Double Iron Condor

The Double Iron Condor strategy is a variation of the standard Iron Condor, involving two separate Iron Condor setups on the same underlying asset.

This strategy can be complex and is typically suited for advanced traders. Let’s break down the two Iron Condor setups you provided and analyze their impact when combined.

Let’s start with an example straight ahead –

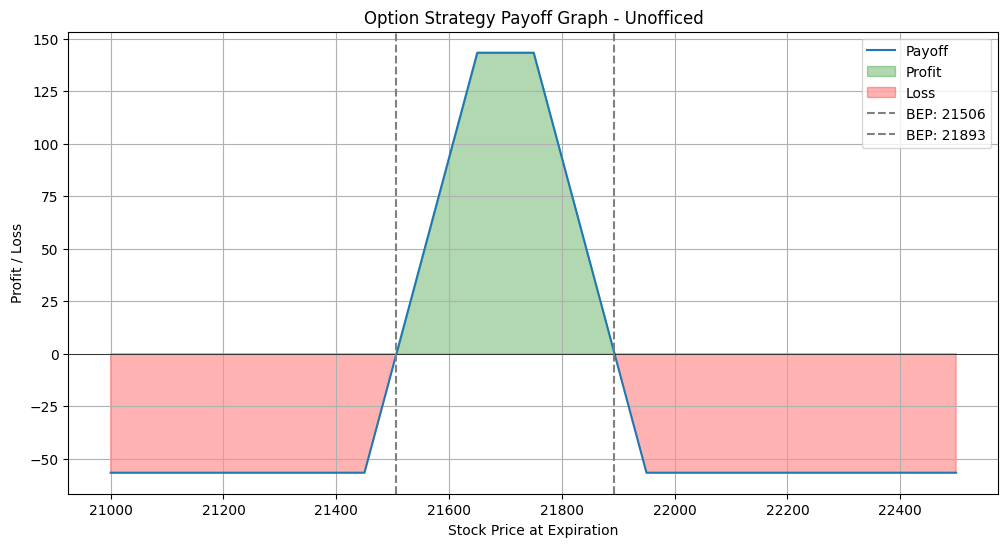

Iron Condor 1

Call Spread:

- Sell 1 call at 21800 strike for 91.9 premium.

- Buy 1 call at 22000 strike for 78 premium.

Put Spread:

- Sell 1 put at 21600 strike for 91.9 premium.

- Buy 1 put at 21400 strike for 46.9 premium.

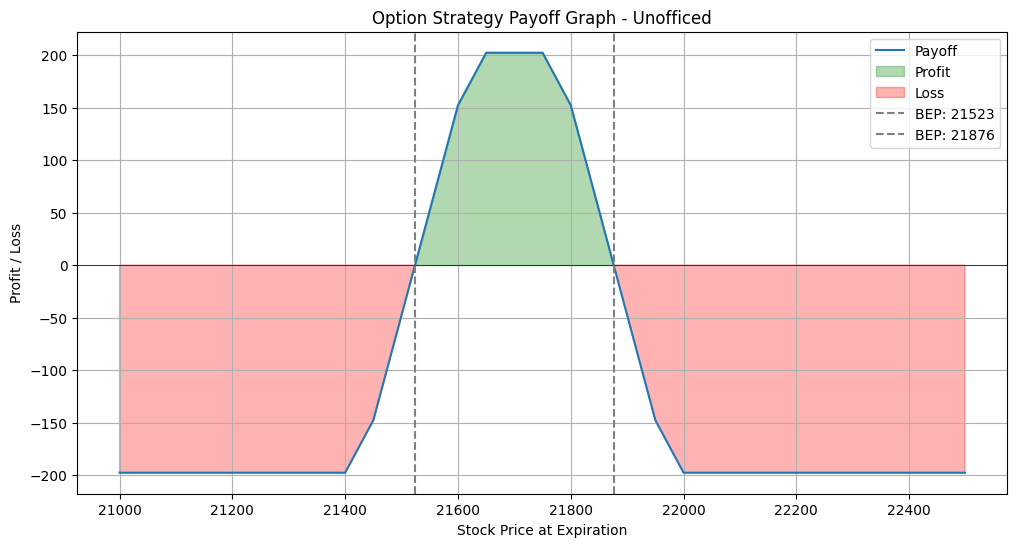

Iron Condor 2

Call Spread:

- Sell 1 call at 21750 strike for 190.05 premium.

- Buy 1 call at 21950 strike for 98.05 premium.

Put Spread:

- Sell 1 put at 21650 strike for 104.35 premium.

- Buy 1 put at 21450 strike for 53.05 premium.

Both of the payoff graphs are plotted in the range of 21000 and 22500.

- Iron Condor has a lower reward and higher risk but the occurrence is uniform i.e. chance of occurrence is higher!

- Iron Condor has a higher reward and lower risk but the occurrence is less uniform than the former.

Now, if we combine the both, We get –

Another iron condor-like shape but the profit and loss graph became more roundy!

Potential Outcomes and Considerations

Increased Range of Profit: The combination of these two Iron Condors increases the range in which the strategy can remain profitable.

Premium Collection: There’s an opportunity to collect more premiums, potentially increasing the profit.

Risk Management: Risk increases as the strategy now involves managing four spreads instead of two.

Market Conditions: Best suited for markets with low to moderate volatility, where drastic price movements are not expected.

Trade Management: Requires diligent monitoring and potential adjustments. The complexity increases with the number of spreads involved.

But again, if we select another iron condor that is far off the option chain, will it become a Batman-like payoff graph?

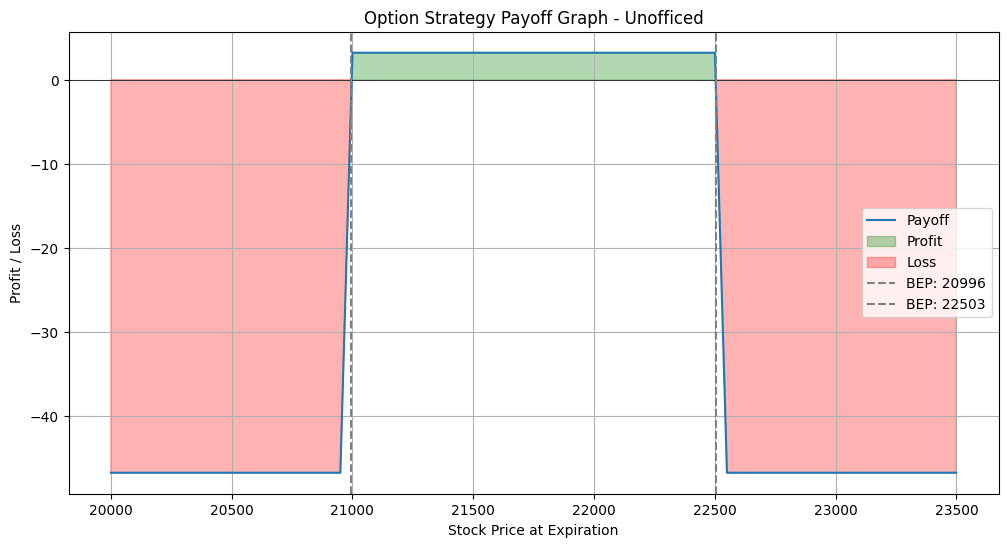

Let’s replace Iron Condor 1 with an iron condor with deep OTM options –

Call Spread:

- Sell 1 call at 22500 strike for 6.35 premium.

- Buy 1 call at 22550 strike for 5.15 premium.

Put Spread:

- Sell 1 put at 21000 strike for 13 premium.

- Buy 1 put at 20950 strike for 11 premium.

Realistically it is an alarming bad trade but we are having a theoretical discussion. As suspected, The payoff graph for this looks pretty weird!

Almost like Van Helsing of Hotel Transylvania movie –

This is also called Iron Albatross Spread. The “Iron Albatross” spread is so named because of the resemblance of its profit and loss (P&L) graph to the wide wingspan of an albatross.

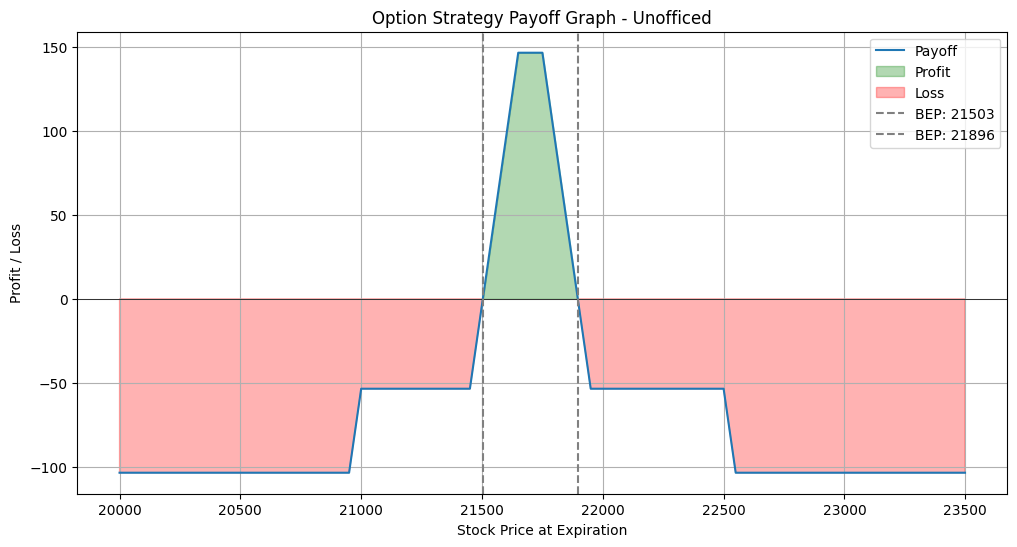

So, Now, if we merge this with our Iron Condor 2 earlier, We get –

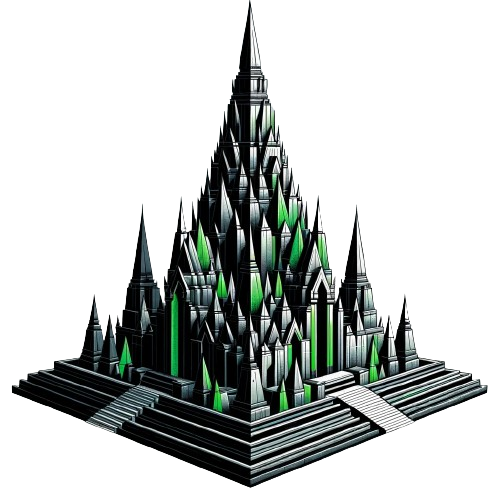

Even though there was an initial expectation of a Batman-like figure with tabletop ears rather than pointy ones, we ultimately ended up with a payoff graph resembling the Konark Sun Temple.

Note –

The Iron Condor strategy is a short strangle with a stop loss on both ends. It means we can not make any combination that will generate a payoff graph like our favorite Batman.

- Iron Condor = Short Strangle (Near OTM) + Long Strangle (Far OTM)

- Double Iron Condor = Double Strangle (Near OTM) + Double Long Strangle (Far OTM)

Similarly, Double Iron Butterfly = Double Straddle (Near OTM) + Double Long Strangle (Far OTM)

We have already established,

- Risk (Double Short Straddle) > Risk ( Double Short Strangle)

- POP (Double Short Straddle) > POP ( Double Short Strangle)

So, We can conclude –

- Risk (Double Iron Butterfly) > Risk ( Double Iron Condor)

- POP (Double Iron Butterfly) > POP ( Double Iron Condor)