Short Call Diagonal Spread + Short Put Diagonal Spread

This combination involves selling a short-term ITM or ATM call and put, while simultaneously buying a longer-term OTM call and put.

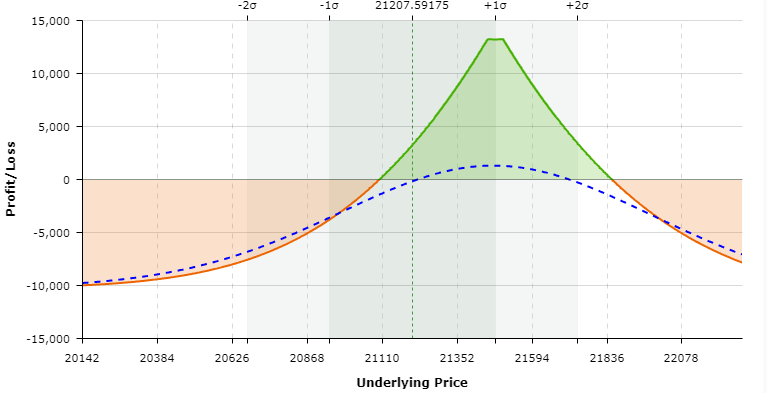

Payoff Structure:

This strategy typically benefits from time decay (theta) and is best suited for a neutral market outlook where significant movement in the underlying asset is not expected.

- The profit potential is generally limited to the premiums received from the short options, minus the cost of the long options.

- The risk is more significant if the underlying asset moves significantly in either direction, potentially leading to losses on one or both of the short positions.

Market Outlook: Neutral.

Right now, NIFTY’s LTP is 21530.55.

Short Call Diagonal Spread Example:

- Sell NIFTY 1st Feb 21500CE at 199.35

- Buy NIFTY 8TH Feb 21700CE at 199.95

Short Put Diagonal Spread Example:

- Sell NIFTY 1st Feb 21450PE at 109.55

- Buy NIFTY 8TH Feb 21300PE at 151.1

So, combining both of them, it will end up like –

- Sell NIFTY 1st Feb 21500CE at 199.35

- Buy NIFTY 8TH Feb 21700CE at 199.95

- Sell NIFTY 1st Feb 21450PE at 109.55

- Buy NIFTY 8TH Feb 21300PE at 151.1

The payoff graph will look like –