Short Call Christmas Tree Spread

The Short Call Christmas Tree Spread is an inverted version of the Long Call Christmas Tree Spread, tailored for scenarios where a trader expects a moderate downward movement in the underlying asset’s price.

It also typically involves three strike prices. This strategy is often used in mildly bearish market conditions, where the trader seeks to gain from a decline in the asset’s price but within a controlled and limited range.

Structure (1-3-2):

- Sell 1 ATM Call: Sell one call option with an at-the-money strike.

- Skip the Next Strike: Omit the immediately next higher strike.

- Buy 3 Calls: Then buy three call options with the following higher strike.

- Sell 2 Higher Calls: Finally, sell two more call options with the next higher strike after that.

Live Example

So, Let’s take a real example –

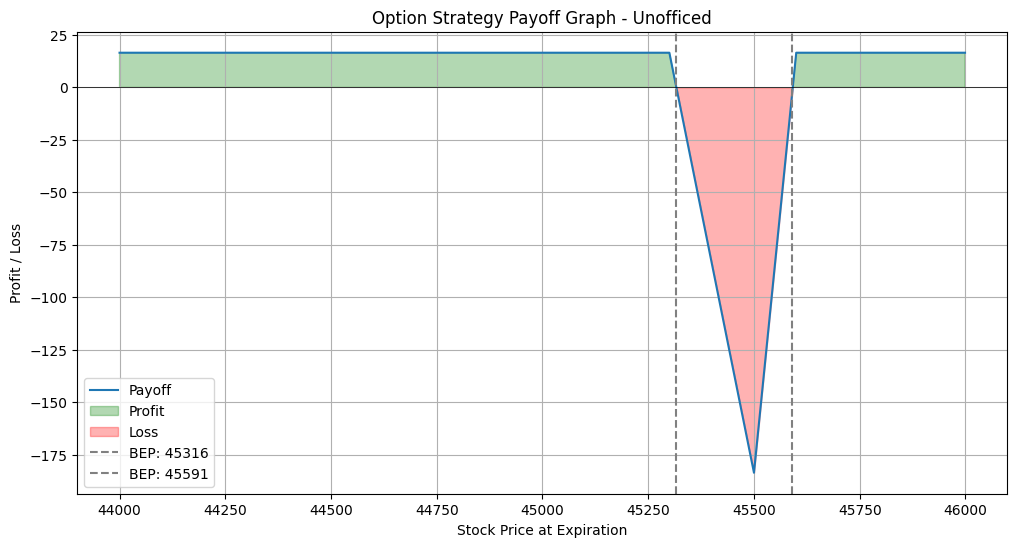

- Sell BANKNIFTY 45300CE at 219 – 1 Lot

- Buy BANKNIFTY 45500CE at 142 – 3 Lots

- Sell BANKNIFTY 45600CE at 111.75 – 2 Lots

This is a short put Christmas Tree spread.

The payoff graph looks like –

It looks like a Christmas Tree but upside down!