Crocodile Option Spread

Let’s dig deep with detailed another example here –

Now, numerous variations can result in asymmetry.

In our example, we’ve selected strike prices that are equidistant from one another. The strikes at 21250, 21300, 21350, 21400, and 21450 are all separated by intervals of 50 points.

However, altering this setup leads to asymmetric results, or in other words, we might get imperfect Batmans!

| Buy 50 qty 21350PE at 130Sell 100 qty 21300PE at 112 | Buy 50 qty 21350CE at 230Sell 100 qty 21400CE at 197Buy 50 qty 21450CE at 169 |

Let’s replace 21250PE with 21100PE.

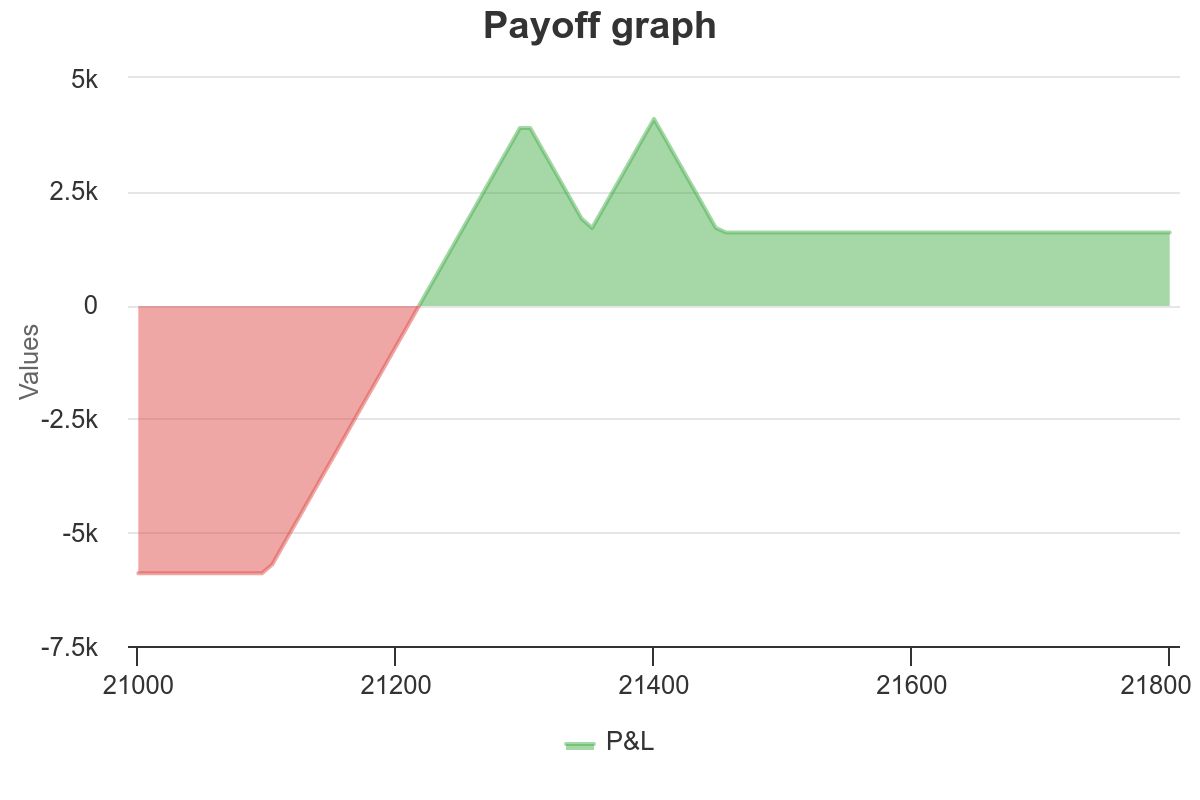

The payoff graph will look like –

It does not look like Batman at all. It looks like a crocodile.

A few years ago, when I jokingly coined the term “Batman Spread,” it was quite well-received. Now, let’s see how the “Crocodile Spread” fares as the next “secret” holy grail among YouTubers and Twitter lords.

In summary,

- Not all Batman Spreads are Double Long Butterfly. There are other ways to attain the same payoff that looks like a bat. (Like Double Long Call Christmas Tree).

- Not every Double Long Butterfly qualifies as a Batman Spread. There are numerous variations in the payoff graph.

The perks of knowing deep details You can name your strategy and market it around like a philosopher’s stone.