Double Short Christmas Tree Spread

Similarly Let’s explore the case, where we combine a Short Call Christmas Spread with a Short Put Christmas Spread.

Let’s understand with an example –

Short Call Christmas Tree Spread

- Sell BANKNIFTY 45300CE at 219 – 1 Lot

- Buy BANKNIFTY 45500CE at 142 – 3 Lots

- Sell BANKNIFTY 45600CE at 111.75 – 2 Lots

Short Put Christmas Tree Spread

- Sell BANKNIFTY 45300PE at 252 – 1 Lot

- Buy BANKNIFTY 45100PE at 162.2 – 3 Lots

- Sell BANKNIFTY 45000PE at 127.9 – 2 Lots

Combining them –

- Sell BANKNIFTY 45300CE + Sell BANKNIFTY 45300PE- 1 Lot

- Buy BANKNIFTY 45500CE + Buy BANKNIFTY 45100PE- 3 Lots

- Sell BANKNIFTY 45000PE + Sell BANKNIFTY 45600CE- 2 Lots

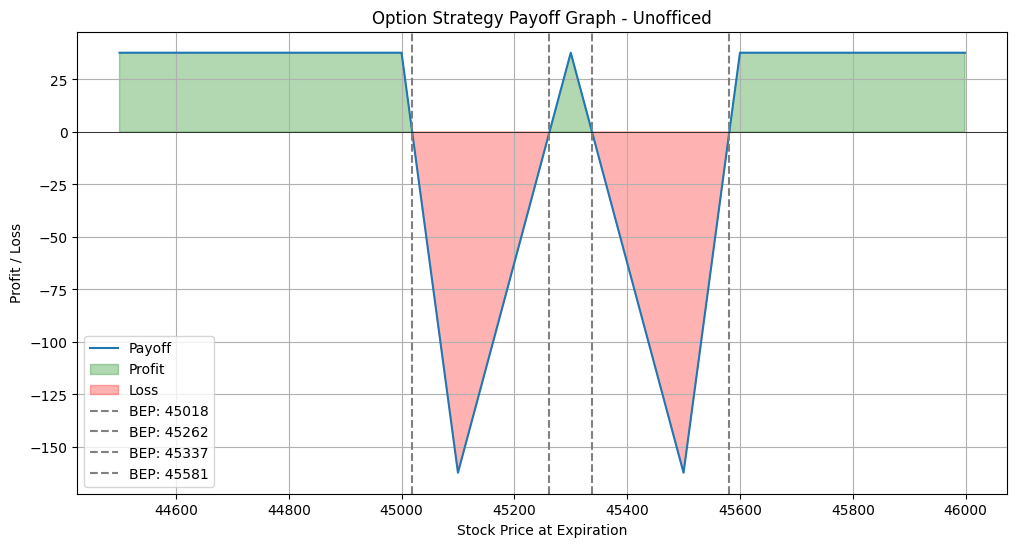

Similarly, The graph will exhibit a complex shape with several peaks and troughs due to the asymmetric and layered structure of both the put and call spreads.

Well, it looks like the Wayne Enterprises Logo.