Long Call Diagonal Spread + Long Put Diagonal Spread

Here, you are buying a longer-term ITM call and put, while selling a shorter-term OTM call and put.

Payoff Structure:

This strategy can benefit from significant movements in either direction of the underlying asset.

- It’s less sensitive to time decay compared to the short diagonal spreads, as the long positions dominate the strategy.

- The maximum profit is not capped and can be substantial if the underlying asset moves significantly. However, the maximum loss is limited to the net debit paid to establish the spreads.

Market Outlook: Moderately Directional i.e. Either Bullish or bearish, expecting significant but moderate movement in either direction.

Right now, NIFTY’s LTP is 21530.55.

Long Put Diagonal Spread Example:

- Buy NIFTY 8TH Feb 21400PE at 187

- Sell NIFTY 1st Feb 21200PE at 121.55

Long Call Diagonal Spread Example:

- Buy NIFTY 8TH Feb 21500CE at 296.25

- Sell NIFTY 1st Feb 21700CE at 77.6

So, combining both of them, it will end up like –

- Buy NIFTY 8TH Feb 21400PE at 187

- Sell NIFTY 1st Feb 21200PE at 121.55

- Buy NIFTY 8TH Feb 21500CE at 296.25

- Sell NIFTY 1st Feb 21700CE at 77.6

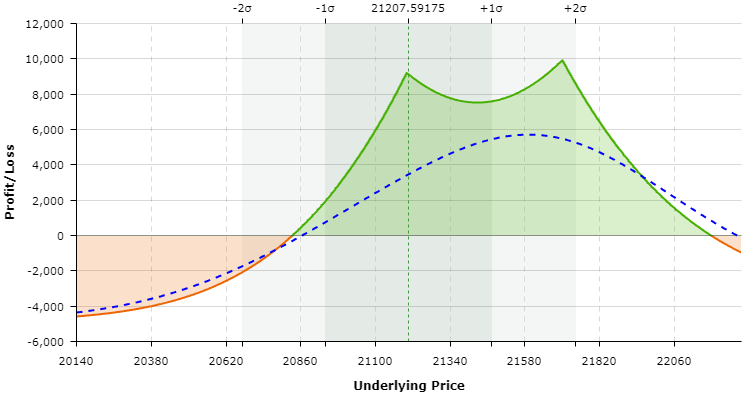

The payoff graph will look like –

This can be called as Time Batman Spread anyways.

Each of these examples aligns with the respective strategy’s typical setup.

The long strategies involve buying a longer-term option and selling a shorter-term option, while the short strategies involve selling a shorter-term option and buying a longer-term option, with appropriate adjustments to the strike prices.

- Due to varying implied volatility (IV) across different expiration dates, there are occasionally opportunities for arbitrage to capitalize on anomalies.

- The market offers a vast array of option spreads, but the key factor is the rationale behind constructing a particular spread for the first time.

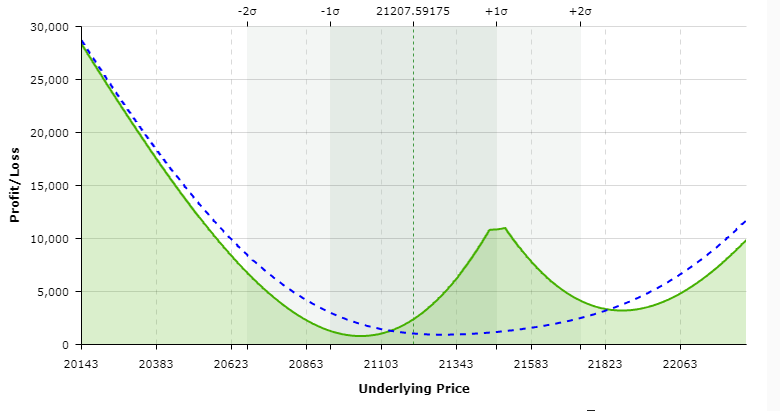

Here is a payoff graph that shows us arbitrage! You can create unlimited variations of dynamic options spread.

To replicate this, You need to do –

- Buy NIFTY 8th Feb 21400PE at ₹ 187.

- Sell NIFTY 1st Feb 21500CE at ₹ 199.35.

- Buy NIFTY 8th Feb 21500CE at ₹ 296.25.

- Sell NIFTY 1st Feb 21450PE at ₹ 109.55.

- Buy NIFTY 8th Feb 21300PE at ₹ 151.1.

It will show, a margin of 45K, and It will make 1K without doing anything and the options are fairly liquid.