Double Long Christmas Tree Spread

Well, What happens if you combine Long Call Christmas Spread with Long Put Christmas Spread?

Let’s understand with an example –

Long Call Christmas Tree Spread

- Buy BANKNIFTY 45300CE at 219 – 1 Lot

- Sell BANKNIFTY 45500CE at 142 – 3 Lots

- Buy BANKNIFTY 45600CE at 111.75 – 2 Lots

Long Put Christmas Tree Spread

- Buy BANKNIFTY 45300PE at 252 – 1 Lot

- Sell BANKNIFTY 45100PE at 162.2 – 3 Lots

- Buy BANKNIFTY 45000PE at 127.9 – 2 Lots

Combining them –

- Buy BANKNIFTY 45300CE + Buy BANKNIFTY 45300PE- 1 Lot

- Sell BANKNIFTY 45500CE + Sell BANKNIFTY 45100PE- 3 Lots

- Buy BANKNIFTY 45000PE + Buy BANKNIFTY 45600CE- 2 Lots

So, if we write them in our old known popular spreads –

- Buy BANKNIFTY 45300 Straddle – 1 Lot

- Sell BANKNIFTY 45500-45100 Strangle- 3 Lots

- Buy BANKNIFTY 45000-45600 Strangle – 2 Lots

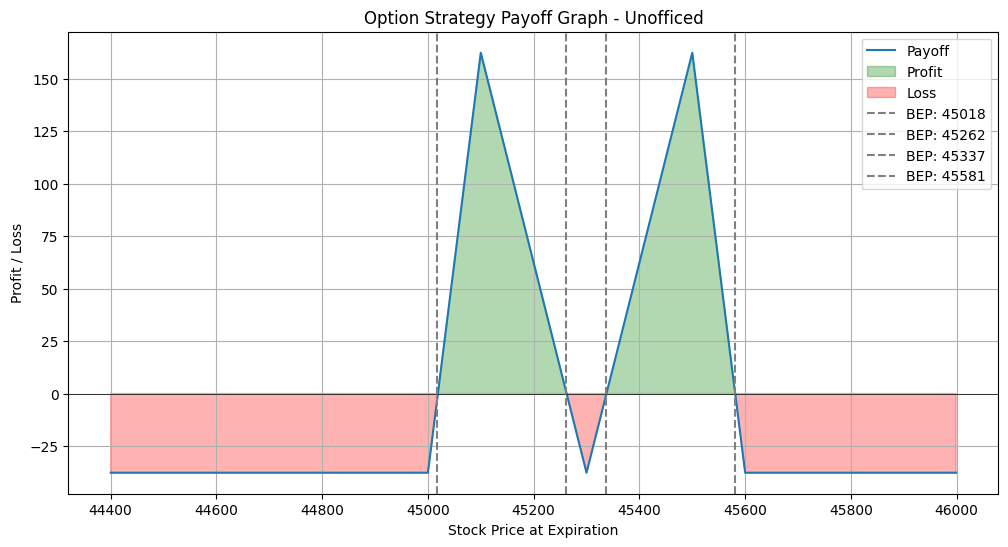

The graph will likely have multiple peaks and valleys due to the asymmetric structure of both the call and put Christmas Tree spreads.

Call Spread Contribution: The call spread part of the strategy will have a maximum profit if BANKNIFTY expires close to 45500, with profit potential tapering off if the index moves significantly above 45600 or below 45300.

Put Spread Contribution: The put spread part will similarly have a maximum profit if BANKNIFTY expires close to 45100, with the profit decreasing as the index moves significantly below 45000 or above 45300.

Does it look familiar?

Any guess on the payoff graph? It will look like –

The payoff structure resembles Batman again!

The Batman Spread keeps coming in as an outcome of multiple ratio spreads. But the ranges are smaller but higher here!