Diagonal Calendar Spread

The Diagonal Calendar Spread is a nuanced options strategy that intricately weaves together the principles of time decay and directional betting, employing a combination of Long Put Calendar Spreads and Long Call Calendar Spreads.

Setup:

- Long Put Calendar Spread

- Long Call Calendar Spread with different strike price

At its core, the Diagonal Calendar Spread merges the Long Put Calendar Spread with the Long Call Calendar Spread. This involves buying a longer-dated call and put option while simultaneously selling a shorter-dated call and put option, each with different strike prices.

The result is a position that benefits from the passage of time and a specific directional movement in the underlying asset.

Here is an example with BankNIFTY –

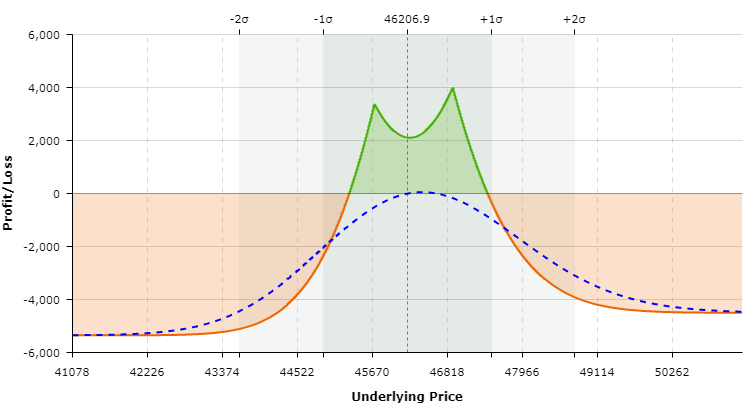

Right now BankNIFTY is trading at 46206.9 (spot) and 46465 (futures).

Long Put Calendar Spread Example:

- Sell BankNIFTY 8th Feb 45700PE at 230.35

- Buy BankNIFTY 14th Feb 45700PE at 375.05

Long Call Calendar Spread Example:

- Sell BankNIFTY 8th Feb 46900CE at 200

- Buy BankNIFTY 14th Feb 46900CE at 384.2

Horizontal Spreads or Time Spreads or Calendar Spreads: This strategy involves buying and selling options with different expiration dates but the same strike price.

Diagonal Spreads: Different in both strike prices and expiration dates.

So, How can we have “Digaonal Calendar Spread?”

To construct a “Diagonal Calendar Spread,” one can merge the strategies of a Long Put Calendar Spread with a Long Call Calendar Spread.

This amalgamation can be exemplified using BankNIFTY options as follows:

Long Put Calendar Spread + Long Call Calendar Spread

= Sell BankNIFTY 8th Feb 45700PE + Buy BankNIFTY 14th Feb 45700PE + Sell BankNIFTY 8th Feb 46900CE + Buy BankNIFTY 14th Feb 46900CE

Now, if we re-arrange,

Long Put Calendar Spread + Long Call Calendar Spread

= Sell BankNIFTY 8th Feb 45700PE + Buy BankNIFTY 14th Feb 46900CE

+ Buy BankNIFTY 14th Feb 45700PE + Sell BankNIFTY 8th Feb 46900CE

= Diagonal Spread 1 + Diagonal Spread 2

The integration of calendar spreads with different strikes evolves into two separate diagonal spreads, aptly named Diagonal Spread 1 and Diagonal Spread 2.

Diagonal Spread 1:

- Sell BankNIFTY 8th Feb 45700PE.

- Buy BankNIFTY 14th Feb 46900CE.

Diagonal Spread 2:

- Buy BankNIFTY 14th Feb 45700PE.

- Sell BankNIFTY 8th Feb 46900CE.

So, We can see the calendar spreads with different strikes can be rewritten as two different diagonal spread. So, its called Diagonal Calendar Spread.

Anyways, So, combining both of them, it will end up like –

- Sell BankNIFTY 8th Feb 45700PE at 230.35

- Buy BankNIFTY 14th Feb 45700PE at 375.05

- Sell BankNIFTY 8th Feb 46900CE at 200

- Buy BankNIFTY 14th Feb 46900CE at 384.2

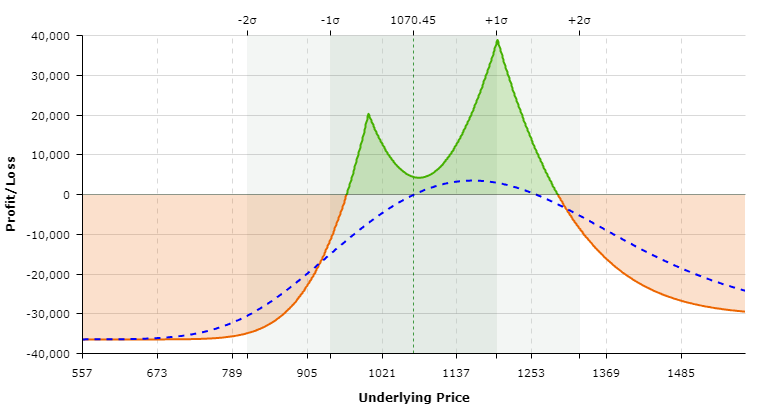

The payoff graph will look like –

This is similar looking payoff that we have seen while doing Double Diagonal Spreads but this is even more balanced than those approaches.

Support And Resistance Based Trades

Here is a chart of Auropharma that shows support and resistance on roughly at 1000 and 1200 levels. So, our primary bet will be – Auropharma will continue to move within its support and resistance right?

So, Let’s deploy –

- Long put calendar spread at 1000.

- Sell 29FEB2024 1000PE at ₹ 23.5

- Buy 28MAR2024 1000PE at ₹ 34.6

- Long call calendar spread at 1200.

- Sell 29FEB2024 1200CE at ₹ 15.1

- Buy 28MAR2024 1200CE at ₹ 34.7

The payoff graph comes like –