Crown Spread

A Crown Spread is an advanced options strategy that intricately positions itself between the pivotal market concepts of support and resistance, utilizing a calendar spread at a strike price that finds itself at the midpoint of these two crucial levels.

Here’s a deeper dive into the mechanics and strategic intent behind the Crown Spread:

Setup:

- Diagonal Calendar Spread

- Calendar Spread at Middle Ground Strike

Exploring deeper than the traditional concepts of support (where prices typically stop dropping) and resistance (where prices tend to stop climbing), let’s consider deploying a calendar spread squarely in the midpoint of these two critical levels.

Middle Ground Strike:

- The chosen strike for the calendar spread acts as a gravitational center, ideally positioned at the midpoint between support and resistance.

- This precise placement is strategic, aiming to maximize the potential benefits from the asset’s price action.

It’s like picking a comfy spot right in the middle of a seesaw.

Market Dynamics:

By selecting a strike that lies at the heart of the support and resistance zones, the strategy bets on the asset’s price maintaining a balanced oscillation.

This reflects an expectation of stability, with the asset’s price movements tethered by these critical market thresholds.

In the example of Auropharma discussed in the Diagonal Calendar Spread, We had our support and resistance strike as 1000 and 1200.

The middle point is 1100.

The Long Put calendar spread at 1100 and Long Call calendar spread at 1100 will contribute to similar looking payoff graph.

So, it is insignificant. For this discussion, Let’s take Long Put calendar spread at 1100. So the setup will become –

- Long put calendar spread at 1000.

- Sell 29FEB2024 1000PE at ₹ 23.5

- Buy 28MAR2024 1000PE at ₹ 34.6

- Long put calendar spread at 1100.

- Sell 29FEB2024 1100PE at ₹ 67.5

- Buy 28MAR2024 1100PE at ₹ 95.15

- Long call calendar spread at 1200.

- Sell 29FEB2024 1200CE at ₹ 15.1

- Buy 28MAR2024 1200CE at ₹ 34.7

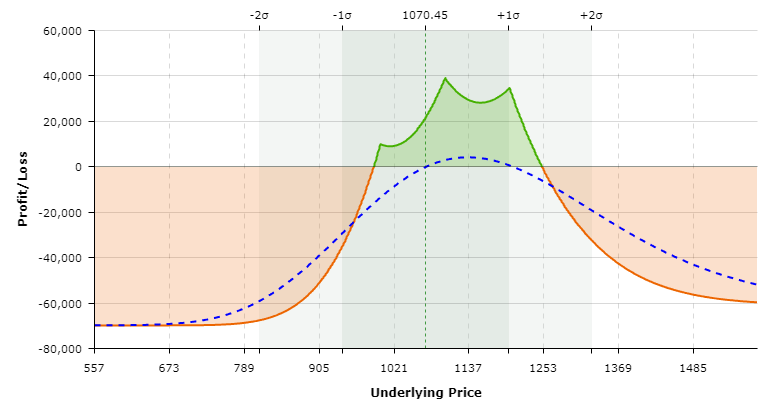

The payoff graph looks like –

The payoff profile of this strategy resembles the majestic crown of a king.

This visual analogy is not only illustrative of the strategy’s structure but also metaphorically positions it as the “Crown of All Strategies.”

This title reflects its sophisticated nature, embodying a balanced blend of precision and strategic foresight.

Risk and Reward Balance:

- While this strategy aims to capitalize on the asset’s price stability, it inherently balances the risks associated with sudden market movements.

- You’re catching glimpses of unexpected profit just as you’re on the verge of hitting breakeven, presenting a prime opportunity to adjust your strategy on time.

- Moreover, if a stock’s price has hit its resistance level and is on its way down, touching the midpoint suggests that momentum might drive it to reach the support level as well (depending on several factors).

This scenario provides an opportune moment to shift your approach and secure profits by transitioning to a different strategy.

This spread, along with the strategy’s unique name, was originally developed and introduced within the Unofficed community.