Long Call Christmas Tree Spread

Typically involves three strike prices.

Structure (1-3-2): The traditional long Christmas Tree spread with calls, often simply called a “call tree,” is structured as follows:

- Buy 1 ATM Call: Purchase one call option with an at-the-money strike.

- Skip the Next Strike: Omit the immediately next higher strike.

- Sell 3 Calls: Then sell three call options with the following higher strike.

- Buy 2 Higher Calls: Finally, buy two more call options with the next higher strike after that. [Objective: These calls are sold to offset the cost of the bought call and to profit from time decay, assuming that the price of the underlying asset won’t reach these higher strike levels by expiration.]

Profit and Loss Dynamics

The Christmas Tree spread strategy is designed to profit from a modest increase in the underlying asset’s price.

- Profit Potential: The maximum profit is realized when the underlying asset closes at the strike price of the middle option at the time of options expiration.

- Maximum Profit Calculation: The maximum profit can be calculated as the difference between the middle strike and the lower strike, minus the net premium paid to establish the spread.

- Maximum Loss: The maximum loss for this strategy is limited to the net debit paid to establish the positions. This occurs when the price movement does not align favorably with the strike prices chosen.

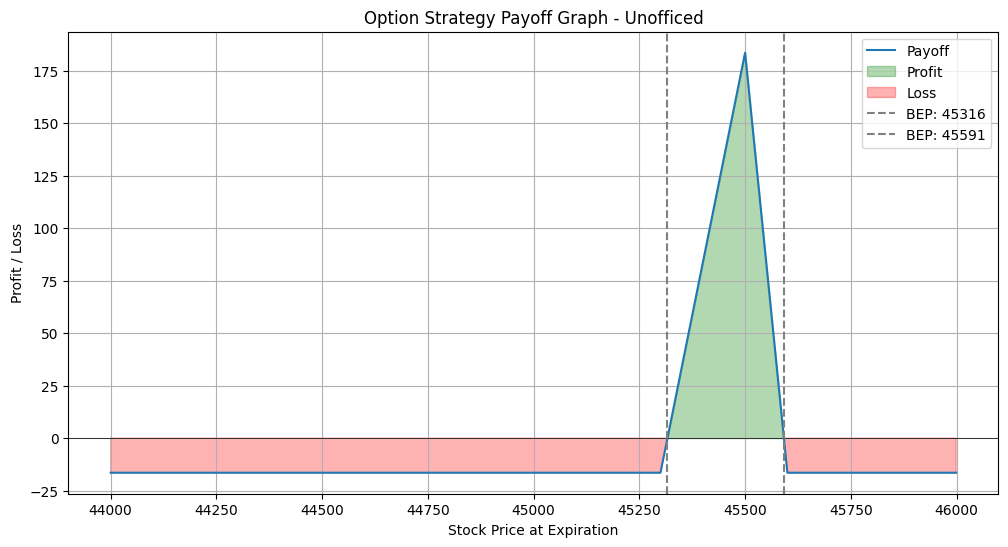

Breakeven Points: There are two breakeven points for the strategy:

- One breakeven point is at the lowest strike price plus the premium paid.

- The other is at the highest strike price minus half the premium.

Role of Time Decay: Time decay, or theta decay, plays a favorable role for the holder of the Christmas Tree spread.

- Ideally, the holder wishes for all options, except for the one at the lowest strike, to expire worthless.

- This is because the value of the sold options (the options with higher strikes) diminishes as expiration approaches, assuming the price of the underlying asset does not exceed these higher strikes significantly.

Live Example

So, Let’s take a real example –

- Buy BANKNIFTY 45300CE at 219 – 1 Lot

- Sell BANKNIFTY 45500CE at 142 – 3 Lots

- Buy BANKNIFTY 45600CE at 111.75 – 2 Lots

This is a long call Christmas Tree spread.

The payoff graph looks like –

Well, it somewhat looks like a Christmas tree. Isn’t it?

Calculating the Net Premium

- Total Premium Paid

= 219 (for 45300CE) + 223.5 (for 45600CE)

= 442.5 - Total Premium Received = 426 (for 45500CE)

- Net Premium

= Total Premium Received – Total Premium Paid

= 426 – 442.5 = -16.5

So, from this calculation, it appears that you pay a net premium of 16.5, which means it’s a debit spread. Although it is extremely rare in some cases, structuring a Christmas Tree spread could result in a net credit, but in this instance, it is a net debit spread

Ideal IV (Implied Volatility) Environment: High

A high implied volatility environment is generally preferred for this strategy. This is because high IV tends to inflate the premium of options, and since the strategy involves selling more options than buying, it benefits from the initial collection of higher premiums.