Inverse Strangle

The Inverse Strangle, a variation of the traditional strangle strategy in options trading, is a complex yet intriguing approach. It’s particularly useful for experienced traders who are navigating volatile markets.

An Inverse Strangle involves selling in-the-money (ITM) call and put options on the same underlying asset with the same expiration date.

Directional Assumption: Neutral

Setup:

The call strike is set higher than the put strike, reversing the setup seen in a regular strangle.

- Sell/Buy ITM Call

- Sell/Buy ITM Put

Ideal Implied Volatility Environment: High

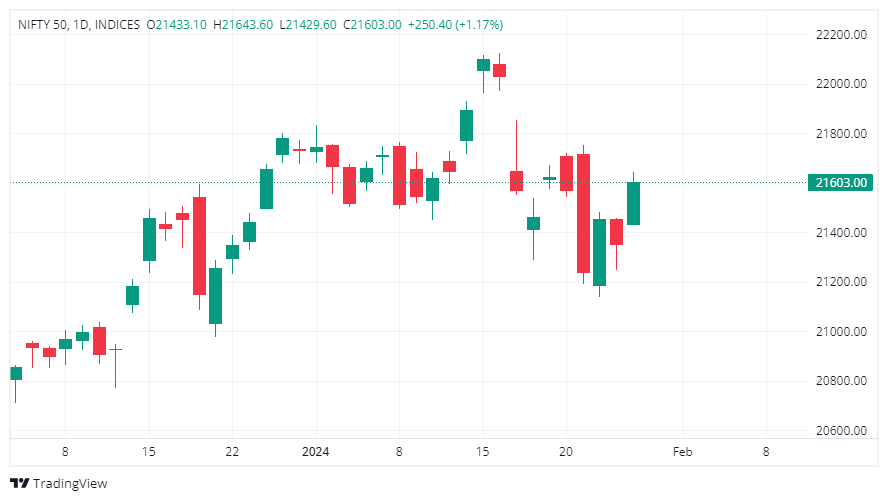

NIFTY is trading at 21600.

Let’s assume we are about to sell at a short strangle at equidistant strikes from this level. So, in that case,

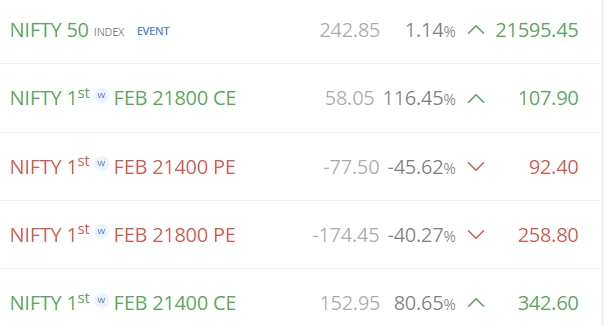

- Sell NIFTY 21800 Call Option (CE) at 107

- Sell NIFTY 21600 Put Option (PE) at 92

The expiration date for both of the options are same.

The Payoff comes as usual.

But, What if we do the reverse? So,

- Sell NIFTY 21800 Put Option (PE) at 258

- Sell NIFTY 21600 Call Option (CE) at 342

Calculation of Breakevens

Short Strangle Breakeven Calculation

To calculate the break-even points (BEP) for a short strangle options strategy, we use the following formulas:

- Lower BEP: Strike Price of Short Put – Net Premium Received

- Upper BEP: Strike Price of Short Call + Net Premium Received

Let’s calculate the BEPs for the Short Strangle –

- Sell NIFTY 21800 Call Option (CE) at 107

- Sell NIFTY 21600 Put Option (PE) at 92

Lower BEP: Strike Price of Short Put – Net Premium Received

- Strike Price of Short Put (PE): 21,600

- Net Premium Received: Premium of Call (107) + Premium of Put (92) = 199

- Lower BEP: 21,600 – 199 = 21,401

Upper BEP: Strike Price of Short Call + Net Premium Received

- Strike Price of Short Call (CE): 21,800

- Net Premium Received: 199 (as calculated above)

- Upper BEP: 21,800 + 199 = 21,999

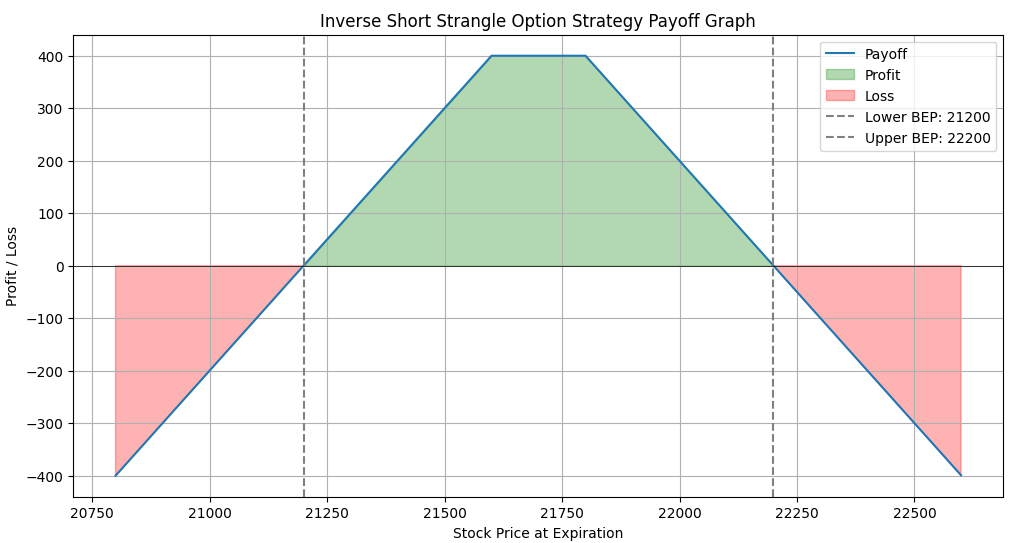

Inverse Short Strangle Breakeven Calculation

In an inverse (or reverse) strangle, the calculation for the break-even points is slightly different.

Let’s recalculate for Scenario 2, assuming it’s an inverse strangle:

Lower BEP: Strike Price of Short Call – Net Premium Received

- Strike Price of Short Call (PE): 21,800

- Net Premium Received: Premium of Call (258) + Premium of Put (342) = 600

- Lower BEP: 21,800 – 600 = 21,200

Upper BEP: Strike Price of Short Put + Net Premium Received

- Strike Price of Short Put (CE): 21,600

- Net Premium Received: 600 (as calculated above)

- Upper BEP: 21,600 + 600 = 22,200

The payoff will be similar to a normal short strangle –

Pros of Inverse Strangle Compared to Short Strangle

1. Enhanced Credit Collection: The Inverse Strangle strategy often allows for the collection of additional premium compared to a Short Strangle. This is because selling in-the-money (ITM) options typically generate more credit than out-of-the-money (OTM) options.

- In the given example, the sale of an inverse short strangle yielded an impressive premium of 600, in stark contrast to the 199 premium obtained from a standard short strangle.

- This represents a tripling in premium earnings.

2. Better Delta Neutralization: The Inverse Strangle can be more effective in neutralizing delta, thereby reducing directional risk. This is particularly beneficial in markets where the underlying asset exhibits significant volatility.

- The breakeven points for the Inverse Short Strangle offer a range of 1000 points, specifically between 22200 and 21200.

- On the other hand, the breakeven points in a Normal Short Strangle show a narrower range of 600 points, situated between 21999 and 21401.

- A wider breakeven range often implies a greater tolerance for price movement in the underlying asset before the position becomes unprofitable. It also means a greater range where the delta stays neutral.

3. Adjusting Existing Positions: The Inverse Strangle is often used as an adjustment technique for existing Short Strangle positions that are being tested. This adjustment can help in managing trades that have moved against the trader’s original expectations.

4. Potential for Managing Risk: In certain scenarios, the Inverse Strangle can provide better risk management compared to a Short Strangle, especially in volatile market conditions.

Cons of Inverse Strangle Compared to Short Strangle

1. Increased Complexity: The Inverse Strangle is generally more complex to manage than a Short Strangle. It requires a deeper understanding of options strategies and market behavior. And, often, they are illiquid!

2. Higher Margin Requirements: Since the Inverse Strangle involves selling ITM options, it usually has higher margin requirements compared to a Short Strangle, which could tie up more trading capital.

3. Greater Risk with Market Reversal:

- If the market reverses direction, the Inverse Strangle can be more risky than a Short Strangle. In short, it becomes harder to manage!

- This is because ITM options have higher intrinsic value, which could lead to larger losses if the market moves unfavorably.

4. More Active Management Needed: This strategy often requires more active management, especially as expiration approaches. Failure to manage the position actively can lead to significant losses or assignments.

5. Limited Suitability for Certain Traders: The Inverse Strangle may not be suitable for all types of traders, particularly those with a short-term focus or limited experience in options trading.

The Inverse Strangle is a nuanced strategy that offers both opportunities and challenges. It’s best suited for traders who have a deep understanding of options strategies and are capable of managing the complexities involved.

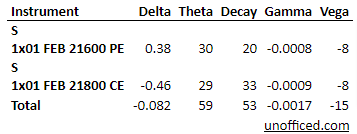

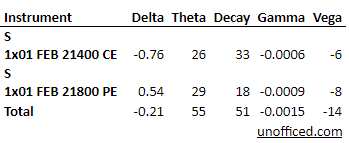

Comparative Analysis of Greeks of Inverse Strangle

The Greeks in the above-discussed setup of Normal Short Strangle look like

The Greeks in the above-discussed setup of Inverse Short Strangle look like

Delta Comparison:

The Inverse Short Strangle shows a stronger negative delta, indicating a higher bearish sentiment compared to the Normal Short Strangle. This suggests that the Inverse Strangle is more sensitive to downward movements in the underlying asset.

But it is too small and negligible in this case.

Theta (Time Decay) Comparison:

Both strategies benefit from time decay, but the Normal Short Strangle has a slightly higher theta, indicating a stronger time decay advantage.

Gamma Comparison:

The Inverse Short Strangle has a slightly higher gamma, suggesting it’s more sensitive to price movements of the underlying asset.

- A higher gamma can mean more risk as the option gets closer to expiration, particularly if the underlying asset is volatile.

Vega (Volatility) Comparison:

Both strategies have a negative vega, meaning they both lose value as volatility increases.

- However, the vega is slightly higher (more negative) in the Normal Short Strangle, indicating it might be more sensitive to increases in volatility.

Risk and Reward Balance:

The Inverse Short Strangle generally represents a higher risk and potentially higher reward strategy, especially given its stronger delta and gamma.

Probability of Profit

When you receive a premium from option strategies, the Probability of Profit (POP) tends to be higher if your breakeven points are further apart. This principle applies to both the Normal Short Strangle and the Inverse Short Strangle strategies, as both generate premium.

The Inverse Short Strangle generally has a higher breakeven point.

This leads to a higher Probability of Profit (POP) compared to the Normal Short Strangle.

When calculated using standard deviation methods:

- The Inverse Short Strangle shows a POP of approximately 57%.

- The Normal Short Strangle has a lower POP, around 47%.

The higher breakeven point in the Inverse Short Strangle suggests a better chance of profitability.

The Normal Short Strangle might be considered more conservative with its slightly more favorable theta and vega for situations where less volatility is expected. In summary, the choice between these two strategies should be based on the trader’s expectations of market movement, volatility, and risk tolerance.

This difference in POP is also a crucial factor to consider when choosing between these strategies. The Inverse Short Strangle, with its higher breakeven point, may offer a better probability of profit under certain market conditions, particularly when a significant premium is collected.