legs and, subsequently, multiple transaction fees. The alligator spread is not a strategy in itself but rather a cautionary scenario that traders aim to avoid.

Alligator spreads can occur in various options strategies, particularly those involving a combination of four or more options, such as condors, butterflies, and custom spreads. Here’s how they typically arise:

- High Commission Costs: In the era before zero-commission trading, each leg of an options strategy incurred a separate commission cost. With multiple legs, these costs could quickly accumulate.

- Complex Strategy Execution: Strategies that involve buying and selling multiple options contracts increase the complexity of the trade and, consequently, the potential for high fees.

- Bid-Ask Spread: The difference between the bid and ask prices of options can also contribute to the alligator spread. If a trader must execute orders at less favorable prices due to wide bid-ask spreads, the potential for profit diminishes.

With the advent of commission-free trading platforms, the alligator spread has become less of a concern for traders.

However, the principle behind the term remains relevant. Traders must still consider the impact of non-commission fees, such as exercise and assignment fees, regulatory fees, and the bid-ask spread.

It depends on broker

Let’s take a scene where we do multi-legged Iron Condor.

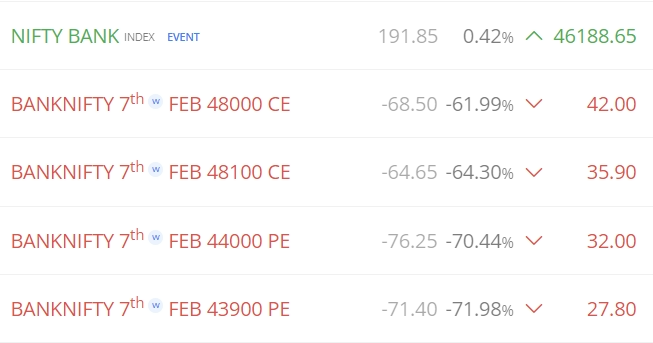

Here is the setup –

- Buy BANK NIFTY 48100CE – 1 lot at 35.90

- Sell BANK NIFTY 48000CE – 1 lot at 42

- Buy BANK NIFTY 43900PE – 1 lot at 27.8

- Sell BANK NIFTY 44000PE – 1 lot at 32

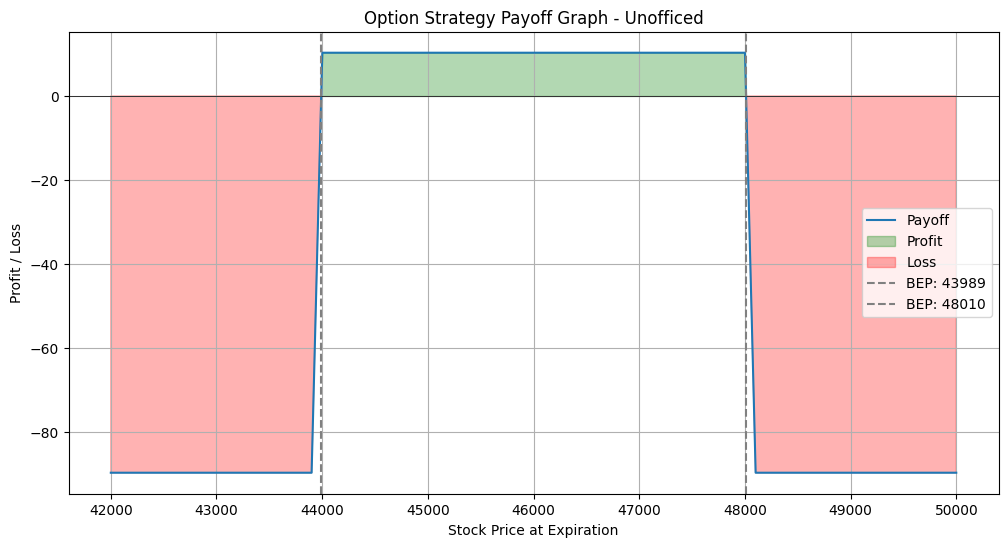

The payoff looks like this –

Now the profit here is around (if it happens) – (-27.8-35.9+42+32) = 10 points. The lot size of BankNIFTY is 15 INR. So, 1 lot of whole setup will be 150 INR.

In a broker like Zerodha or Upstox, where they charge 20 INR per lot, We lose 4*20 = 80 INR straight away as a part of brokerage.

In India, different broker has different brokerage. So, if one choose the traditional plan a full service broker like ICICI, they give higher leverage in margin trading but they charge 100 INR per lot in options. So, It will become 4*100 = 400 INR straight away!

It becomes an alligator spread there.