Inverse Iron Albatross Spread

The Inverse Iron Albatross Spread is a sophisticated options strategy, representing an inverted version of the Iron Albatross.

This strategy still uses four options – two calls and two puts – but the arrangement of strikes and whether they are bought or sold is the exact opposite of the standard Iron Albatross.

Characteristics and Structure

Inverted Structure:

Unlike the Iron Albatross, which involves selling OTM options and buying further OTM options, the Inverse Iron Albatross does the opposite.

Components:

- Buy OTM Call: Purchase a call option with a strike price above the current price of the underlying asset.

- Sell Further OTM Call: Sell a call option with a strike price higher than the bought call.

- Buy OTM Put: Purchase a put option with a strike price below the current price of the underlying asset.

Live Example:

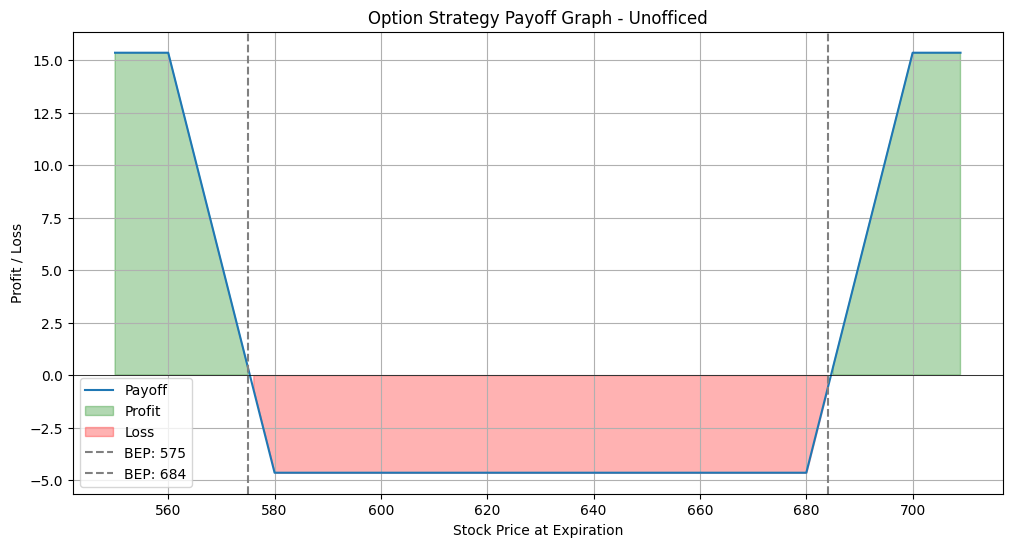

Let’s take this massive range in SBI and construct an Inverse Iron Albatross Spread.

- Buy 660CE at 10.1

- Sell 680CE at 6.05

- Buy 580PE at 4.95

- Sell 560PE at 2.6

This is exactly the opposite of Iron Albatross Spread. The payoff graph also looks exactly the opposite –

Key Characteristics

- Potential for Significant Profit in Extreme Movements: Contrary to the standard Iron Albatross, the Inverse Iron Albatross benefits from significant market movements either upwards or downwards, as the bought OTM options can gain substantial value.

- Risk Profile: While the sold further OTM options limit the total risk, the main risk in this strategy arises when the market remains stagnant or doesn’t move enough to surpass the costs of the bought options.

- Market Outlook: Suitable for markets where moderate to significant movements are anticipated in either direction.

Hedging Against Market Events

The Inverse Iron Albatross Spread serves as a strategic hedge, particularly useful in situations where a portfolio has significant exposure to directional risk.

Mitigating Event-Driven Volatility:

- Fundamental events often trigger substantial market movements. The Inverse Iron Albatross, with its structure of buying OTM options and selling further OTM options, is designed to capitalize on these large swings.

- By strategically placing this spread around the current market price, it can provide substantial gains if the market moves sharply in response to an event.

- The Inverse Iron Albatross offers a safeguard against this risk by benefiting from significant price movements in either direction.

This strategy also provides a buffer during times when a directional strategy might be at risk due to unexpected market reactions to news or events.

Complementing the Options Wheel Strategy

Balancing the Wheel:

The options wheel strategy typically involves selling options to collect premiums, which can lead to the accumulation of positions in the underlying asset. While profitable in trending markets, this strategy can be risky if the market stagnates or reverses direction.

Implementing an Inverse Iron Albatross in conjunction with the options wheel can help mitigate this risk.

- If the market breaks down or moves contrary to the wheel’s positions, the Inverse Iron Albatross can provide profits to offset potential losses.

- The combination of the options wheel and the Inverse Iron Albatross introduces strategic diversity to a trader’s arsenal, allowing for a more holistic approach to market conditions.

This diversification is particularly beneficial in markets that are prone to sudden changes in direction or that are not exhibiting a strong trend.

The Inverse Iron Albatross Spread is a versatile hedging tool that can be particularly effective in protecting against large, unexpected market movements, especially during key economic or corporate events.

When used in combination with strategies like the options wheel, it provides a balanced approach, guarding against one-sided market risks and enhancing the resilience of an investment strategy.