Hidden Risks in Box Spread Strategies

“If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.” -Jack Bogle

Box spreads, often employed for cash management and arbitrage opportunities tied to interest rate differentials, carry certain hidden risks despite their perception as low-risk strategies. Understanding these risks is crucial for any trader considering box spreads as part of their investment strategy.

Fluctuations in Interest Rates:

- Like fixed-income investments, box spreads are sensitive to interest rate movements.

- An adverse shift in rates can result in unexpected losses, similar to those experienced with other rate-sensitive securities.

In the Indian market, increased implied volatility (IV) can dynamically raise exposure margins, leading to potential debit balances. Should this occur, brokers may close random legs of the spread, significantly escalating the strategy’s risk.

American Style Options:

Possess the risk of being exercised before expiration, introducing potential complications for short positions in a box spread.

Risk of Assignment:

- There’s a chance a short option, particularly if it becomes deep in-the-money, could be assigned early.

- While owning corresponding deep in-the-money calls and puts theoretically mitigates this risk, significant price movements in the underlying asset can lead to assignment scenarios.

Broker Practices and Malpractices

Brokerage-Driven Early Closures:

Some brokers, including noted instances in the Indian market such as Alice Blue etc, have engaged in the malpractice of prematurely closing trades before expiration labeling it as RMS Policy. This practice is motivated by generating brokerage fees, as settlements do not incur brokerage.

It’s a critical risk factor to consider, as it can unexpectedly alter the risk-reward profile of the strategy.

The Famous Robinhood Incident:

The saga of 1R0NYMAN and the notorious box spread trade that captivated the Reddit community earlier this month serves as a stark reminder of the perils of seemingly “riskless” arbitrage strategies in the options market.

Here is a link to the reddit thread –

Here is a detailed explanation of his trade –

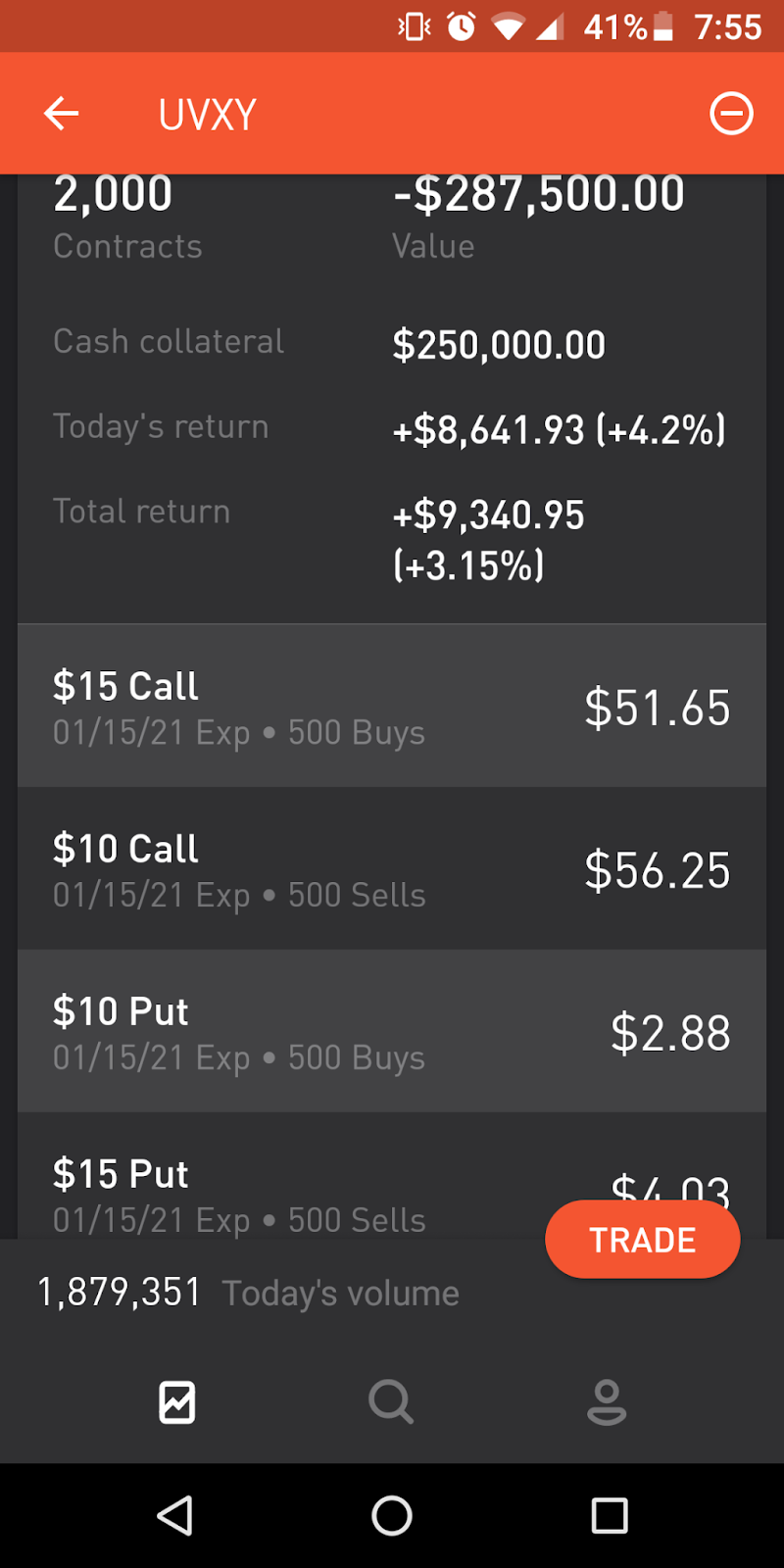

ProShares Ultra VIX Short Term Futures ETF is known with the ticker of UVXP. The trade he took was –

- $15 Call bought at 51.65

- $10 Call sold at 56.25

- $10 Put bought at 2.8

- $15 Put sold at 4.03

He did on 500 qty.

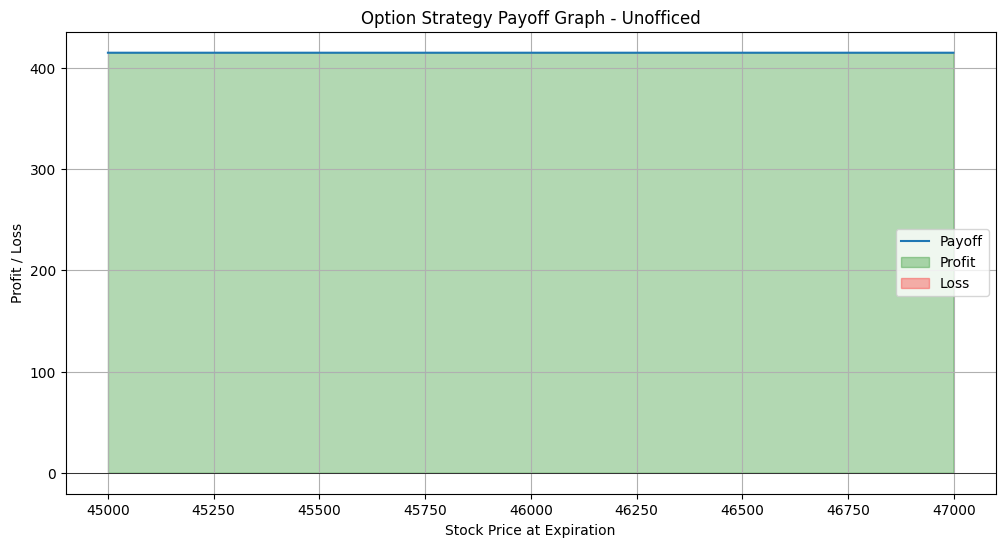

The payoff graph shows a pure profit of 400$.

Initiated with a modest $5,000 through Robinhood, a platform celebrated for its commission-free trading, 1R0NYMAN embarked on what was believed to be a foolproof venture.

Despite the trader’s confidence, famously declaring “It literally cannot go tits up,” the speculative strategy quickly unraveled.

Even amidst warnings from the “Wall Street Bets” group moderators on Reddit, including explicit advisories against the trade, the trader proceeded, withdrawing $10,000 before chaos ensued.

“He bought 4 different types of options that gave him a $300k credit. At the end of expiration, like 2 years from now, he would’ve collected $40k or $50k. The way he bought it was set up like a hedge, so it didn’t matter if the stock went up or down because he had options that covered him no matter what. But then 283 of those options were exercised by the guy on the other end of his trade meaning he had to come up with 28,300 shares of that stock which he didn’t have. I guess then Robinhood took the liberty of exercising his call options to pay for the options that got exercised from him and then it was just a whole shitshow after that.” – Reddit

The trader faced this situation when deep puts sold were assigned, compelling Robinhood to exercise long calls for share delivery, leading to significant financial distress.

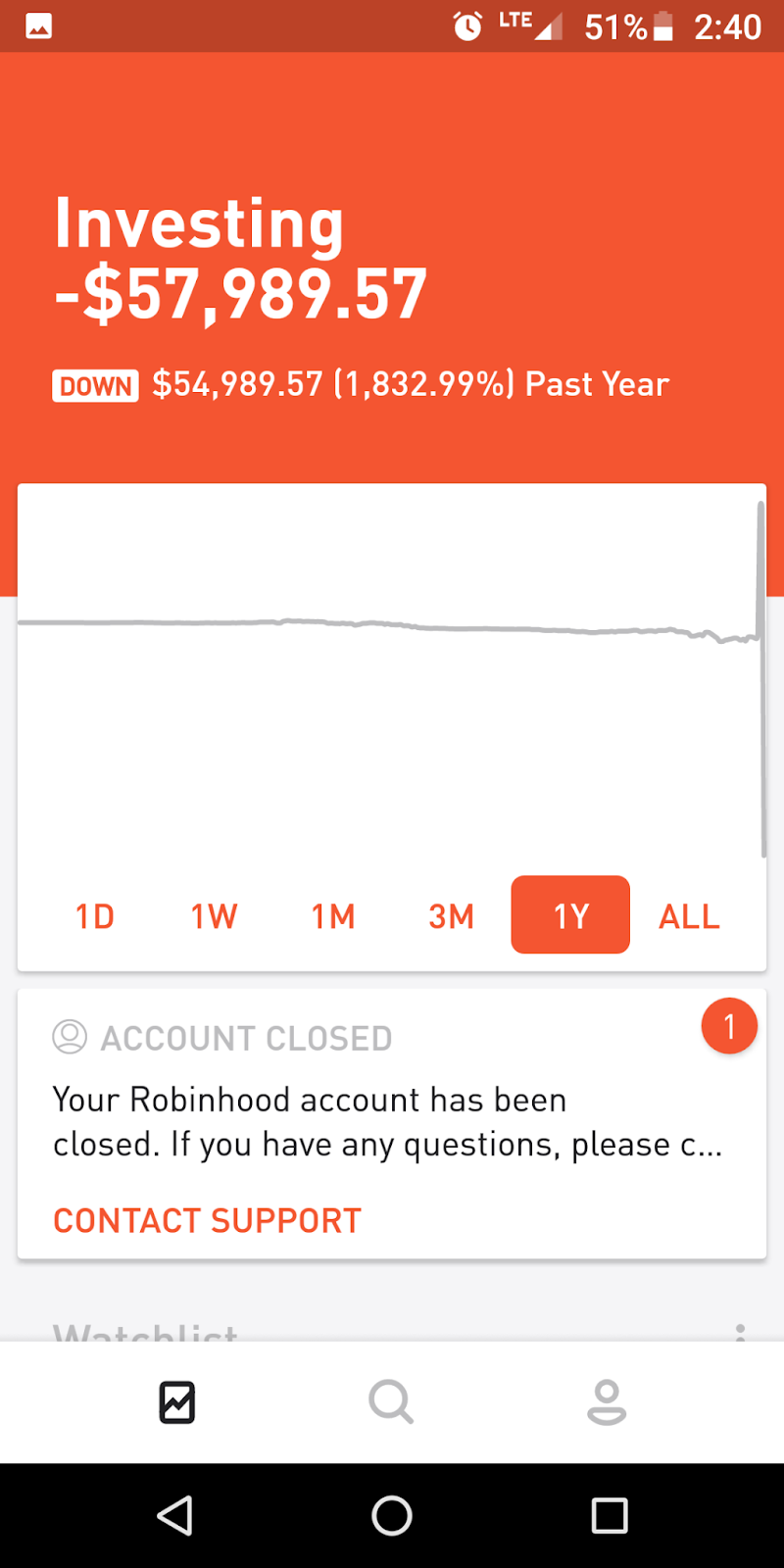

The subsequent financial turmoil resulted in nearly $58,000 in losses, culminating in the closure of the trader’s account. This debacle became fodder for the “Wall Street Bets” community, igniting a flurry of memes and discussions.

Robinhood’s response was swift, banning the trading of box spreads on its platform and issuing a statement clarifying the misunderstood risks of such strategies. This incident not only highlighted the hidden dangers of box spreads but also raised questions about the platform’s role in facilitating trades that entail significant risk, especially for accounts with limited capital.

Reflecting on the Lessons Learned

1R0NYMAN’s ordeal serves as a cautionary tale for traders dabbling in sophisticated options strategies. It underscores the importance of understanding the intricate risks involved, beyond the allure of arbitrage opportunities. The narrative also prompts a reevaluation of trading platforms’ responsibilities in educating their users and regulating trades that could lead to disproportionate losses.

As the dust settles, 1R0NYMAN’s vow for a “comeback tour” reminds us of the resilience often found in the trading community. However, the story remains a pivotal lesson in the risks of overconfidence and the complexities of options trading, echoing beyond the confines of Reddit into the broader discourse on investment strategy and risk management.