Short Put Christmas Tree Spread

The Short Put Christmas Tree Spread is a strategic approach inverse to its Long Put counterpart, primarily designed for a different market outlook. This spread typically involves three strike prices and is structured to profit from a moderate upward movement in the underlying asset’s price.

The Short Put Christmas Tree Spread is employed when a trader has a bullish outlook but wants to limit risk and potentially benefit from time decay.

Structure (1-3-2):

- Sell 1 ATM Put: Sell one put option with an at-the-money strike.

- Skip the Next Strike: Omit the immediate next lower strike.

- Buy 3 Puts: Then buy three put options with the following lower strike.

- Sell 2 Lower Puts: Finally, sell two more put options with the next lower strike after that.

Live Example

So, Let’s take a real example –

- Sell BANKNIFTY 45300PE at 252 – 1 Lot

- Buy BANKNIFTY 45100PE at 162.2 – 3 Lots

- Sell BANKNIFTY 45000PE at 127.9 – 2 Lots

This is a short call Christmas Tree spread.

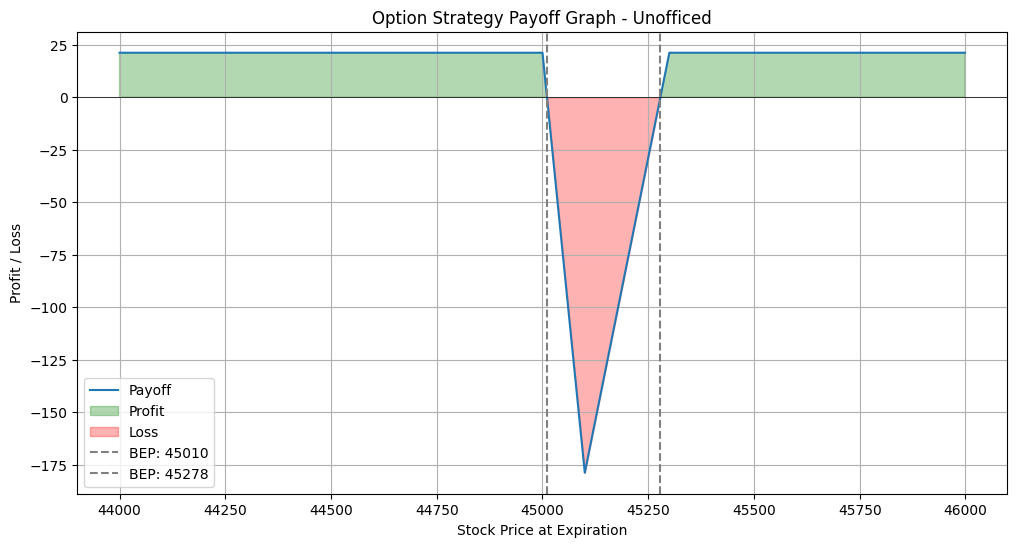

The payoff graph looks like –