Bullish Condor Spread

The Bullish Condor Spread is an options trading strategy designed for a moderately bullish market outlook.

This strategy aims to capitalize on a slight increase in the price of the underlying asset. It involves a combination of buying and selling call options at different strike prices.

Setup of the Bullish Condor Spread

- Buy Lower Strike Call:

- Action: Purchase a call option that is either at-the-money (ATM) or slightly out-of-the-money (OTM).

- Rationale: This call option gains value if the underlying asset’s price increases, establishing the base of the bullish outlook.

- Sell Lower Middle Strike Call:

- Action: Sell a call option with a strike price slightly higher than the bought call.

- Rationale: Helps offset the cost of the bought call and starts to cap the profit potential on the upside.

- Sell Higher Middle Strike Call:

- Action: Sell another call option with a strike price higher than the first sold call.

- Rationale: Further offsets the cost and extends the upper bound of the profit range.

- Buy Higher Strike Call:

- Action: Purchase a call option with a strike price higher than both sold calls.

- Rationale: This limits the risk on the upside by capping potential losses if the underlying asset’s price increases significantly beyond expectations.

Live Example:

- Buy BANKNIFTY 45800CE at 61.95 – 1 Lot

- Sell BANKNIFTY 46300CE at 11.5 – 1 Lot

- Sell BANKNIFTY 46800CE at 4.15 – 1 Lot

- Buy BANKNIFTY 47300CE at 2.45 – 1 Lot

The strikes are all equidistant from each other as it is a condor spread.

It is a call spread as it is entirely made with call options.

Ideal Implied Volatility Environment: High IV

The strategy tends to be more effective in a high implied volatility environment, as this can increase the premiums of the sold options, enhancing potential profits.

Profit and Loss Dynamics

- Maximum Profit: The distance between the strikes of the sold calls (500 points, i.e., 46800 – 46300) plus the net credit received from setting up the spread.

- Net Credit: Calculated as the premiums of sold calls minus the premiums of bought calls (11.5 + 4.15 – 61.95 – 2.45) =-48.75. So, there is a debit of 48.75

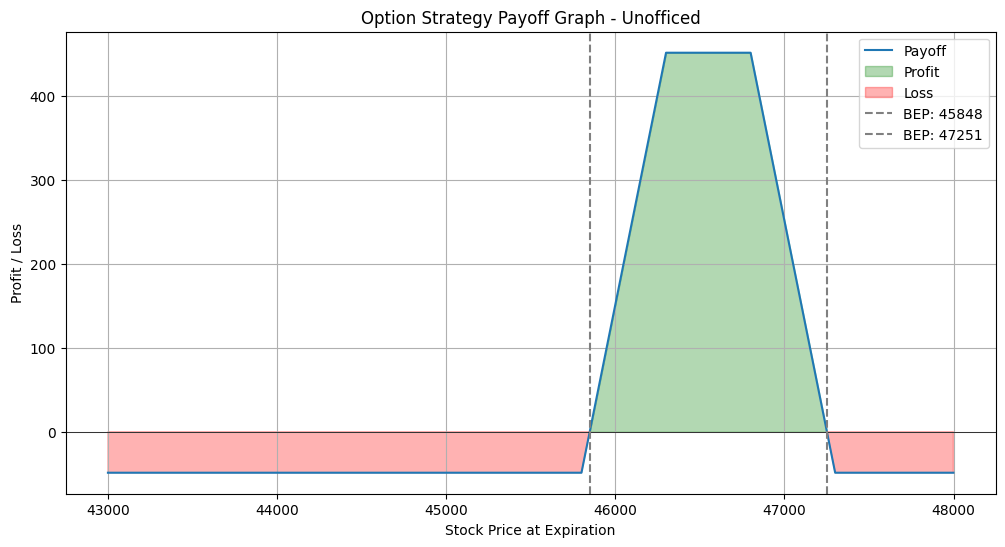

Breakeven Points

- Upper Breakeven: Strike price of the higher sold call (46800) plus the net credit. 46800 – 48.75 = 46751.25.

- Lower Breakeven: Strike price of the lower bought call (45800) minus the net credit. 45800 + 48.75 = 45848.75.

Here is the payoff graph –

The trader would reach the maximum profit potential if the price of the underlying asset is near the middle and strikes at expiration.

The strategy yields a profit if the price at expiration is between the two breakeven points (45848.75 and 46751.25).

The Bullish Condor Spread is a strategy designed for a moderate bullish market outlook, offering a balanced risk-reward profile.

It is essential for the trader to closely monitor the market movements and manage the positions, especially as the expiration date approaches, to optimize the outcome of the spread.

Bullish Condor for Upward Movement:

- If the market is nearing the upper breakeven point of your current strategy and you anticipate an upward movement, consider deploying a Bullish Condor.

- The Bullish Condor can capitalize on this upward movement, particularly around the breakeven area, where it tends to offer higher profit potential.

Bullish Condor and Short Condor:

- A short spread, also known as a credit spread, involves receiving a net premium when initiating the trade.

- A long spread, in options trading, refers to a position where the trader has paid a net premium to enter the trade.

So, if there is a net credit, We can call it Short Condor. But, in this example, we paid a premium, So, it is a Long Condor.

A Bullish Condor can also be a Short Condor, depending on the specific construction of the options spread. This might sound contradictory at first since the terms “bullish” and “short” typically imply different market outlooks. However, in the context of complex options strategies like condor spreads, the distinction can sometimes blur and it becomes a case-to-case basis.