Reverse Box Spread

In this scenario, where a straightforward box spread results in a locked-in loss, traders might consider deploying a reverse box spread.

A reverse box spread involves reversing the roles of the options:

- Sell an In-the-Money (ITM) Call: Instead of buying an ITM call, you would sell an ITM call option.

- Buy an Out-of-the-Money (OTM) Call: Instead of selling an OTM call, you purchase an OTM call option.

- Sell an In-the-Money (ITM) Put: Instead of buying an ITM put, you sell an ITM put option.

- Buy an Out-of-the-Money (OTM) Put: Instead of selling an OTM put, you buy an OTM put option.

So, it will become

- Sell the ITMs

- Sell 46200PE at 490 (ITM)

- Sell 46100CE at 514.05 (ITM)

- Buy the OTMs

- Buy 46200CE at 468.8 (OTM)

- Buy 46100PE at 422.9 (OTM)

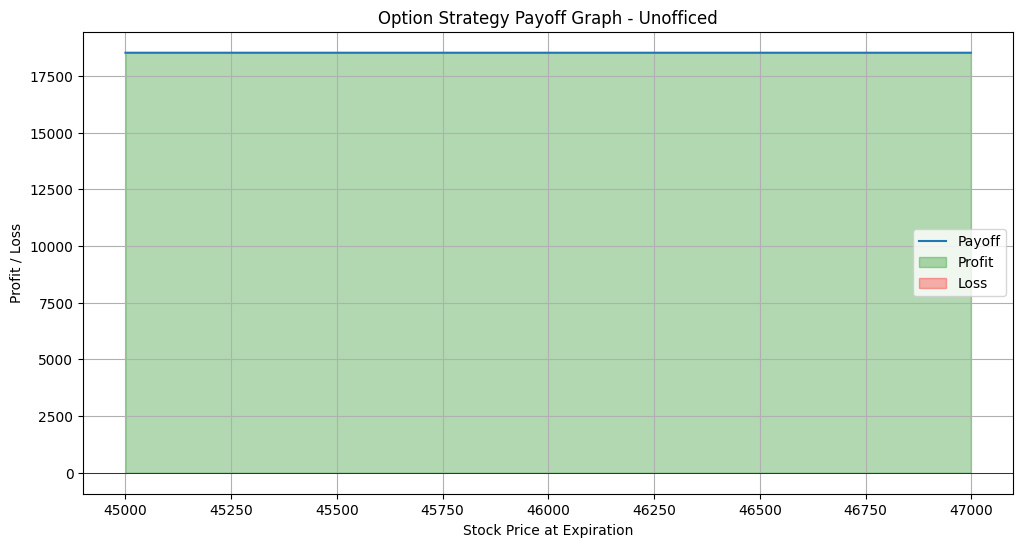

The payoff graph becomes green instantly.

Total cost

= (Debit for buying 46200PE) + (Debit for buying 46100CE) – (Credit for selling 46200CE) – (Credit for selling 46100PE)

= (-490) + (-514.05) – (-468.8) – (-422.9) = -1004.05 + 891.7 = -112.35

Box spread value = -100 * 15 = -1500 INR

P/L

= Intrinsic Value of the Spread – Total Setup Cost

= -1500 INR – (-1685.25 INR)

= -1500 INR + 1685.25 INR = 185.25 INR

The amount og 185.25 INR for 1 lot looks like extremely bad but when it is deployed over 100 lots, it will become 18525.

So, it is a good strategy for deploying if the margin is staying free till the expiration. Also, To effectively identify profitable opportunities for both box and reverse box spreads, traders can design and deploy quantitative scanners. We can scan the market in real time, analyzing the premiums of various options across different strikes and expirations.

Strategy Recommendations

- Preference for European Options: To mitigate the risk of early exercise and assignment, traders are advised to consider short box spreads on indices or other securities that utilize European-style options, which are not subject to early exercise.

- Cautionary Measures: Traders should exercise caution, conduct thorough risk assessments, and consider the specific characteristics of the options and the market environment before engaging in box spread strategies.

While box spreads can offer strategic advantages for arbitrage and cash management, the presence of hidden risks such as interest rate sensitivity, early exercise and assignment, brokerage malpractices, and the potential for significant losses due to market movements necessitates a cautious and informed approach.

Understanding these risks is essential for traders to navigate and mitigate potential pitfalls effectively.