Box Spread

A box spread is strategically employed when the price of the combined spreads is below their intrinsic value at expiration. Conversely, if the market has priced these spreads too high, a trader might utilize a short box, which involves entering opposite positions compared to the long box.

This strategy is aptly named for the structural analogy it draws from the shape of a box, as it comprises two vertical spreads: a bull call spread and a bear put spread.

The strategy involves creating a synthetic long and a synthetic short position on the same asset to lock in a risk-free profit.

The Structure of a Box Spread

A box spread consists of four different options contracts, which form the sides of the “box”:

- Buy a Call (Lower Strike):

- Action: Purchase an in-the-money call option.

- Purpose: This represents one side of the box, establishing a synthetic long position at the lower strike price.

- Sell a Put (Lower Strike):

- Action: Sell an in-the-money put option at the same strike price as the call bought.

- Purpose: This completes the synthetic long position and is the second side of the box.

- Sell a Call (Higher Strike):

- Action: Sell an out-of-the-money call option at a higher strike price.

- Purpose: This initiates the synthetic short position and forms the third side of the box.

- Buy a Put (Higher Strike):

- Action: Purchase an out-of-the-money put option at the same strike price as the call sold.

- Purpose: This completes the synthetic short position, finalizing the four sides of the box.

Ideal Conditions for a Box Spread

- Pricing Inefficiencies: The Box Spread is most effective in a market with pricing inefficiencies between options premiums and their intrinsic values.

- Low Transaction Costs: Because the profit from a box spread is often small, low transaction costs are crucial to ensure the strategy remains profitable.

Profit and Loss Dynamics

- Risk-Free Arbitrage: In theory, the box spread is intended to produce a risk-free profit if the price discrepancy exists.

- Maximum Profit: The fixed profit from a box spread is determined at the outset and is the difference between the two strike prices minus the net cost of establishing the spread.

- Maximum Loss: Because this is an arbitrage strategy, there shouldn’t be a loss if the box spread is executed correctly and the options are priced fairly. However, transaction costs and mispricing can lead to losses.

Breakeven Points

A box spread isn’t about reaching a breakeven at expiration like most options strategies; it’s about locking in a guaranteed return right from the start.

Execution and Risks

- Interest Rates: The risk-free rate of return is a factor in the pricing of options used in a box spread, so changes in interest rates can affect the profitability of the strategy.

- Dividends: If the underlying asset pays dividends, it can affect option prices and the profitability of the box spread.

- Liquidity: Execution risk can occur if there isn’t enough liquidity in the market, potentially leading to slippage and affecting the expected profit.

Key Insights on Box Spreads

- Strategic Combination: A box spread is constructed by integrating a bull call spread with a corresponding bear put spread.

- Predictable Outcome: The payoff from a box spread is predetermined and is equivalent to the difference between the strike prices of the options involved.

- Time Value and Pricing: The market value of a box spread today is inversely related to the time remaining until expiration—the longer the time frame, the lower the current market price.

- Implementation Costs: The expenses incurred, especially brokerage commissions, can significantly impact the overall profitability of a box spread.

- Synthetic Financial Instrument: Traders may also utilize box spreads for cash management objectives, as they can serve as a synthetic means of borrowing or lending funds.

The Box Spread is a sophisticated strategy that can be used to lock in profits through arbitrage opportunities in options pricing. While it is theoretically a risk-free strategy, practical considerations such as transaction costs, liquidity, and the timely execution of trades can introduce risks.

Box Spread Example

NIFTY Bank is trading at 46150.

- Buy the ITMs

- Buy 46200PE at 490 (ITM)

- Buy 46100CE at 514.05 (ITM)

- Sell the OTMs

- Sell 46200CE at 468.8 (OTM)

- Sell 46100PE at 422.9 (OTM)

The total cost of the trade before commissions is calculated as follows:

Total cost

= (Debit for buying 46200PE) + (Debit for buying 46100CE) – (Credit for selling 46200CE) – (Credit for selling 46100PE)

= 490 + 514.05 – 468.8 – 422.9

= 1004.05 – 891.7

= 112.35 points

The lot size is 15. So, the total cost is 112.35 * 15 = 1685.25 INR.

The spread between the strike prices remains 100. Given the lot size of 15, the value of the box spread before commissions is:

Box spread value = 100 * 15

Box spread value = 1500 INR

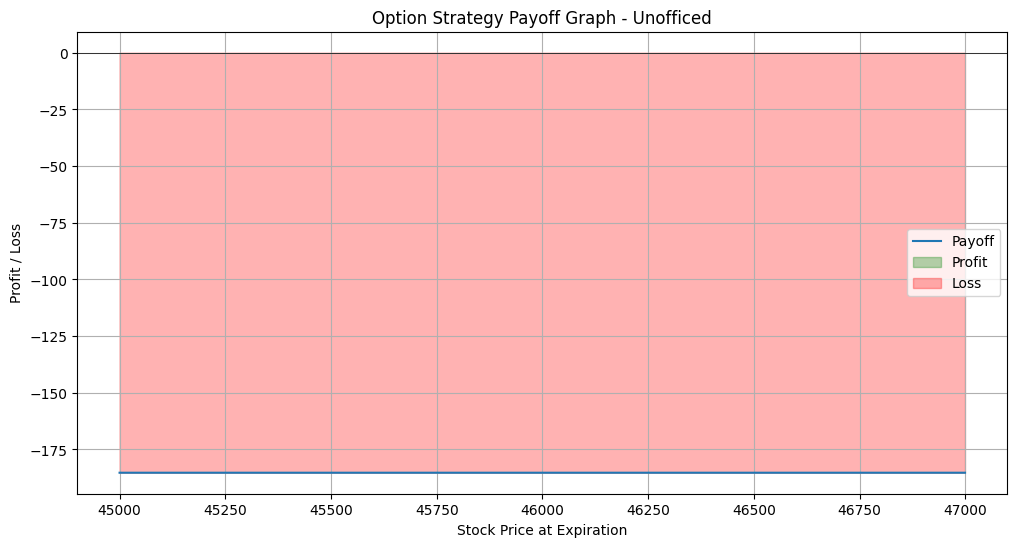

P/L

= Intrinsic Value of the Spread-Total Setup Cost

= 1500 INR – 1685.25 INR

= – 185.25 INR

This loss of 185.25 INR represents the guaranteed shortfall from the box spread strategy before any commissions are applied.

It means sure shot loss. The payoff graph looks like –

Since the total cost to set up the box spread exceeds the maximum possible return from the spread itself, the strategy ensures a locked-in loss under these conditions.