Double Long Butterfly Spread

The Double Long Butterfly Spread is an advanced options trading strategy that combines a Long Put Butterfly Spread and a Long Call Butterfly Spread.

This strategy is designed to capitalize on a stock or index trading in a narrow range. It’s particularly effective in a market with low volatility where significant price movements are not expected.

In the previous chapter, we discussed that a variation of Double Long Butterfly makes a Batman Spread.

But Why?

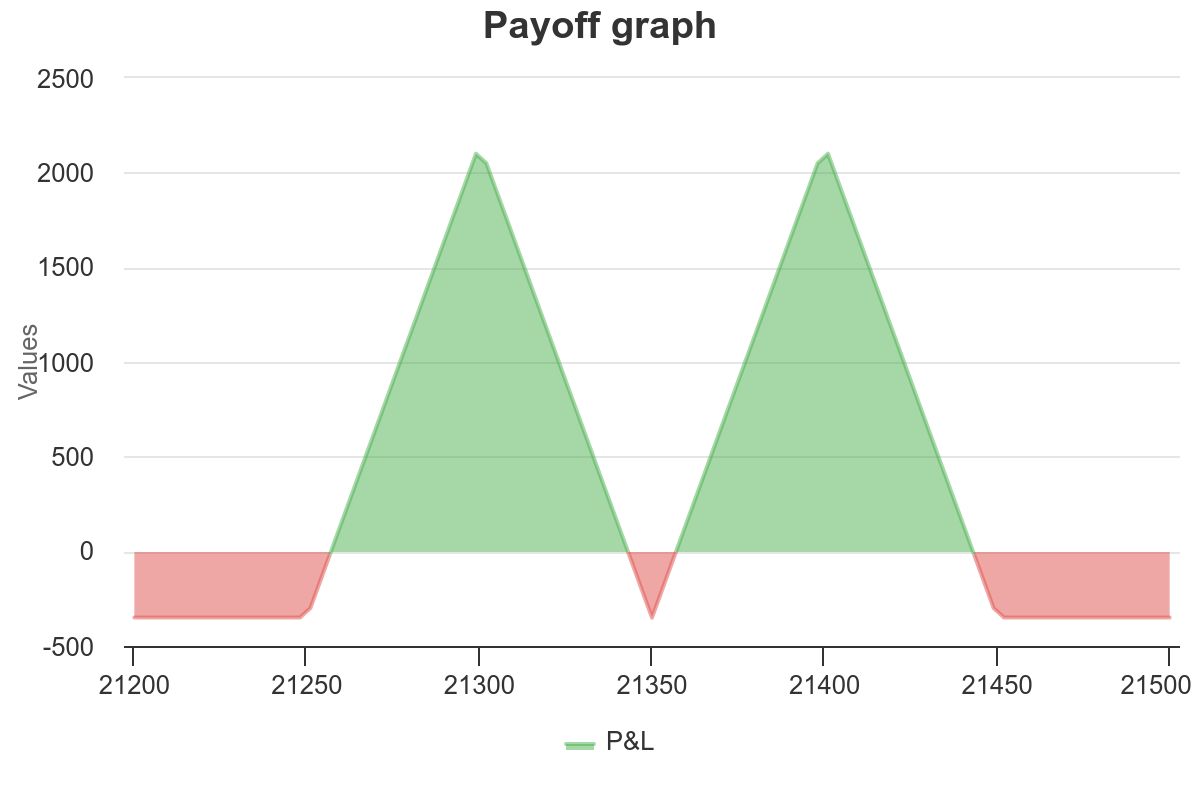

As We have seen and discussed earlier, the payoff of Batman Options Spread looks like this –

Well, it looks like a bat!

Combining the Spreads

- When combining these two spreads, all options must have the same expiration date.

- To attain Batman spread, The strike prices of the ATM options in both the put and call spreads are usually the same, aligning the peak profit points of both strategies.

- If it is the same, then there will not be two peaks.

Anyways, The term Double Long Butterfly means it is made with two Butterflies. One is Call Butterfly and another is Put Butterfly.

Advantages of the Double Long Butterfly Spread

- Wider Profit Range: By combining both put and call butterflies, the Double Long Butterfly Spread typically has a wider profit range compared to a single butterfly spread.

- Limited Risk: The maximum risk is limited to the net premium paid to establish the spreads.

- Flexibility: This strategy allows for adjustments based on changing market conditions or expectations.

Disadvantages

- Complexity: Managing four different strike prices with multiple legs increases the complexity of trade management.

- Costs: Involves higher transaction costs due to the number of contracts traded.

- Limited Profit Potential: While risk is limited, the profit potential is also capped.

We need to revisit our concept of Long Butterfly Spread.

Long Butterfly Spread:

Directional Assumption: Neutral

Setup: This spread is typically created using a ratio of 1-2-1 (1 ITM option, 2 ATM/near ATM options, 1 OTM option).

- Buy Call/Put (above short strike)

- Sell 2 Calls/Puts

- Buy Call/Put (below short strike)

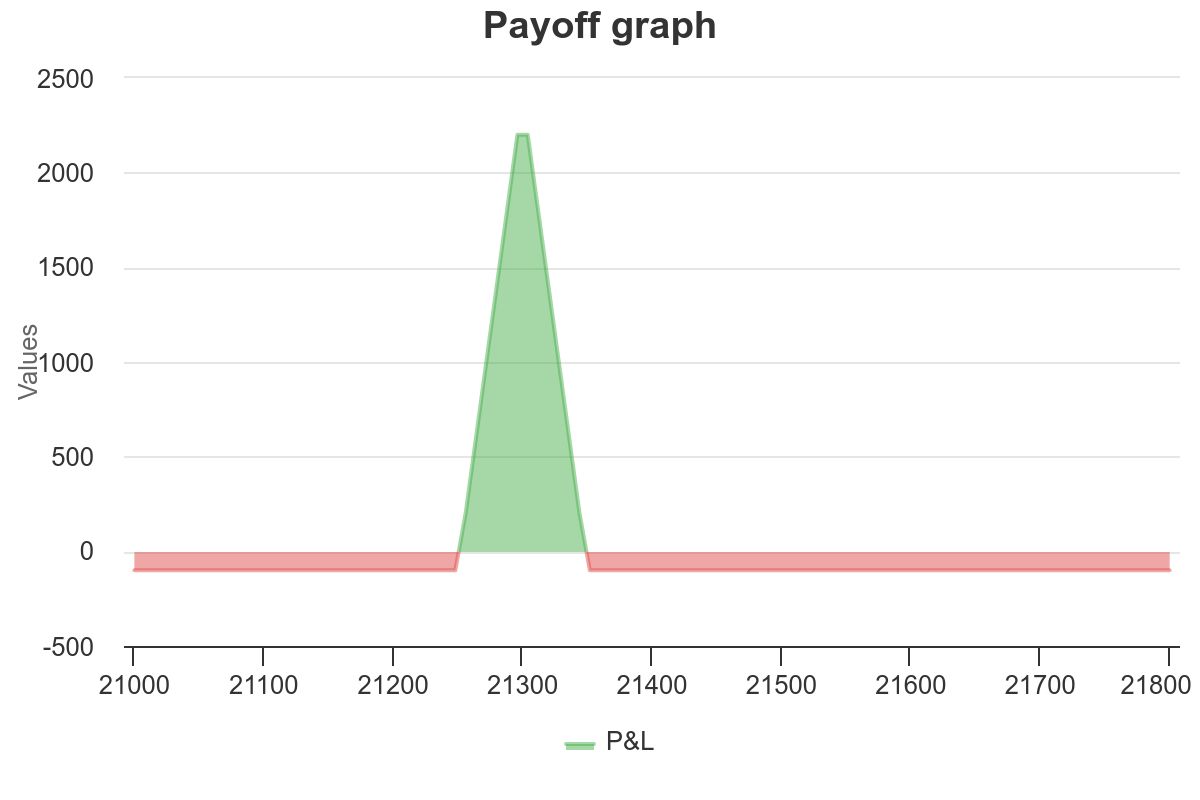

Long Put Butterfly Setup Example:

- Buy 50 qty 21350PE at 130

- Sell 100 qty 21300PE at 112

- Buy 50 qty 21250PE at 96

Here is the payoff graph –

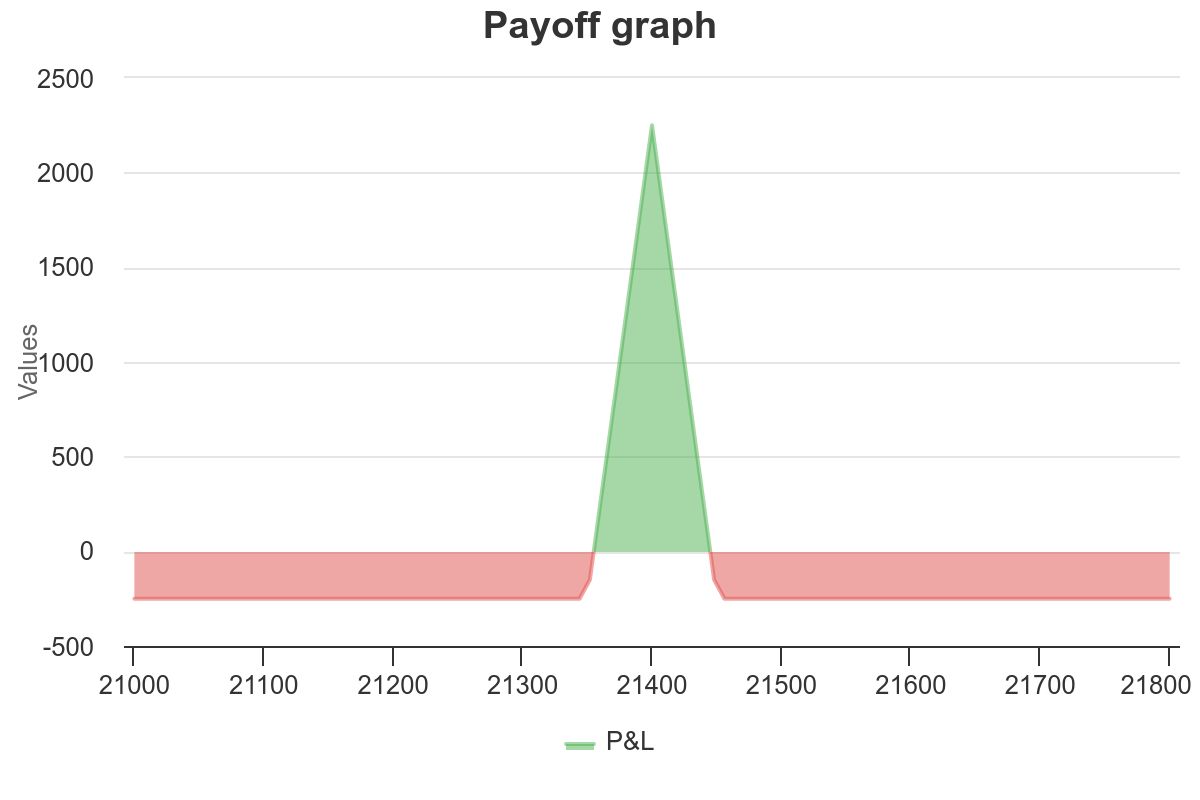

Let’s do the same with the CE Options in the Batman Spread discussed earlier, We get Long Call Butterfly –

Long Call Butterfly Setup Example:

- Buy 50 qty 21350CE at 230

- Sell 100 qty 21400CE at 197

- Buy 50 qty 21450CE at 169

Here is the payoff graph –

Now, When We combine these spreads, We get the payoff graph which looks like our Batman Spread.

| Long Put ButterflyBuy 50 qty 21350PE at 130Sell 100 qty 21300PE at 112Buy 50 qty 21250PE at 96 | Long Call ButterflyBuy 50 qty 21350CE at 230Sell 100 qty 21400CE at 197Buy 50 qty 21450CE at 169 |

But, Why Batman is called a variation of the Double Long Butterfly?

To discuss that, We need to talk about the selection of strike prices in a Double Long Butterfly.

A Double Long Butterfly strategy can only be a Batman Spread only if the strike prices are equidistant.